There's Reason For Concern Over Softing AG's (ETR:SYT) Massive 27% Price Jump

Softing AG (ETR:SYT) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 31% in the last twelve months.

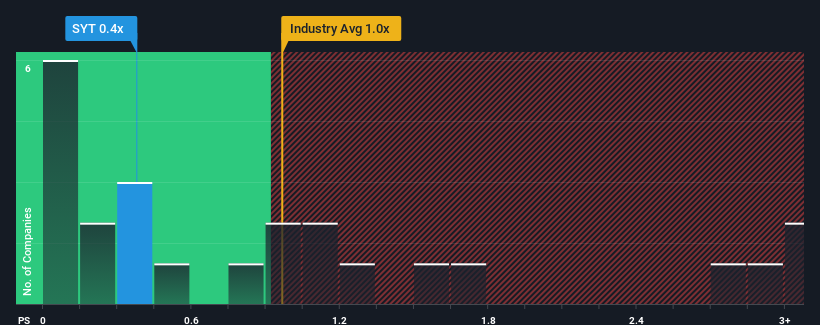

Even after such a large jump in price, it's still not a stretch to say that Softing's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Electronic industry in Germany, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Softing

What Does Softing's P/S Mean For Shareholders?

Softing hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Softing's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Softing's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 19% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 2.2% per annum over the next three years. That's shaping up to be materially lower than the 8.7% per annum growth forecast for the broader industry.

With this information, we find it interesting that Softing is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Softing's P/S Mean For Investors?

Its shares have lifted substantially and now Softing's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given that Softing's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Softing (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Softing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SYT

Softing

Develops and and markets software, hardware, and system solutions worldwide.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives