- Germany

- /

- Communications

- /

- DB:CEK

Is CeoTronics AG's (FRA:CEK) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Most readers would already be aware that CeoTronics' (FRA:CEK) stock increased significantly by 147% over the past three months. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on CeoTronics' ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

Our free stock report includes 3 warning signs investors should be aware of before investing in CeoTronics. Read for free now.How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CeoTronics is:

12% = €2.8m ÷ €24m (Based on the trailing twelve months to November 2024).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every €1 worth of equity, the company was able to earn €0.12 in profit.

Check out our latest analysis for CeoTronics

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of CeoTronics' Earnings Growth And 12% ROE

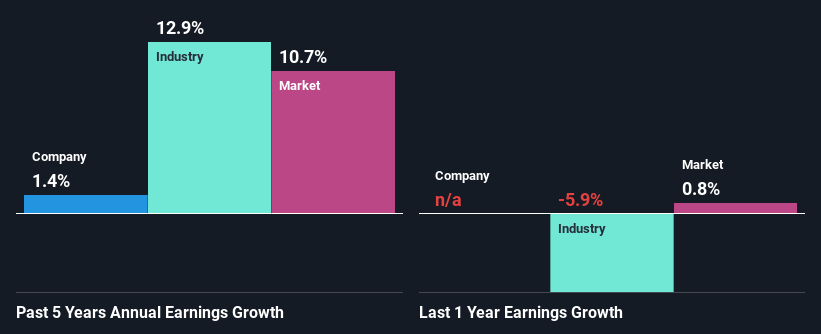

At first glance, CeoTronics seems to have a decent ROE. And on comparing with the industry, we found that the the average industry ROE is similar at 11%. Despite this, CeoTronics' five year net income growth was quite flat over the past five years. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. Such as, the company pays out a huge portion of its earnings as dividends, or is faced with competitive pressures.

As a next step, we compared CeoTronics' net income growth with the industry and were disappointed to see that the company's growth is lower than the industry average growth of 13% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. What is CEK worth today? The intrinsic value infographic in our free research report helps visualize whether CEK is currently mispriced by the market.

Is CeoTronics Using Its Retained Earnings Effectively?

Despite having a moderate three-year median payout ratio of 39% (meaning the company retains61% of profits) in the last three-year period, CeoTronics' earnings growth was more or les flat. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

In addition, CeoTronics has been paying dividends over a period of eight years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 27% over the next three years. As a result, the expected drop in CeoTronics' payout ratio explains the anticipated rise in the company's future ROE to 19%, over the same period.

Summary

Overall, we feel that CeoTronics certainly does have some positive factors to consider. Yet, the low earnings growth is a bit concerning, especially given that the company has a high rate of return and is reinvesting ma huge portion of its profits. By the looks of it, there could be some other factors, not necessarily in control of the business, that's preventing growth. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:CEK

CeoTronics

Provides systems for mobile digital radio networks and end devices used in local applications, and professional communications headsets and intercom systems in Germany and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives