- Germany

- /

- Tech Hardware

- /

- XTRA:C3RY

Cherry SE's (ETR:C3RY) Shares Climb 45% But Its Business Is Yet to Catch Up

Cherry SE (ETR:C3RY) shareholders are no doubt pleased to see that the share price has bounced 45% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 71% share price decline over the last year.

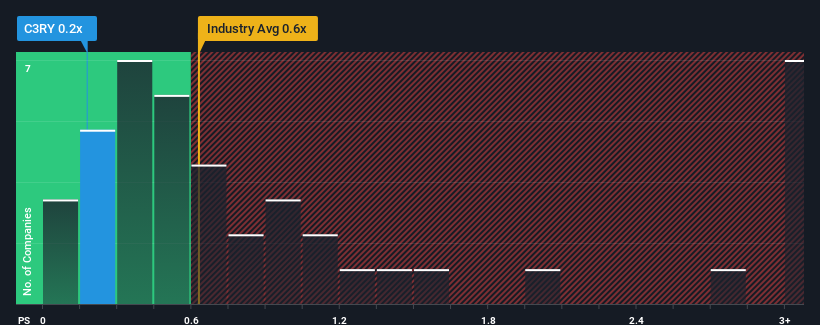

Although its price has surged higher, it's still not a stretch to say that Cherry's price-to-sales (or "P/S") ratio of 0.2x right now seems quite "middle-of-the-road" compared to the Tech industry in Germany, where the median P/S ratio is around 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Cherry

What Does Cherry's Recent Performance Look Like?

Cherry has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Keen to find out how analysts think Cherry's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cherry's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Cherry's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 14% overall from three years ago. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 1.2% per year as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 18% per annum growth forecast for the broader industry.

In light of this, it's curious that Cherry's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Bottom Line On Cherry's P/S

Cherry's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Cherry's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Cherry (1 is potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Cherry, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:C3RY

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives