What Does SAP’s Solid Cloud Momentum Mean for Its 2025 Share Price?

Reviewed by Bailey Pemberton

Thinking about what to do with SAP stock right now? You are not alone. Whether you already hold shares or are eyeing them for your portfolio, recent price movements have definitely kept investors on their toes. Over the last week, SAP’s share price inched up 2.2%, a subtle boost that stands out against a backdrop of growing global interest in cloud-computing and business software solutions. However, if you zoom out just a little, the thirty-day return slips into the red at -0.5%, and year-to-date, the stock is down 3.5%. That said, anyone who has held SAP over the past year is sitting on a healthy 15.7% gain. The longer-term picture is even brighter, with a 175.8% return over three years and 87.8% over five.

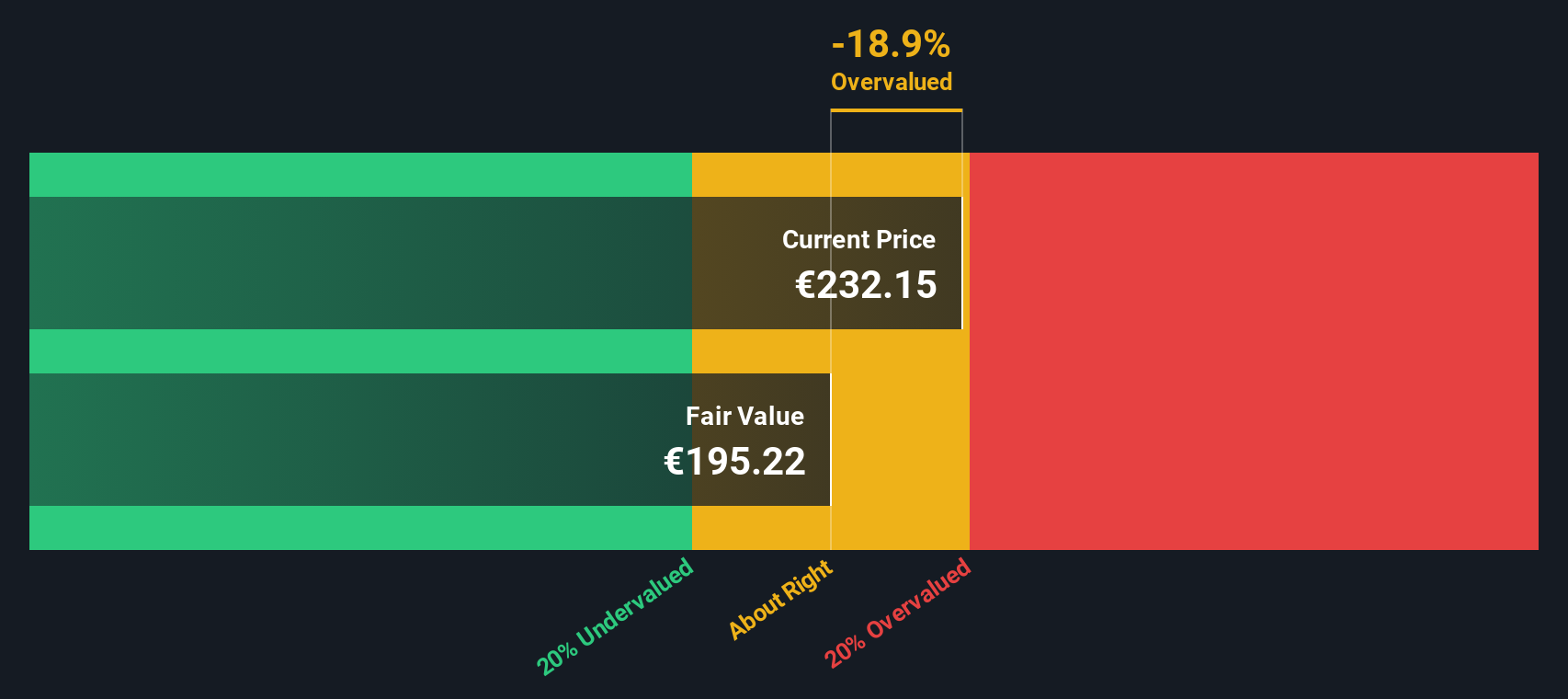

Those numbers suggest a company that has powered through a range of environments, reflecting both confidence about its future and occasional changes in investor risk appetite. Recent discussions across the industry about the evolving digital transformation landscape seem to have contributed to renewed optimism. Yet, for all the excitement, smart investors know that price gains are only half the story. It is valuation that truly tells you what you are getting for your money. Based on a straightforward value scoring system, SAP is undervalued in 3 out of 6 key checks, giving it a value score of 3. But are these traditional checks enough to capture SAP’s real worth? Let’s look at how valuation approaches stack up and stay tuned for what might be a smarter way to assess value in today’s changing markets.

Approach 1: SAP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting future free cash flows and discounting them back to today's euros. This provides a present-value snapshot of what the business is worth. This approach is especially relevant for firms like SAP, where steady cash flow generation is key.

SAP’s latest twelve-month free cash flow stands at approximately €6.3 billion, and analysts expect robust growth ahead. By 2027, consensus projections place annual free cash flow at €11.4 billion, with Simply Wall St extrapolations extending that into the next decade. Over ten years, SAP’s annual free cash flow is projected to consistently rise, reaching close to €16.8 billion by 2035.

After crunching these projections, the DCF model arrives at an intrinsic value of €243.38 per share. This is about 5.4% above the current share price, which implies SAP stock is marginally undervalued using this method.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out SAP's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: SAP Price vs Earnings (PE Ratio)

The price-to-earnings (PE) ratio is a widely used metric for evaluating profitable companies like SAP, since it links a company’s market value directly to its earnings power. The PE ratio provides a straightforward way to compare how much investors are willing to pay today for each euro of current earnings. It is particularly useful for established tech firms with reliable and growing profits, as is the case with SAP.

What counts as a “normal” PE ratio depends largely on expectations for future earnings growth and the perceived risk of the company. Higher expected growth and lower risk typically justify a higher PE ratio, since investors are paying up for future prospects and stability. Conversely, a lower growth outlook or elevated risks warrant a discounted multiple.

SAP currently trades at a PE ratio of 41x. This compares to a Software industry average of 30.4x, and a peer average of 37.8x. On the surface, this suggests SAP is priced above both its industry and peer group. However, these simple comparisons overlook important contextual factors.

This is where the Simply Wall St Fair Ratio comes in. The Fair Ratio is a tailored multiple that takes into account SAP’s earnings growth outlook, profit margins, market capitalization, and relevant risks. It provides a more comprehensive sense of fair value than plain industry or peer averages. For SAP, the Fair Ratio stands at 43.6x. Because SAP’s actual PE of 41x is only marginally below this Fair Ratio, it points to the shares being appropriately valued relative to their fundamentals and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SAP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personal story about a company: what you believe about SAP’s future, how its growth will play out, and what all that means for fair value. Narratives help you link SAP’s outlook to real numbers by combining your assumptions on revenue, earnings, and margins into a tailored forecast, which then connects directly to your fair value and investment decision.

Narratives are not just for professionals. They are easy to use and available in the Community section on Simply Wall St, where millions of investors share their perspectives. With a few clicks, you can compare your Narrative for SAP to others and see how your view stacks up. Narratives also update automatically when big news or earnings reports come out, helping you adjust to new information in real time.

For example, some investors see SAP’s future growth and assign a fair value as high as €345 per share, while more cautious outlooks put it as low as €192. This demonstrates how Narratives reflect different expectations and risk appetites. By comparing these views to the current price, you can quickly decide if SAP fits your strategy, making investment decisions clearer and more personalized.

Do you think there's more to the story for SAP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)