Brockhaus Technologies Leads These 3 High Growth Tech Stocks In Germany

Reviewed by Simply Wall St

The German market has recently faced a downturn, with the DAX index losing 1.81% amid escalating geopolitical tensions in the Middle East and cautious investor sentiment across Europe. In this environment, identifying high-growth tech stocks like those led by Brockhaus Technologies requires focusing on companies that demonstrate resilience through innovation and adaptability to shifting economic landscapes.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Formycon | 32.50% | 30.70% | ★★★★★☆ |

| Ströer SE KGaA | 7.52% | 29.17% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| cyan | 28.13% | 71.37% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| medondo holding | 35.61% | 82.66% | ★★★★★☆ |

| Rubean | 55.25% | 67.67% | ★★★★★☆ |

| GK Software | 8.70% | 33.04% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

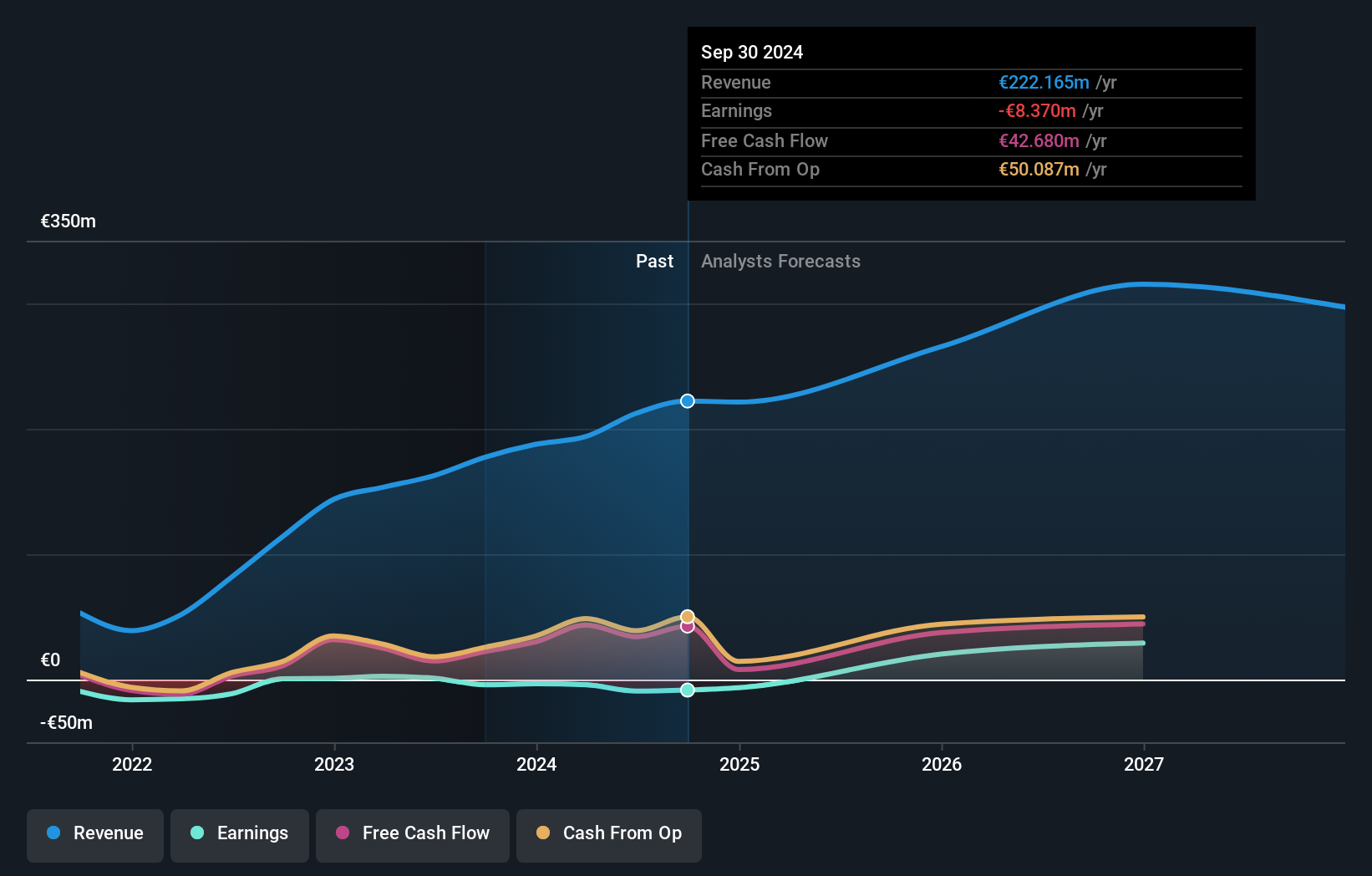

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market capitalization of approximately €297.76 million.

Operations: Brockhaus Technologies AG generates revenue primarily through its Financial Technologies and Security Technologies segments, with Financial Technologies contributing €174.59 million and Security Technologies €37.03 million. The company operates as a private equity firm focusing on these sectors to drive its business growth.

Brockhaus Technologies, amidst a challenging financial landscape marked by a net loss widening to €6.65 million from €0.765 million year-over-year, continues to prioritize innovation with significant R&D investments. These efforts are reflected in their projected revenue growth of 16.8% annually, outpacing the German market's 5.4%. Recently at high-profile conferences in Munich, the company reaffirmed its revenue targets for 2024 and 2025, signaling confidence in its strategic direction despite current unprofitability. This focus on R&D not only underscores Brockhaus's commitment to technological advancement but also positions it potentially well for future profitability, aligning with an expected sharp rise in earnings by 93% per annum as forecasted. The company's aggressive pursuit of growth through research and development is evident from its recent presentations and earnings guidance updates; however, it remains crucial for Brockhaus to convert these expenditures into tangible financial returns as it navigates towards profitability over the next three years. With a clear emphasis on enhancing its tech capabilities within Germany’s competitive landscape, Brockhaus may well leverage these innovations to capture greater market share and improve financial health moving forward.

- Take a closer look at Brockhaus Technologies' potential here in our health report.

Understand Brockhaus Technologies' track record by examining our Past report.

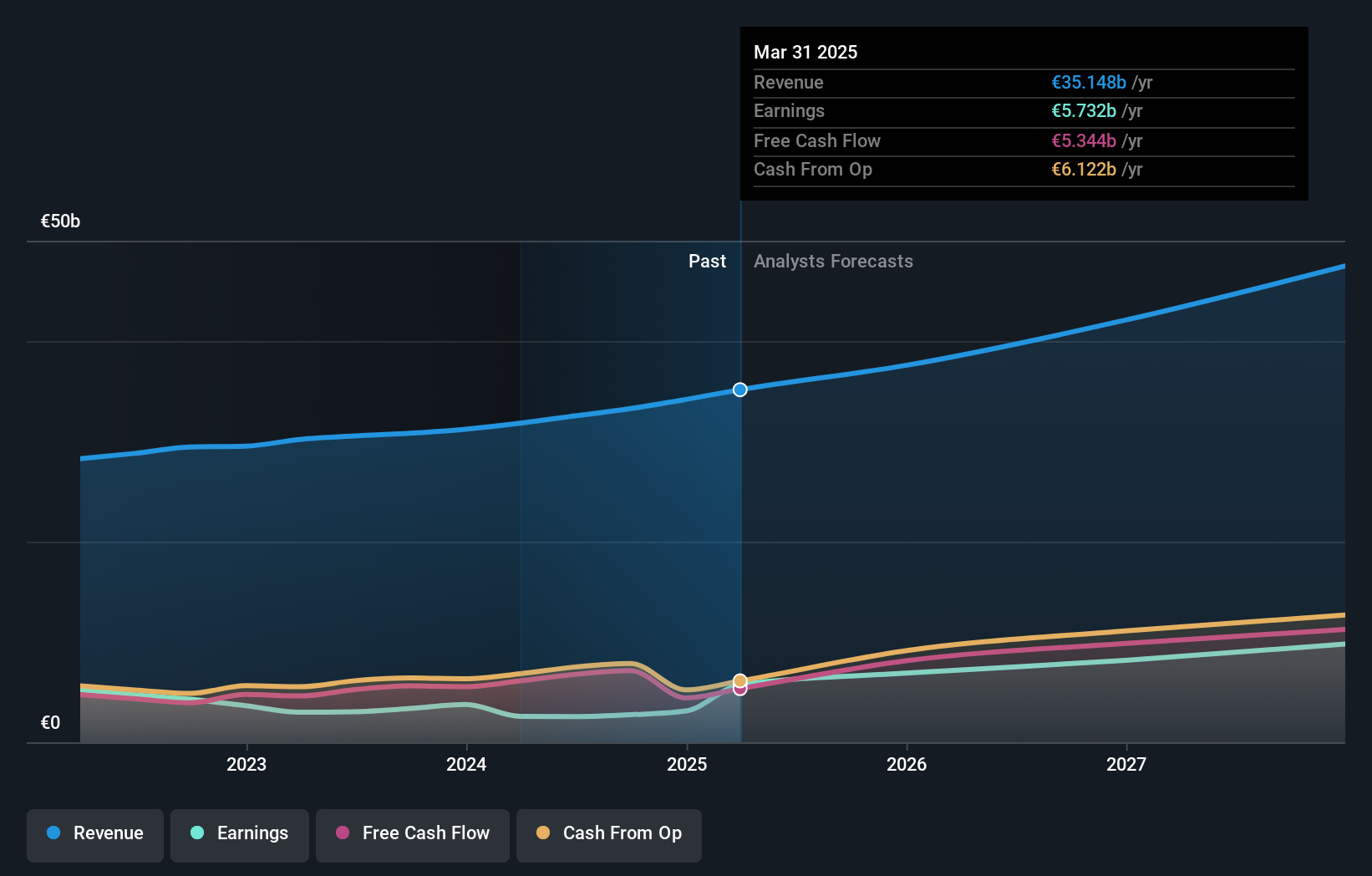

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers a range of applications, technology, and services globally and has a market capitalization of approximately €241.81 billion.

Operations: SAP generates revenue primarily through its Applications, Technology & Services segment, which accounted for €32.54 billion. The company's operations are focused on providing a comprehensive suite of software solutions and services to businesses worldwide.

Amidst a backdrop of challenging market dynamics, SAP has demonstrated resilience and strategic foresight, particularly in its R&D initiatives which remain robust with significant expenditures aimed at fostering innovation. The company's commitment to research has led to a notable 9.6% projected annual revenue growth and an impressive 37.9% expected increase in earnings per year, figures that underscore SAP's potential within the high-growth tech sector in Germany. Recent developments include the unveiling of AI advancements that enhance the capabilities of its Joule system—central to improving business efficiency across global commerce—which could further solidify its competitive edge by integrating AI more deeply into core business operations.

- Dive into the specifics of SAP here with our thorough health report.

Assess SAP's past performance with our detailed historical performance reports.

