- Germany

- /

- Communications

- /

- XTRA:ADV

This Analyst Just Downgraded Their Adtran Networks SE (ETR:ADV) EPS Forecasts

Today is shaping up negative for Adtran Networks SE (ETR:ADV) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analyst factored in the latest outlook for the business, concluding that they were too optimistic previously.

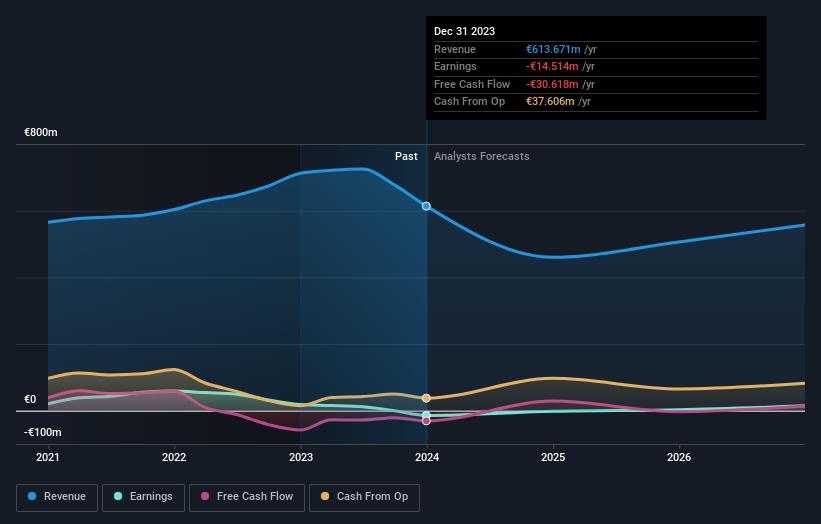

Following the latest downgrade, the solo analyst covering Adtran Networks provided consensus estimates of €460m revenue in 2024, which would reflect a disturbing 25% decline on its sales over the past 12 months. Losses are predicted to fall substantially, shrinking 86% to €0.04 per share. Yet before this consensus update, the analyst had been forecasting revenues of €570m and losses of €0.01 per share in 2024. So there's been quite a change-up of views after the recent consensus updates, with the analyst making a serious cut to their revenue forecasts while also expecting losses per share to increase.

Check out our latest analysis for Adtran Networks

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that sales are expected to reverse, with a forecast 25% annualised revenue decline to the end of 2024. That is a notable change from historical growth of 6.6% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 3.2% annually for the foreseeable future. It's pretty clear that Adtran Networks' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to note from this downgrade is that the consensus increased its forecast losses this year, suggesting all may not be well at Adtran Networks. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the serious cut to this year's outlook, it's clear that the analyst has turned more bearish on Adtran Networks, and we wouldn't blame shareholders for feeling a little more cautious themselves.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for Adtran Networks going out as far as 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion