SAP (XTRA:SAP) Profit Margin Surges, Challenging Expectations for Sustained Turnaround

Reviewed by Simply Wall St

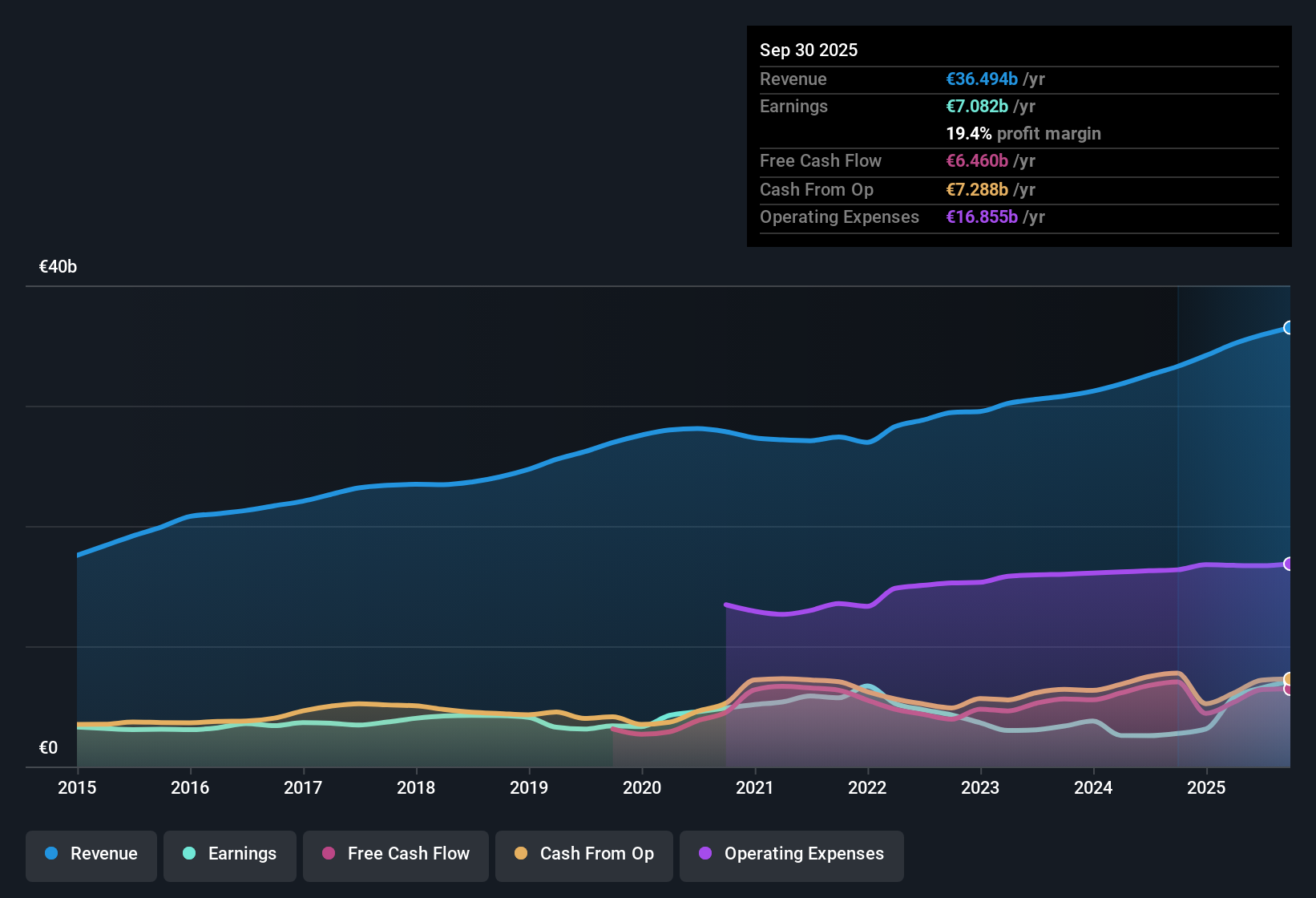

SAP (XTRA:SAP) delivered a sharp profit turnaround, with net profit margins rising to 19.4% from 8.3% previously and annual earnings growth increasing 158%, in stark contrast to its former five-year average annual decline of 4.1%. Estimates now call for annual earnings growth of 14.4% and revenue growth of 11.1%. Both figures are expected to outpace the wider German market's anticipated 6% annual revenue increase, while net earnings growth is expected to lag just behind the market at 16.6% per year. With no major risk factors flagged and high-quality profitability trends, SAP's outlook draws attention for its margin expansion and valuation potential.

See our full analysis for SAP.The next section compares these results with the key narratives driving market opinion. Some common themes are reinforced, while others may face new scrutiny.

See what the community is saying about SAP

AI and Cloud Drive Margin Momentum

- SAP's current net profit margin stands at 19.4%, up dramatically from 8.3% previously. This points to sustained profitability gains that analysts expect will rise further to 20.2% within three years.

- Analysts' consensus view sees cloud adoption and embedded Business AI fueling higher recurring revenue. This, in turn, supports margin expansion and greater earnings visibility.

- Rapid migration to cloud offerings such as S/4HANA and RISE with SAP is boosting high-margin, subscription-based revenue, underscoring analysts’ confidence in multi-year profit sustainability.

- Cloud backlog and double-digit growth in cloud ERP support forecasts for scalable, recurring profit growth that aligns with the consensus outlook.

- The consensus narrative notes that internal productivity improvements from SAP’s own AI tools are further separating expenses from revenue growth, reinforcing expectations for sustainable operating leverage.

- Implementation of digital transformation allows SAP to widen the gap between its cost base and top-line growth, directly supporting margin improvement as cited by analysts.

- Market reach and topline acceleration through strategic partnerships provide additional support to this core bullish thesis for robust operating leverage.

Regulatory and Competitive Pressures Cloud Outlook

- SAP faces intensifying global and regulatory headwinds, including evolving data sovereignty requirements and frequent restructuring. These factors risk elevating operating expenses and introducing unpredictability into future net earnings.

- The consensus narrative cautions that higher compliance costs and shifting customer preferences could compress margins or slow planned earnings growth.

- Ongoing transformation efforts, such as workforce reskilling and severance management, may offset productivity gains if not well executed.

- The rise of open-source and modular cloud solutions increases competition, raising the probability of customer attrition and delayed margin expansion, as noted by analysts.

Valuation: Premium Multiple, Upside Gap Remains

- SAP trades at a price-to-earnings ratio of 39.8x, above both the peer average (36.5x) and the broader European software industry (29.4x). However, the current share price (€242) remains below the DCF fair value of €253.29 and well under the consensus analyst target of €288.10.

- The consensus narrative highlights that sustaining this valuation premium will depend on SAP meeting ambitious growth, earnings, and margin forecasts.

- Some observers may point to high forecasted revenue growth and margin expansion compared to industry peers as justification for SAP’s above-average P/E multiple.

- Others argue that risks such as competitive pressure or execution missteps could challenge the market’s willingness to reward SAP with a persistent valuation premium.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SAP on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Use your insight to share your own view and craft a unique narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding SAP.

See What Else Is Out There

While SAP’s premium valuation depends on hitting bold growth and margin targets, competitive threats and rising compliance costs could put future earnings delivery under pressure.

If you’re after companies where the price better reflects fundamentals, now’s your chance to discover value opportunities with these 876 undervalued stocks based on cash flows before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion