B+S Banksysteme (FRA:DTD2) Shareholders Have Enjoyed An Impressive 201% Share Price Gain

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of B+S Banksysteme Aktiengesellschaft (FRA:DTD2) stock is up an impressive 201% over the last five years.

See our latest analysis for B+S Banksysteme

While B+S Banksysteme made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, if the market is looking past earnings to focus on revenue, there is a hope for, or expectation of, strong growth. The main reason for this is that fast revenue growth can be readily extrapolated into a profitable future, but stagnant revenue cannot.

In the last 5 years B+S Banksysteme saw its revenue grow at 8.2% per year. That's a fairly respectable growth rate. We'd argue this growth has been reflected in the share price which has climbed at a rate of 25% per year over in that time. Given that the business has made good progress on the top line, it would be worth taking a look at the growth trend. Accelerating growth can be a sign of an inflection point - and could indicate profits lie ahead. Worth watching 100%

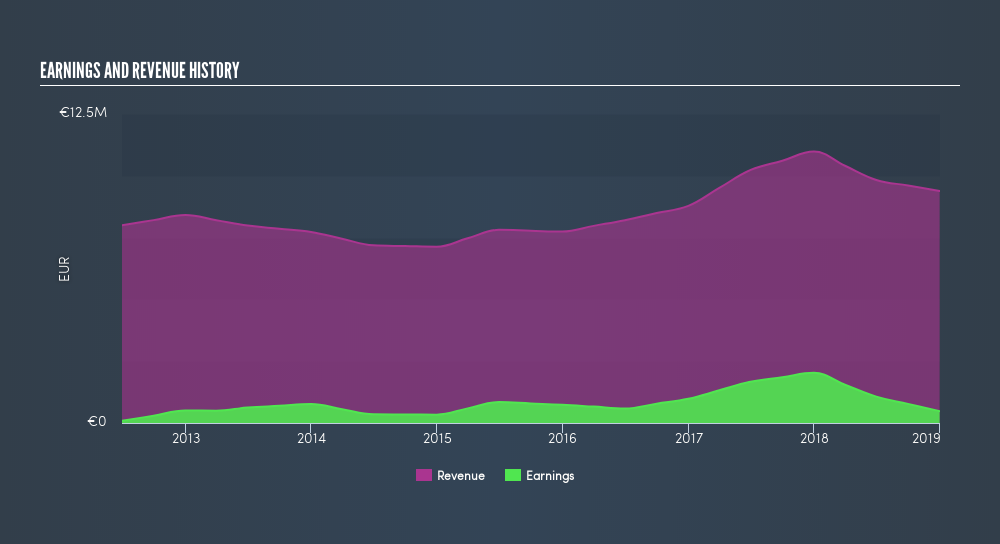

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

While the broader market lost about 7.1% in the twelve months, B+S Banksysteme shareholders did even worse, losing 38%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 25%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Before forming an opinion on B+S Banksysteme you might want to consider these 3 valuation metrics.

But note: B+S Banksysteme may not be the best stock to buy. So take a peek at this freelist of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:DTD2

B+S Banksysteme

Provides software solutions for banks and financial service providers.

Undervalued with solid track record.

Market Insights

Community Narratives