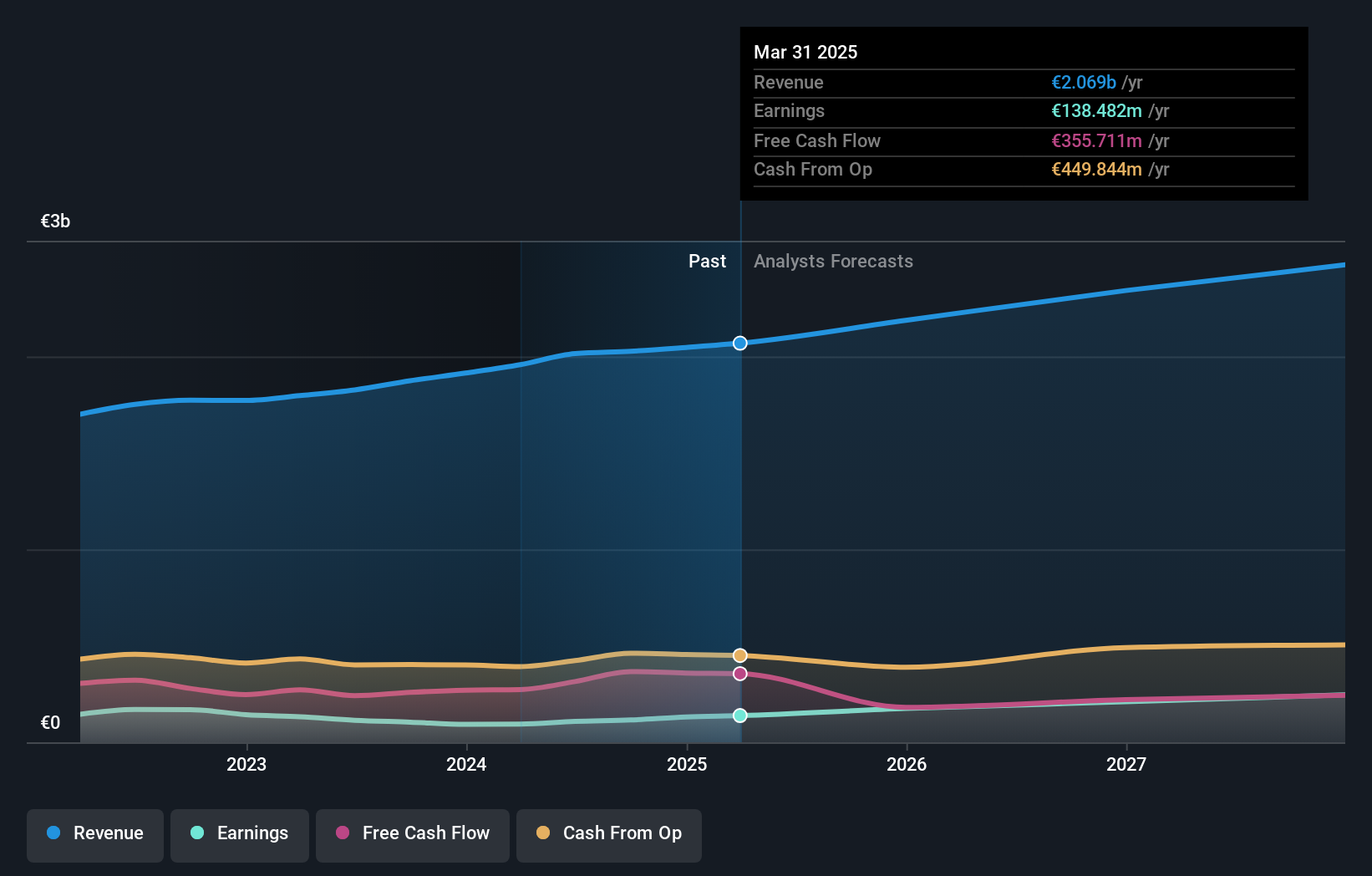

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA is a company that offers out-of-home media and online advertising solutions both in Germany and internationally, with a market cap of €3.16 billion.

Operations: Ströer SE & Co. KGaA generates revenue primarily from its Out-Of-Home Media and Digital & Dialog Media segments, with €922.53 million and €862.76 million respectively. The company also has a presence in Daas & E-Commerce, contributing €357.19 million to its revenue streams.

Ströer SE & Co. KGaA's recent performance and strategic presentations underscore its evolving stance in the high-growth tech sector in Germany. With a 7.5% revenue growth forecast, it surpasses the German market average of 5.4%, reflecting robust operational momentum. Notably, its R&D commitment is substantial, aligning with an impressive anticipated earnings growth of 29.2% annually, which starkly outpaces the broader market's 20.2%. These figures were highlighted across multiple industry conferences, suggesting Ströer is not only enhancing its technological capabilities but also effectively communicating these advances to stakeholders globally—a strategy that may well bolster its competitive edge as it navigates future tech landscapes.

- Unlock comprehensive insights into our analysis of Ströer SE KGaA stock in this health report.

Gain insights into Ströer SE KGaA's past trends and performance with our Past report.

Key Takeaways

- Take a closer look at our German High Growth Tech and AI Stocks list of 40 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.