Amidst the backdrop of trade policy uncertainties and mixed economic signals, European markets have recently shown resilience, with indices like Germany’s DAX experiencing gains despite overall market fluctuations. In such a climate, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking to navigate the current market environment.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.18% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.16% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.89% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.02% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.59% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.20% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.33% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.92% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

| Thermador Groupe (ENXTPA:THEP) | 3.10% | ★★★★★☆ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

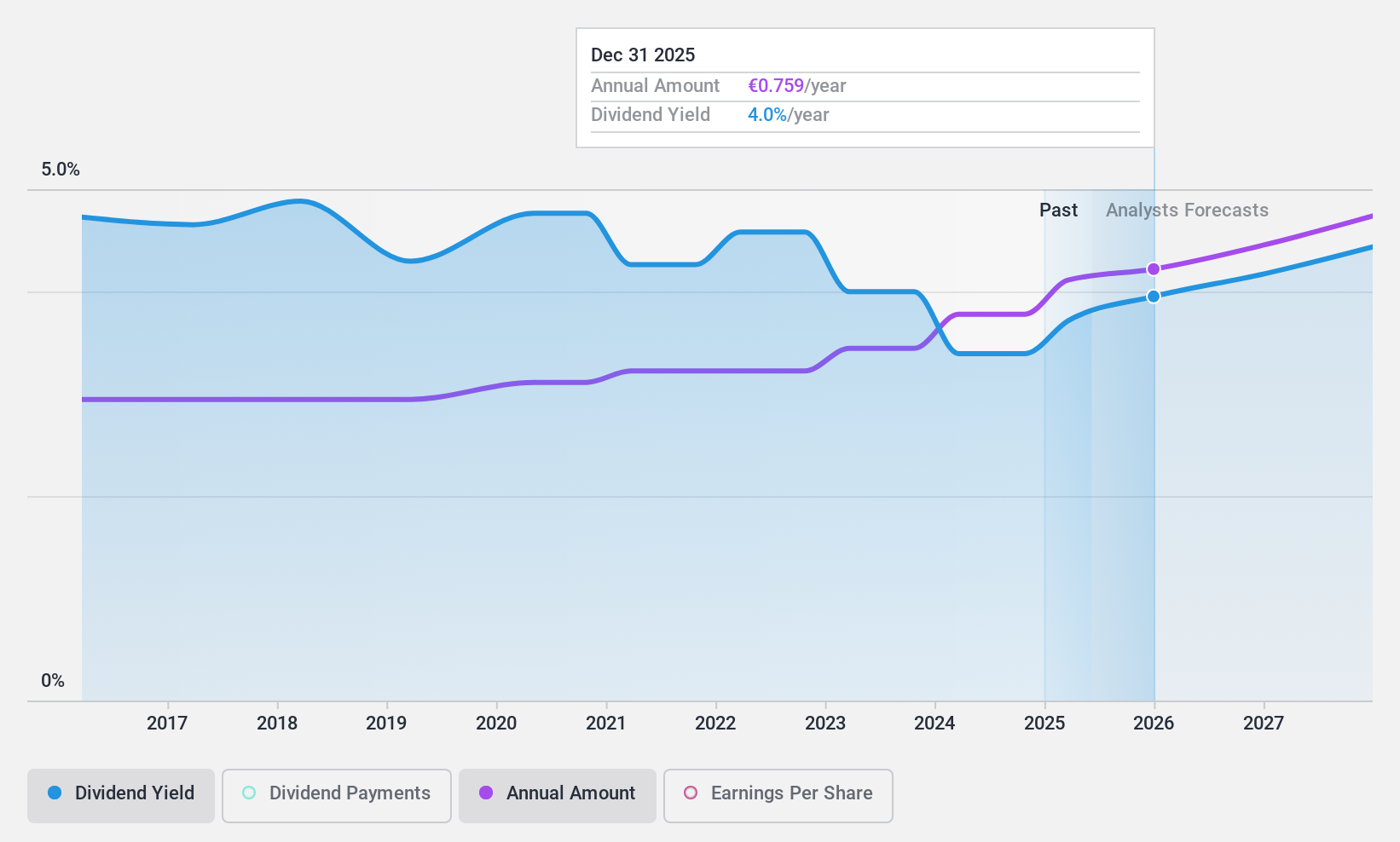

Kemira Oyj (HLSE:KEMIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kemira Oyj is a chemicals company operating in Finland and globally across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of €3.40 billion.

Operations: Kemira Oyj generates its revenue primarily from two segments: Pulp & Paper, contributing €1.65 billion, and Industry & Water, contributing €1.30 billion.

Dividend Yield: 3.4%

Kemira Oyj offers a stable dividend history with payments growing over the past decade, supported by a manageable payout ratio of 45.7% and cash flow coverage at 35.9%. Despite trading below estimated fair value, its current yield of 3.35% is lower than top Finnish market payers. Recent earnings growth and strategic M&A plans bolster its financial outlook, while proposed dividends for 2025 reflect continued commitment to shareholder returns amidst operational expansions and debt reduction efforts.

- Navigate through the intricacies of Kemira Oyj with our comprehensive dividend report here.

- According our valuation report, there's an indication that Kemira Oyj's share price might be on the cheaper side.

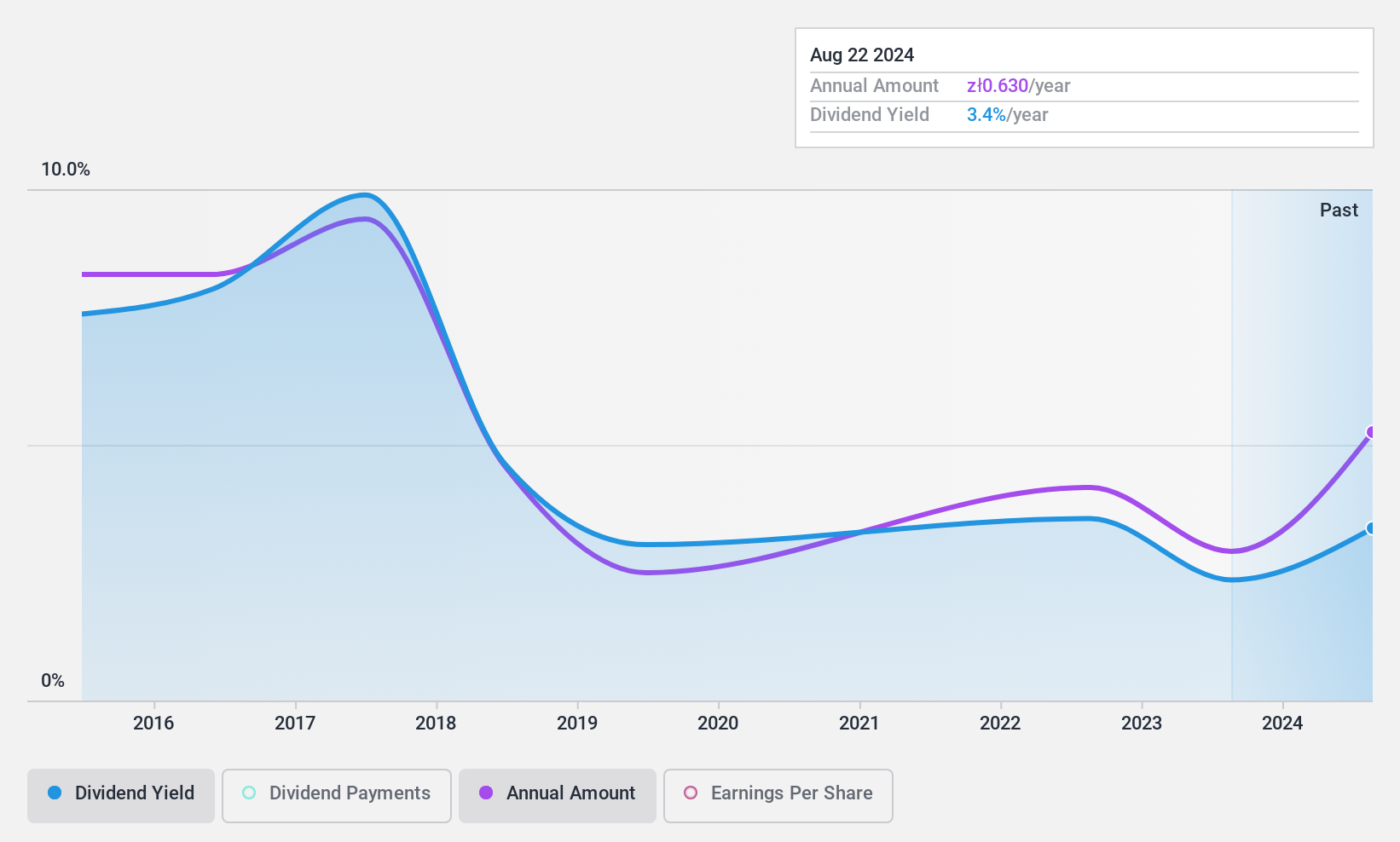

Kino Polska TV Spolka Akcyjna (WSE:KPL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kino Polska TV Spolka Akcyjna is a media company operating in Poland and internationally with a market cap of PLN396.43 million.

Operations: Kino Polska TV Spolka Akcyjna generates revenue from several segments, including Zoom TV (PLN31.65 million), Freeze TV (PLN56.52 million), Kino Polska Channels (PLN35.35 million), Sale of License Rights (PLN17.51 million), Production of TV Channels (PLN7.61 million), and Filmbox Movie Channels and Thematic Channels (PLN158.00 million).

Dividend Yield: 3.2%

Kino Polska TV Spolka Akcyjna has seen dividend growth over the past decade, though payments have been volatile with occasional drops exceeding 20%. The company's dividends are well covered by earnings and cash flows, with payout ratios of 17.6% and 18.2%, respectively. Despite trading significantly below estimated fair value, its dividend yield of 3.15% is modest compared to top Polish market payers, indicating potential for improvement in reliability and yield competitiveness.

- Get an in-depth perspective on Kino Polska TV Spolka Akcyjna's performance by reading our dividend report here.

- Our valuation report unveils the possibility Kino Polska TV Spolka Akcyjna's shares may be trading at a discount.

