B+S Banksysteme (FRA:DTD2) Takes On Some Risk With Its Use Of Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that B+S Banksysteme Aktiengesellschaft (FRA:DTD2) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for B+S Banksysteme

What Is B+S Banksysteme's Net Debt?

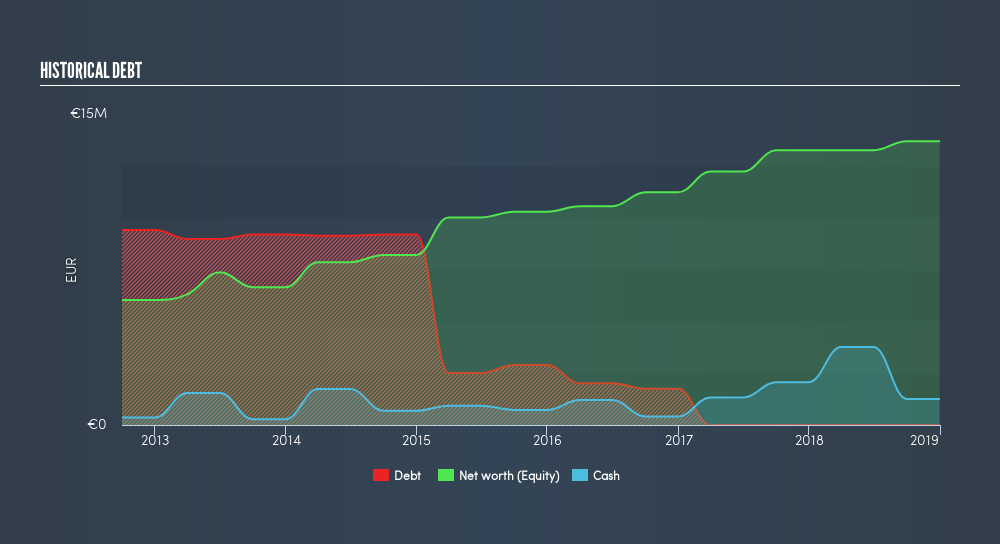

The chart below, which you can click on for greater detail, shows that B+S Banksysteme had €5.02m in debt in December 2018; about the same as the year before. On the flip side, it has €1.26m in cash leading to net debt of about €3.77m.

How Healthy Is B+S Banksysteme's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that B+S Banksysteme had liabilities of €7.14m due within 12 months and liabilities of €6.07m due beyond that. On the other hand, it had cash of €1.26m and €5.44m worth of receivables due within a year. So it has liabilities totalling €6.51m more than its cash and near-term receivables, combined.

This deficit isn't so bad because B+S Banksysteme is worth €14.4m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Since B+S Banksysteme does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

B+S Banksysteme's debt is only 2.71 times its EBITDA, and its EBIT cover its interest expense 4.31 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Even worse, B+S Banksysteme saw its EBIT tank 78% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if B+S Banksysteme can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, B+S Banksysteme actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us excited like the crowd when the beat drops at a Daft Punk concert.

Our View

B+S Banksysteme's EBIT growth rate and interest cover definitely weigh on it, in our esteem. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. Looking at all the angles mentioned above, it does seem to us that B+S Banksysteme is a somewhat risky investment as a result of its debt. That's not necessarily a bad thing, since leverage can boost returns on equity, but it is something to be aware of. Over time, share prices tend to follow earnings per share, so if you're interested in B+S Banksysteme, you may well want to click here to check an interactive graph of its earnings per share history.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:DTD2

B+S Banksysteme

Provides software solutions for banks and financial service providers.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion