Is Schweizer Electronic (ETR:SCE) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Schweizer Electronic AG (ETR:SCE) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Schweizer Electronic

What Is Schweizer Electronic's Debt?

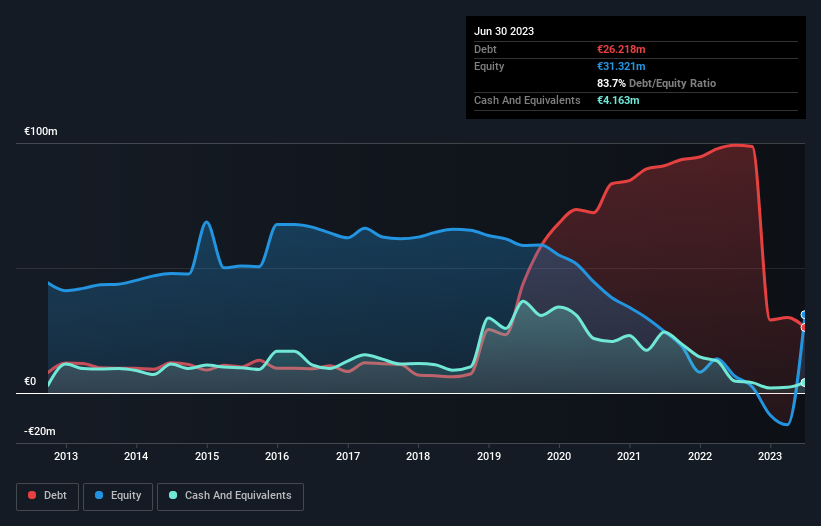

You can click the graphic below for the historical numbers, but it shows that Schweizer Electronic had €26.2m of debt in June 2023, down from €99.1m, one year before. However, because it has a cash reserve of €4.16m, its net debt is less, at about €22.1m.

A Look At Schweizer Electronic's Liabilities

According to the last reported balance sheet, Schweizer Electronic had liabilities of €30.8m due within 12 months, and liabilities of €47.1m due beyond 12 months. On the other hand, it had cash of €4.16m and €35.7m worth of receivables due within a year. So its liabilities total €38.1m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's €30.9m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Schweizer Electronic's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Schweizer Electronic wasn't profitable at an EBIT level, but managed to grow its revenue by 5.7%, to €135m. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Importantly, Schweizer Electronic had an earnings before interest and tax (EBIT) loss over the last year. Its EBIT loss was a whopping €14m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of €7.5m and the profit of €22m. So one might argue that there's still a chance it can get things on the right track. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with Schweizer Electronic (including 1 which is a bit concerning) .

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:SCE

Schweizer Electronic

Engages in the development, manufacture, and marketing of printed circuit boards worldwide.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Align Technology Stock: Premium Orthodontics in a Cost-Sensitive World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion