The German market has shown resilience with the DAX index posting a modest gain of 0.11%, reflecting cautious optimism amid broader European economic conditions. As investors navigate this landscape, dividend stocks have emerged as a compelling option for those seeking steady income streams. In today's market, characterized by fluctuating interest rates and economic uncertainties, reliable dividend stocks can provide both stability and attractive yields.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Deutsche Post (XTRA:DHL) | 4.90% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.22% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.17% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.71% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.45% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.58% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.68% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.28% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.64% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems both in Germany and internationally with a market cap of €93.09 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) generates revenue from two main segments: €96.65 million from Systems and €161.99 million from Displays.

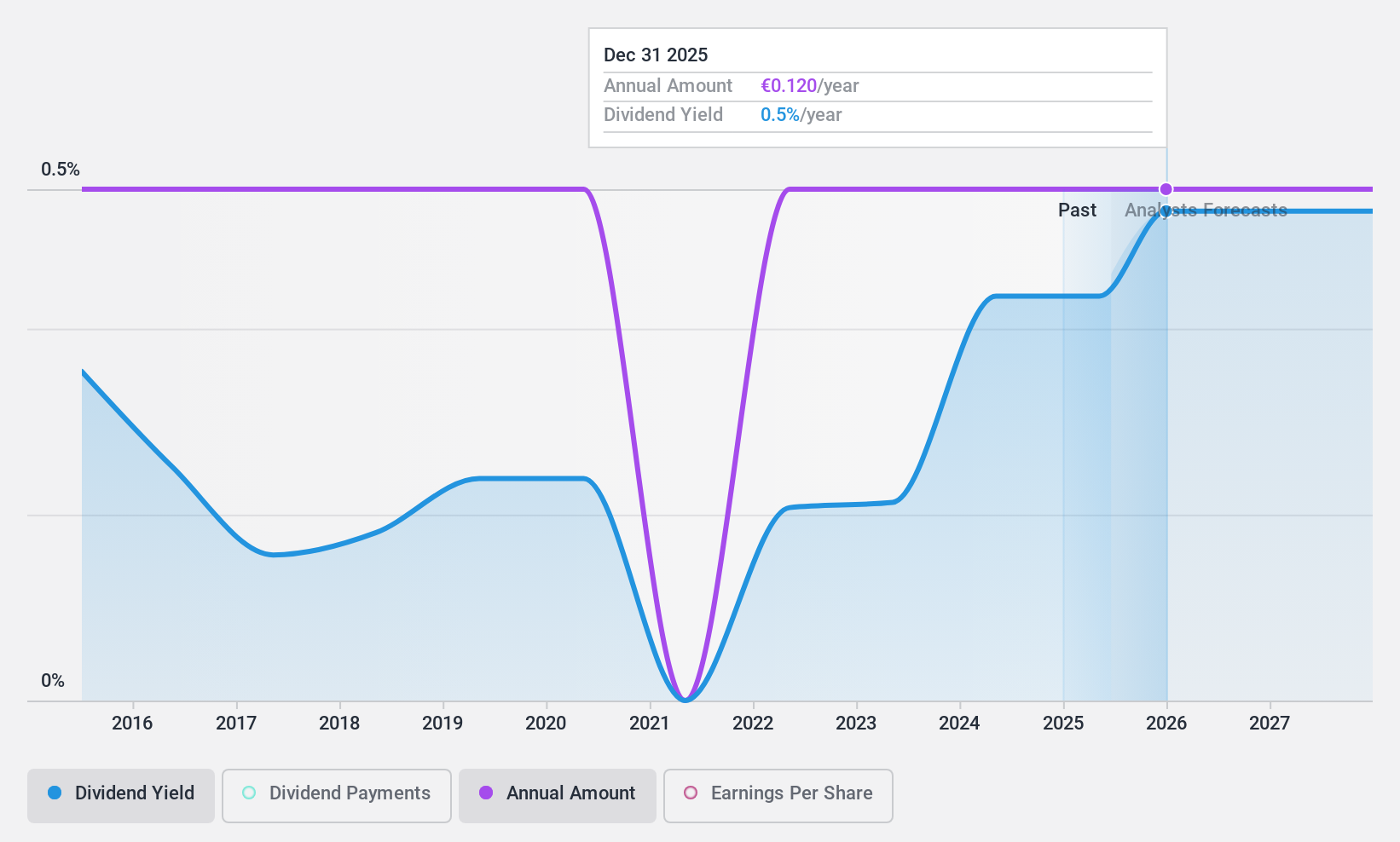

Dividend Yield: 7.6%

DATA MODUL Produktion und Vertrieb von elektronischen Systemen has seen its dividend payments increase over the past decade, supported by a reasonable payout ratio of 64% and a low cash payout ratio of 19.5%. Despite offering an attractive yield (7.58%) in the top 25% of German dividend payers, recent earnings have declined significantly, with Q2 sales at EUR 50.99 million and net income at EUR 0.897 million compared to last year's figures. Profit margins have also decreased from 6.5% to 4.3%, highlighting potential concerns about sustainability amidst volatile historical dividend payments.

- Click here and access our complete dividend analysis report to understand the dynamics of DATA MODUL Produktion und Vertrieb von elektronischen Systemen.

- Upon reviewing our latest valuation report, DATA MODUL Produktion und Vertrieb von elektronischen Systemen's share price might be too optimistic.

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm that focuses on mergers and acquisitions and corporate spin-offs, with a market cap of €568.79 million.

Operations: INDUS Holding AG generates revenue from three main segments: Materials (€584.27 million), Engineering (€586.92 million), and Infrastructure (€567.79 million).

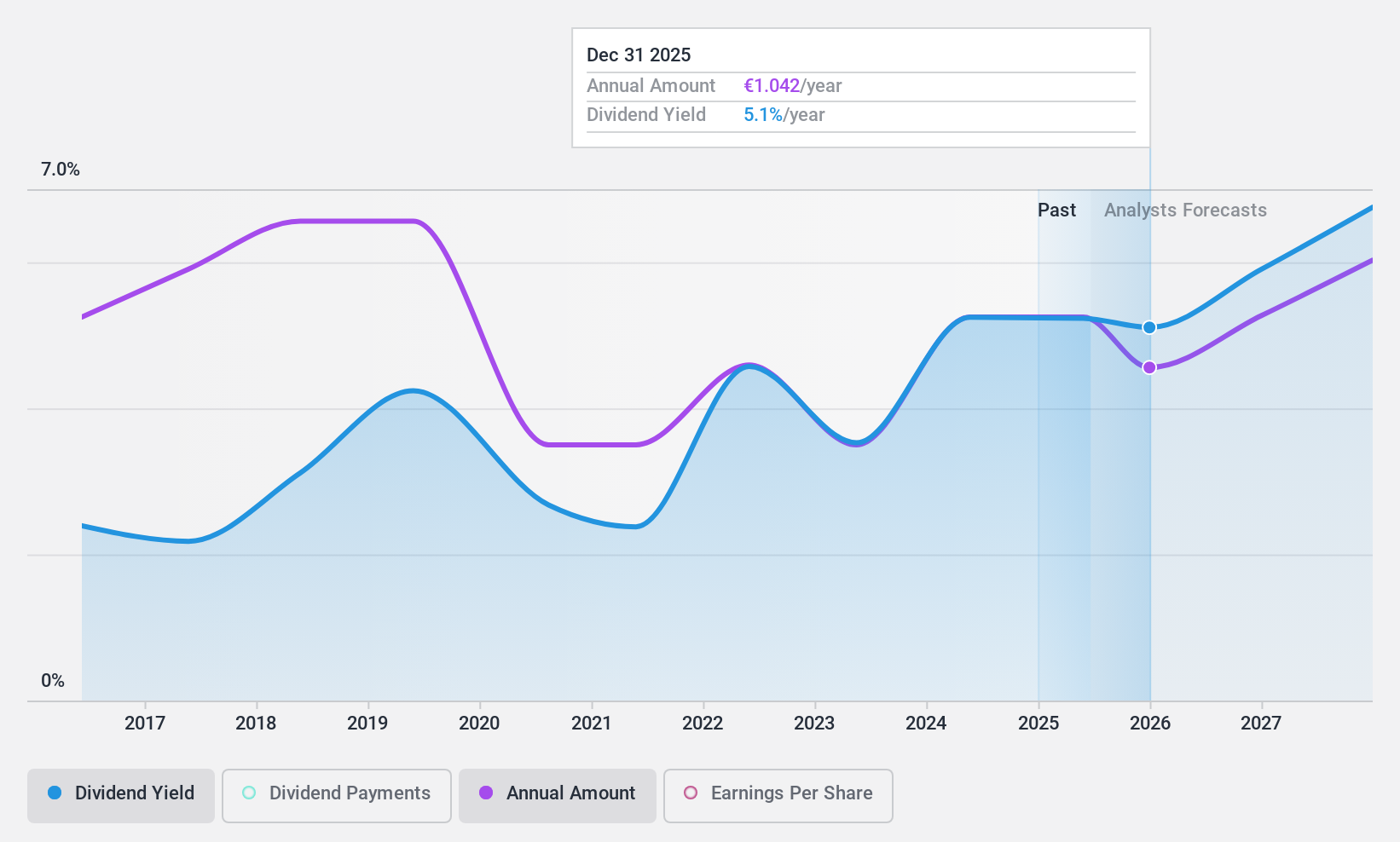

Dividend Yield: 5.4%

INDUS Holding's dividends are well-covered by earnings (47.1% payout ratio) and cash flows (19% cash payout ratio), though the dividend track record has been unstable over the past decade. Despite trading at 61.7% below fair value, the company faces high debt levels and volatile dividend history. Recent buybacks of 1,100,000 shares for €25.3 million may indicate confidence in future prospects despite lowered sales and EBIT guidance for 2024 due to unfavorable macroeconomic conditions.

- Take a closer look at INDUS Holding's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that INDUS Holding is priced lower than what may be justified by its financials.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany and internationally, with a market cap of €934.61 million.

Operations: Mensch und Maschine Software SE's revenue segments include €107.71 million from M+M Software and €216.19 million from M+M Digitization.

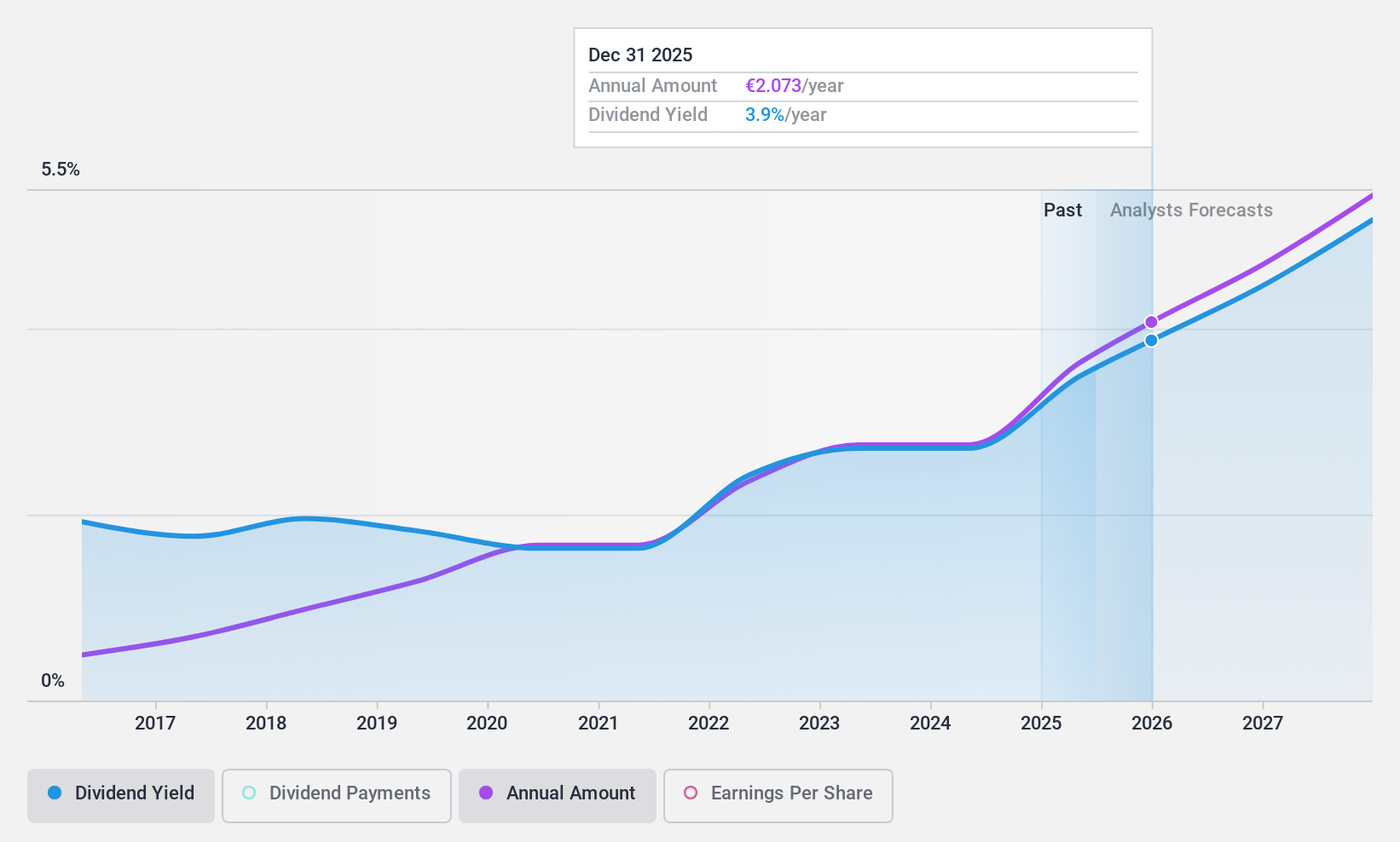

Dividend Yield: 3%

Mensch und Maschine Software has demonstrated reliable and growing dividend payments over the past decade, although its high payout ratio of 91% indicates dividends are not well covered by earnings. However, with a cash payout ratio of 65%, the dividends are supported by cash flows. Recent earnings growth and presentations at major investment conferences highlight ongoing business strength, but its 3% yield is below the top tier in Germany. The stock trades significantly below fair value estimates.

- Dive into the specifics of Mensch und Maschine Software here with our thorough dividend report.

- The valuation report we've compiled suggests that Mensch und Maschine Software's current price could be quite moderate.

Seize The Opportunity

- Unlock more gems! Our Top German Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top German Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DAM

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Engages in the development, manufacture, and distribution of flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally.

Flawless balance sheet average dividend payer.