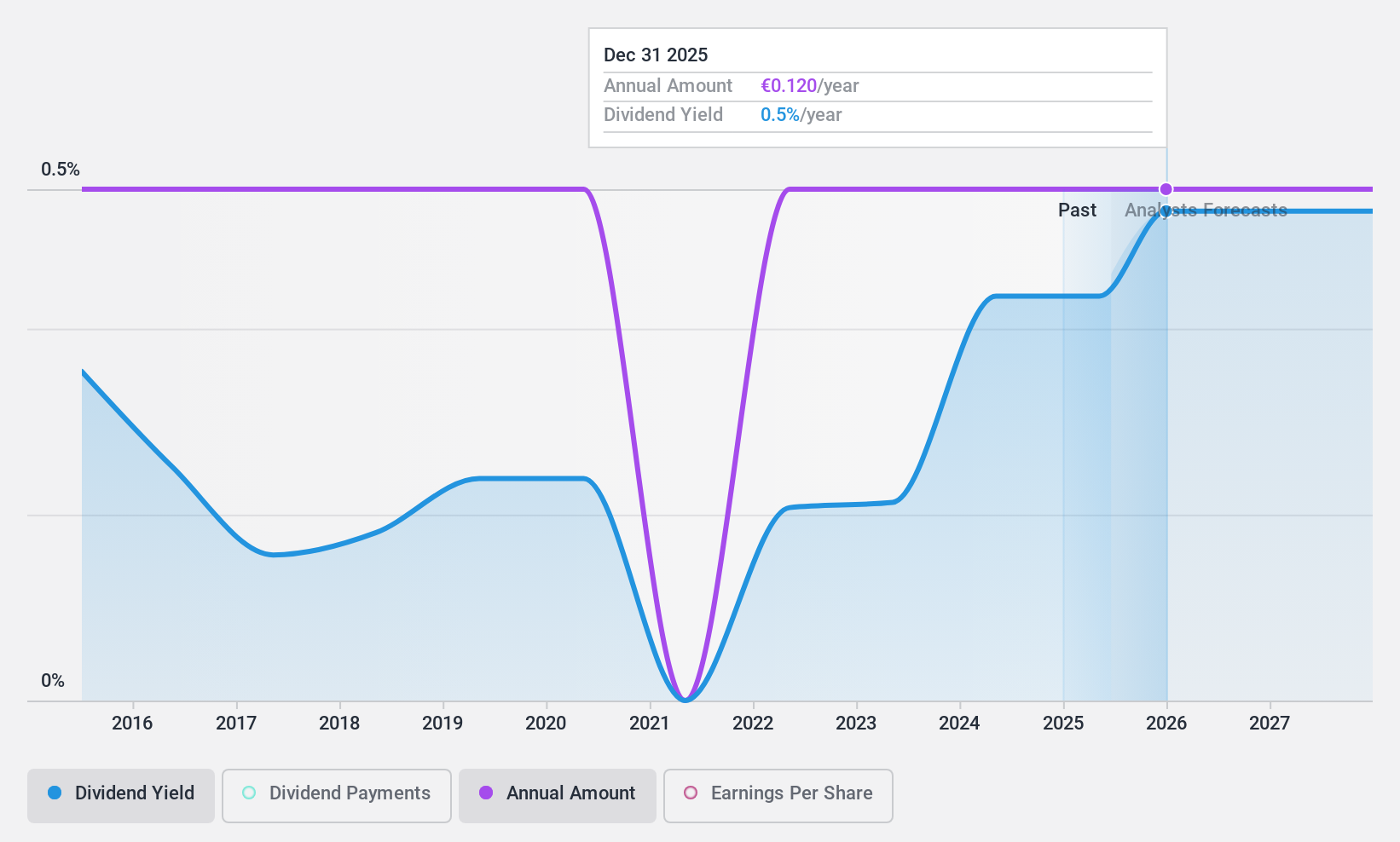

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATA MODUL Aktiengesellschaft, Produktion und Vertrieb von elektronischen Systemen develops, manufactures, and distributes flatbed displays, monitors, electronic subassemblies, and information systems both in Germany and internationally with a market cap of €92.39 million.

Operations: DATA MODUL's revenue is primarily derived from its Displays segment, which accounts for €151.05 million, followed by the Systems segment at €92.66 million.

Dividend Yield: 7.6%

DATA MODUL's dividend yield of 7.63% ranks in the top 25% of German market payers, yet its payments have been volatile over the past decade and are not well covered by earnings, with a high payout ratio of 93%. Despite this, dividends are supported by cash flows due to a low cash payout ratio of 23.1%. The stock trades at a significant discount to its estimated fair value, offering potential for valuation appreciation.

- Dive into the specifics of DATA MODUL Produktion und Vertrieb von elektronischen Systemen here with our thorough dividend report.

- Our expertly prepared valuation report DATA MODUL Produktion und Vertrieb von elektronischen Systemen implies its share price may be lower than expected.

Summing It All Up

- Discover the full array of 230 Top European Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DAM

DATA MODUL Produktion und Vertrieb von elektronischen Systemen

Manufactures and distributes flatbed displays, monitors, electronic subassemblies, and information systems in Germany and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion