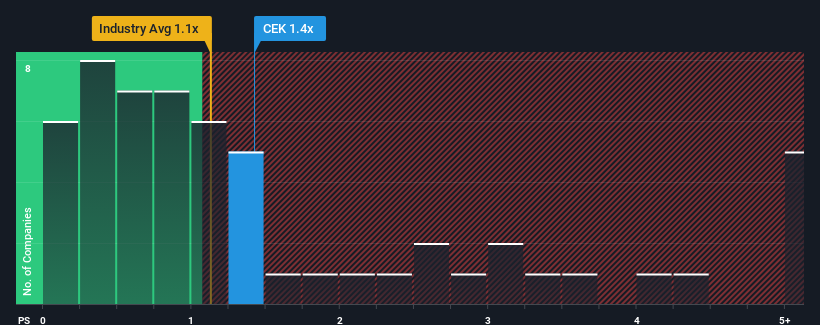

With a median price-to-sales (or "P/S") ratio of close to 1.2x in the Communications industry in Germany, you could be forgiven for feeling indifferent about CeoTronics AG's (FRA:CEK) P/S ratio of 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for CeoTronics

How CeoTronics Has Been Performing

While the industry has experienced revenue growth lately, CeoTronics' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on CeoTronics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, CeoTronics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. As a result, revenue from three years ago have also fallen 8.3% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.6% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that CeoTronics' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From CeoTronics' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, CeoTronics' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for CeoTronics (2 are potentially serious!) that you need to be mindful of.

If these risks are making you reconsider your opinion on CeoTronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:CEK

CeoTronics

Manufactures and distributes electronic audio and video systems, and data transmission and communication solutions for difficult conditions in Germany, rest of Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives