As European inflation nears the central bank’s target and Germany's DAX reaches new heights, investors are increasingly looking for stable income sources amidst market fluctuations. In this context, dividend stocks offer a compelling option, providing regular income streams while potentially benefiting from capital appreciation. When considering dividend stocks in today's market environment, it's crucial to look for companies with strong financial health and consistent payout histories.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 4.89% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.28% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.74% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.07% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.70% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.41% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.19% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.81% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.42% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally with a market cap of €98.03 million.

Operations: DATA MODUL Produktion und Vertrieb von elektronischen Systemen generates revenue from two main segments: €96.65 million from Systems and €161.99 million from Displays.

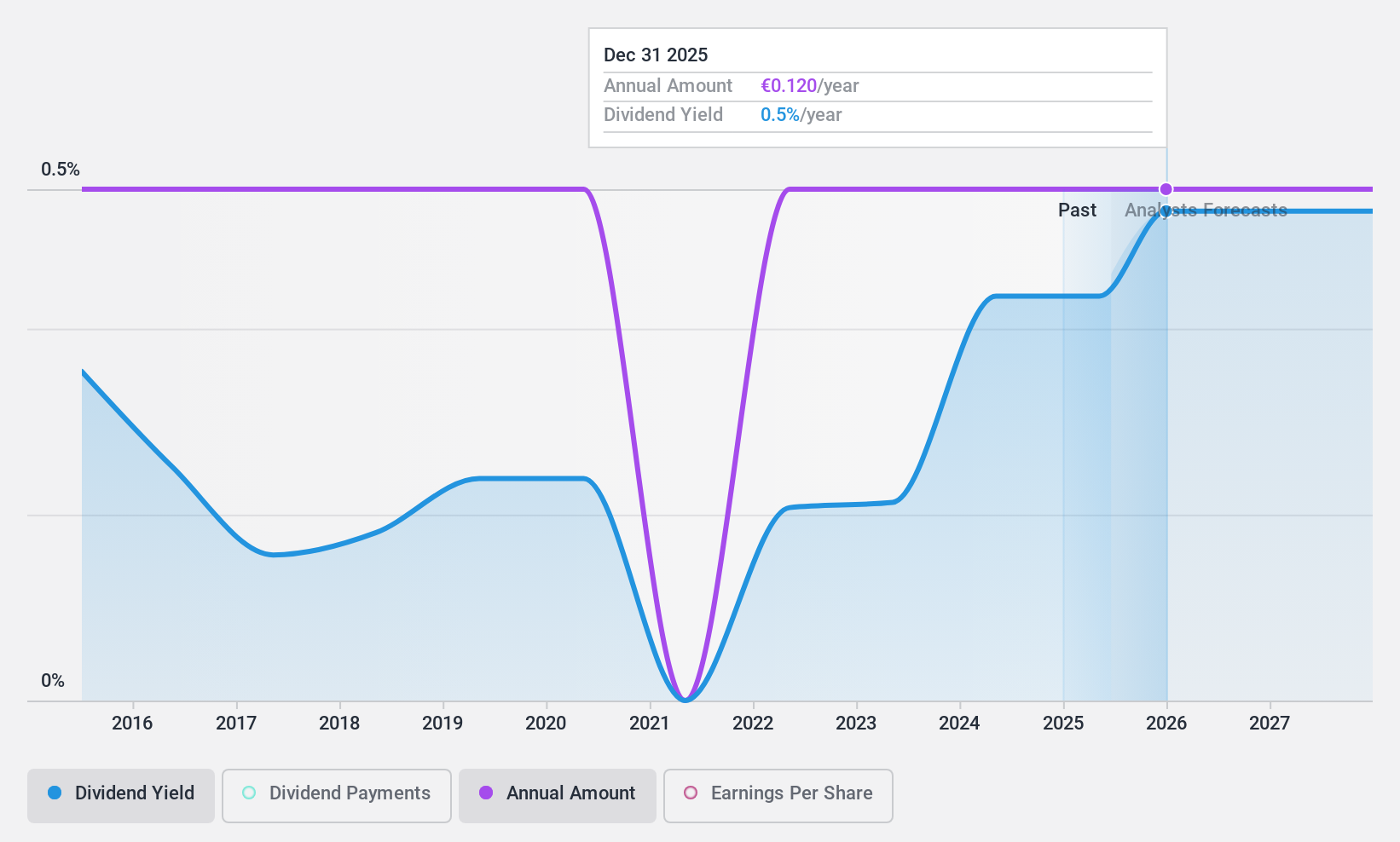

Dividend Yield: 7.2%

DATA MODUL Produktion und Vertrieb von elektronischen Systemen offers a high dividend yield of 7.19%, placing it in the top 25% of German dividend payers. Despite a reasonable payout ratio of 64% and strong cash flow coverage (19.5%), its dividends have been volatile over the past decade, with recent earnings showing a decline. The company's price-to-earnings ratio is attractively low at 8.9x, but profit margins have decreased from last year’s figures.

- Take a closer look at DATA MODUL Produktion und Vertrieb von elektronischen Systemen's potential here in our dividend report.

- Upon reviewing our latest valuation report, DATA MODUL Produktion und Vertrieb von elektronischen Systemen's share price might be too optimistic.

technotrans (XTRA:TTR1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: technotrans SE is a global technology and services company with a market cap of €118.47 million.

Operations: technotrans SE generates revenue from two main segments: €62.21 million from Services and €184.28 million from Technology.

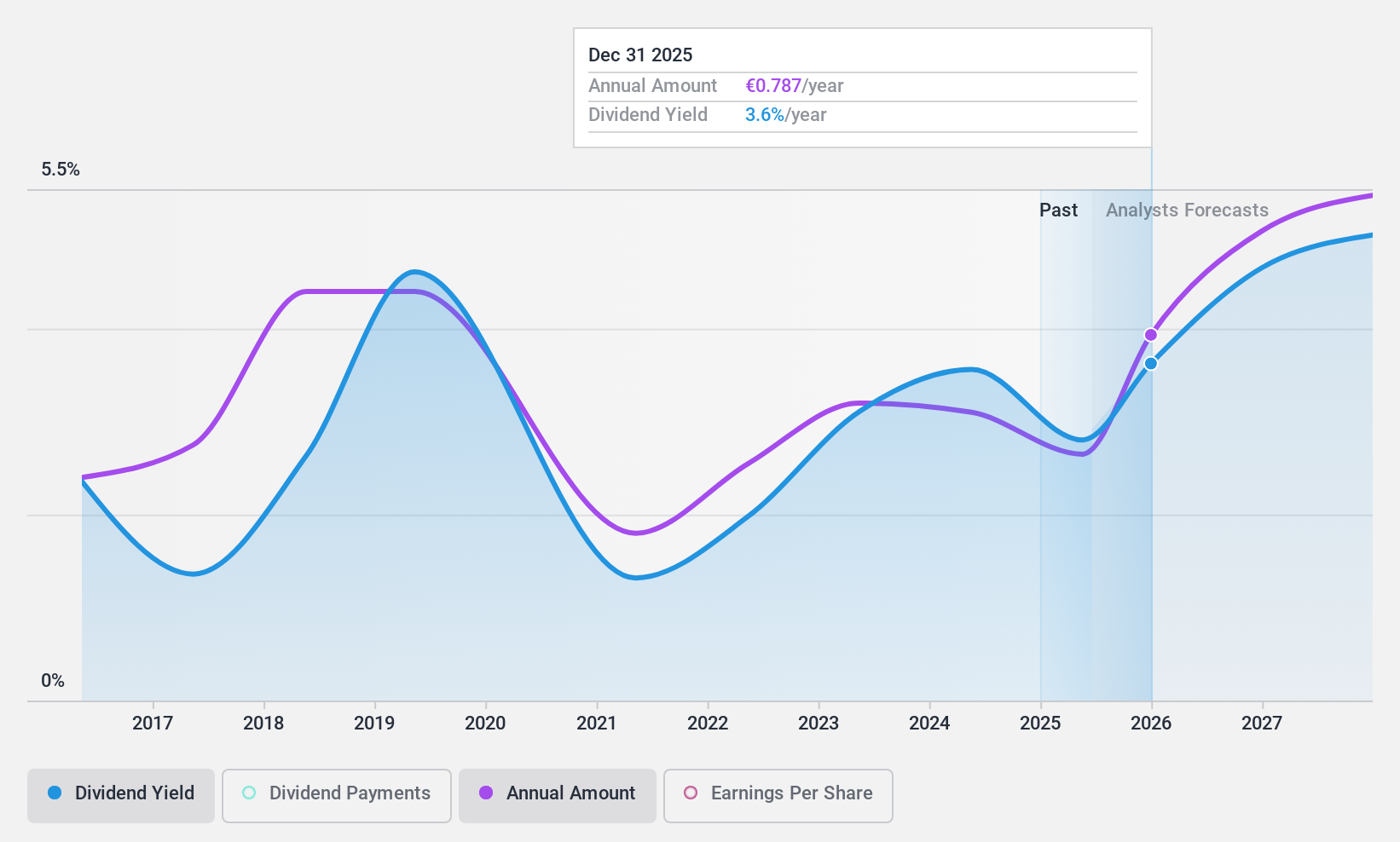

Dividend Yield: 3.6%

technotrans SE's dividend sustainability is supported by a moderate payout ratio of 56.7% and a cash payout ratio of 32.3%, indicating dividends are well covered by both earnings and cash flows. However, its dividend yield of 3.62% is below the top quartile in Germany, and the company's dividend history has been volatile over the past decade despite some growth in payments. Earnings are projected to grow at an annual rate of 26.14%.

- Click here and access our complete dividend analysis report to understand the dynamics of technotrans.

- Insights from our recent valuation report point to the potential undervaluation of technotrans shares in the market.

Uzin Utz (XTRA:UZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €240.11 million.

Operations: Uzin Utz SE's revenue segments include Western Europe (€81.64 million), South/Eastern Europe (€27.70 million), USA - Laying Systems (€73.60 million), Netherlands - Wholesale (€33.66 million), Germany - Laying Systems (€209.68 million), Netherlands - Laying Systems (€83.59 million), Germany - Machinery and Tools (€31.94 million), and Germany - Surface Care and Refinement (€34.21 million).

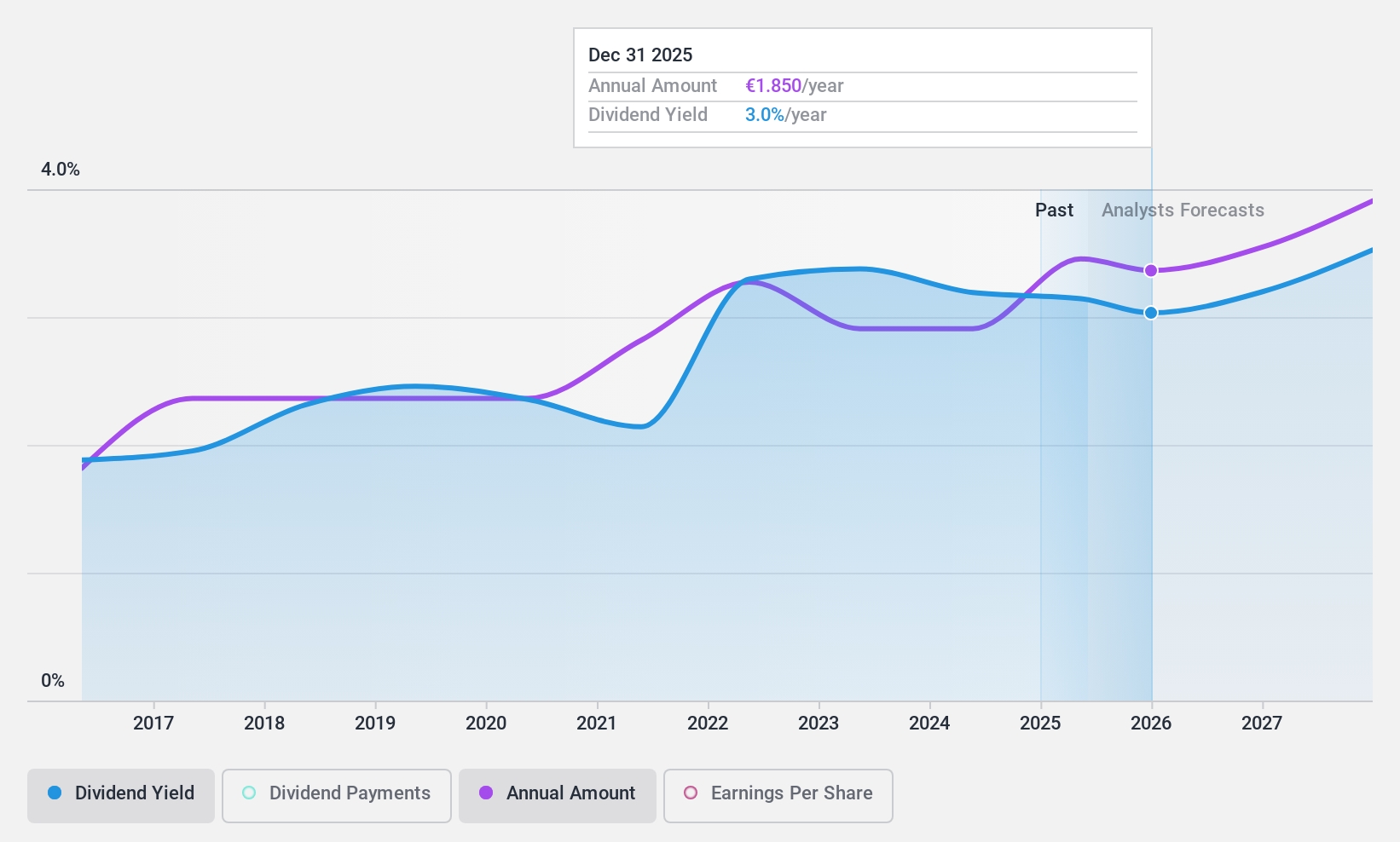

Dividend Yield: 3.4%

Uzin Utz SE's recent earnings report shows stable revenue at €242.86 million and a net income increase to €12.38 million for the half year ended June 30, 2024. The company's dividend is well-covered by both earnings (payout ratio: 33.8%) and cash flows (cash payout ratio: 19.9%), with a reliable history of growth over the past decade. However, its dividend yield of 3.36% is lower than the top quartile in Germany, though it offers good value with a P/E ratio of 10x compared to the market average of 16.9x.

- Get an in-depth perspective on Uzin Utz's performance by reading our dividend report here.

- Our valuation report here indicates Uzin Utz may be overvalued.

Make It Happen

- Access the full spectrum of 31 Top German Dividend Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:UZU

Uzin Utz

Develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives