Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, InterCard AG Informationssysteme (FRA:II8) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for InterCard Informationssysteme

What Is InterCard Informationssysteme's Net Debt?

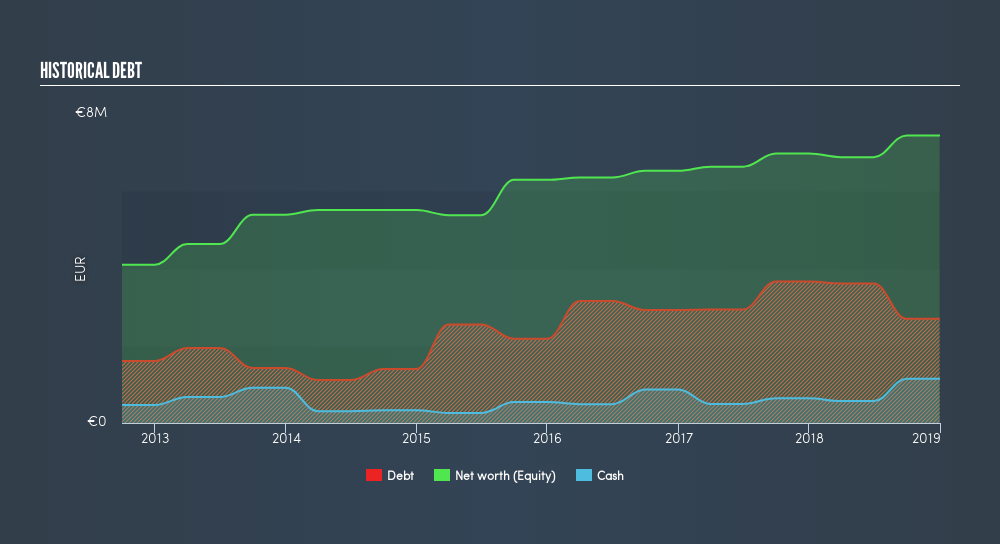

As you can see below, InterCard Informationssysteme had €2.70m of debt at December 2018, down from €3.67m a year prior. However, it does have €1.15m in cash offsetting this, leading to net debt of about €1.55m.

A Look At InterCard Informationssysteme's Liabilities

We can see from the most recent balance sheet that InterCard Informationssysteme had liabilities of €2.20m falling due within a year, and liabilities of €2.43m due beyond that. Offsetting these obligations, it had cash of €1.15m as well as receivables valued at €677.6k due within 12 months. So its liabilities total €2.80m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because InterCard Informationssysteme is worth €6.25m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt. Because it carries more debt than cash, we think it's worth watching InterCard Informationssysteme's balance sheet over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

InterCard Informationssysteme's net debt is sitting at a very reasonable 1.75 times its EBITDA, while its EBIT covered its interest expense just 3.91 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. Importantly, InterCard Informationssysteme grew its EBIT by 70% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is InterCard Informationssysteme's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last three years, InterCard Informationssysteme actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Neither InterCard Informationssysteme's ability to convert EBIT to free cash flow nor its interest cover gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. We think that InterCard Informationssysteme's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Over time, share prices tend to follow earnings per share, so if you're interested in InterCard Informationssysteme, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:SC8

Secanda

Secanda AG provides identification and payment systems for companies and authorities, clinics and care, college and education, and municipalities and events.

Excellent balance sheet and good value.

Market Insights

Community Narratives