- Germany

- /

- Communications

- /

- XTRA:ADV

Exploring High Growth Tech Stocks Including Beijing Labtech Instruments And 2 More

Reviewed by Simply Wall St

In a week marked by busy earnings reports and economic data, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 hit record highs before experiencing sharp declines, highlighting the volatility currently impacting growth stocks. Amid these fluctuations, small-cap stocks have shown resilience compared to their larger counterparts, making it crucial for investors to focus on companies with strong fundamentals and innovative potential in sectors such as high-growth technology.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.17% | 70.50% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.33% | 69.07% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions to the global laboratory industry, with a market cap of CN¥1.86 billion.

Operations: Beijing Labtech Instruments Co., Ltd. focuses on producing and distributing laboratory products and solutions globally. The company's revenue is primarily derived from its comprehensive range of laboratory instruments, catering to various sectors within the industry.

Beijing Labtech Instruments has demonstrated a robust financial performance, with a notable increase in sales to CNY 311.09 million and net income rising to CNY 35.1 million over the recent nine months, reflecting year-over-year improvements of 3.7% and 31.7%, respectively. This growth is underpinned by an aggressive R&D strategy, where investments are closely aligned with revenue increases, ensuring sustained innovation and market competitiveness. With earnings forecasted to grow by an impressive 26.5% annually, outpacing the Chinese market's average of 25.7%, the company is well-positioned within the high-tech sector despite a challenging industry backdrop marked by its recent -2.1% earnings contraction against an industry growth rate of 1.6%. The firm's strategic focus on expanding its technological capabilities while maintaining positive free cash flow highlights its potential for continued market relevance and financial health.

LuxNet (TPEX:4979)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LuxNet Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, and sale of electric and optical communication components in Taiwan, with a market cap of NT$20.07 billion.

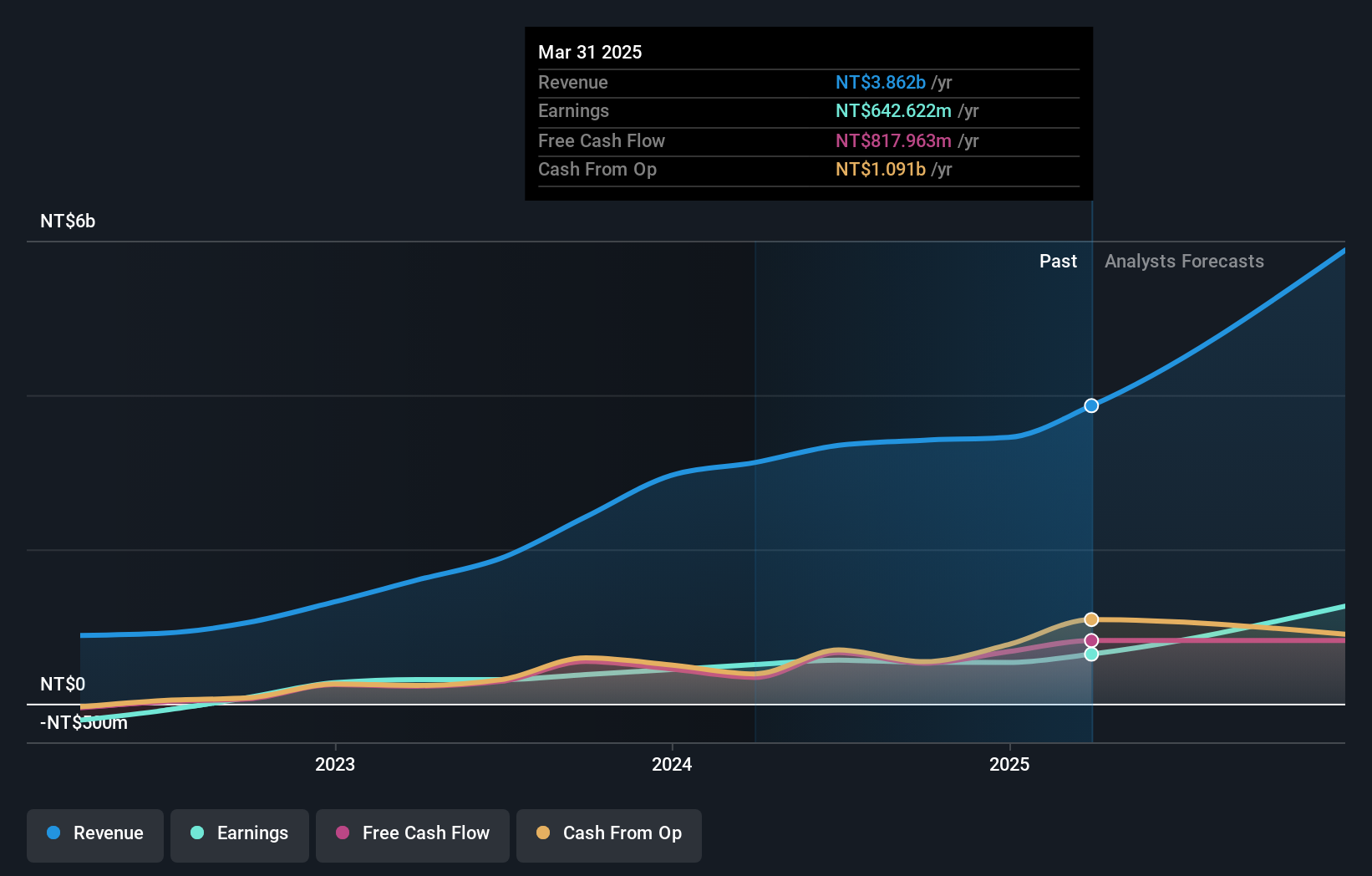

Operations: Specializing in optical communication system active components, LuxNet generates revenue of NT$3.35 billion from this segment.

LuxNet's recent financial performance underscores its robust position in the tech sector, with a remarkable surge in sales and net income, growing year-over-year by 38.6% and 70%, respectively. This growth trajectory is bolstered by an aggressive R&D investment strategy, which not only fuels innovation but also aligns closely with revenue increases—demonstrating a clear commitment to maintaining competitive edge. Moreover, LuxNet's earnings are expected to grow at an impressive rate of 22.65% annually, outpacing the TW market's average growth rate of 19.1%. This forward momentum is further evidenced by their significant earnings growth over the past year at 81%, exceeding their industry’s average growth rate of 6.9%.

- Navigate through the intricacies of LuxNet with our comprehensive health report here.

Explore historical data to track LuxNet's performance over time in our Past section.

Adtran Networks (XTRA:ADV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Adtran Networks SE focuses on developing, manufacturing, and selling optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to support data, storage, voice, and video services, with a market cap of €1.02 billion.

Operations: Adtran Networks SE generates revenue primarily from its optical networking equipment segment, which accounts for €481.90 million. The company serves telecommunications carriers and enterprises by providing solutions that enable data, storage, voice, and video services.

Adtran Networks, navigating a challenging fiscal period, reported a significant revenue drop to EUR 108.17 million in Q2 2024 from EUR 170.19 million the previous year, reflecting broader market dynamics yet underscoring potential resilience. Despite current unprofitability with a net loss of EUR 0.826 million this quarter, forecasts suggest an optimistic turnaround with earnings expected to surge by 124.1% annually over the next three years. This growth is anticipated as part of Adtran's strategic adjustments and innovation focus, particularly in R&D where investments align closely with long-term revenue projections—currently growing at a modest rate of 6.8% per year but outpacing the German market's average of 5.5%.

- Click here and access our complete health analysis report to understand the dynamics of Adtran Networks.

Examine Adtran Networks' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Unlock our comprehensive list of 1292 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives