SAP (XTRA:SAP) Partners Globally With JA Worldwide To Empower Over 85,000 Youth

Reviewed by Simply Wall St

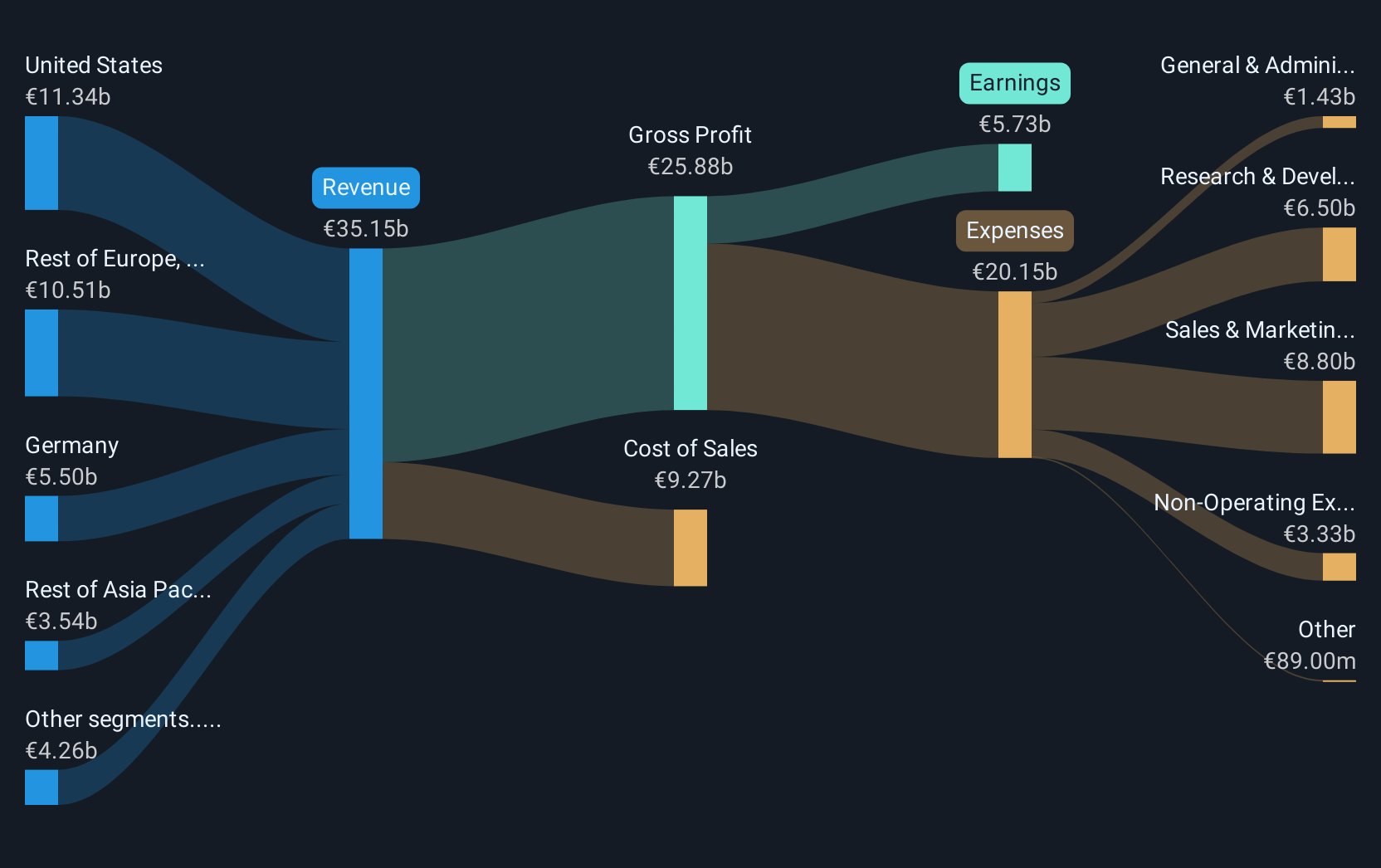

In a significant proactive step towards empowering young individuals globally, JA Worldwide and SAP (XTRA:SAP) have announced a partnership focused on workforce readiness. Over the last quarter, SAP's share price saw a 17% increase, buoyed by not only this engaging initiative but also a strong earnings report that highlighted impressive revenue growth and a return to profitability. Collaborations with Vianai Systems and Accenture, alongside advancements in technology, contributed additional positive momentum. This upward trend aligns with a generally flat market amidst uncertainty about trade policies, underscoring SAP's capability in navigating challenging global conditions effectively.

Buy, Hold or Sell SAP? View our complete analysis and fair value estimate and you decide.

The partnership between JA Worldwide and SAP could have a meaningful impact on both the future business narrative and SAP's market position. It aligns with SAP's focus on workforce readiness and innovation in cloud and AI, enhancing its strategic objectives. Over the past three years, SAP shares have delivered a substantial total return of 207.08%, illustrating strong performance. Notably, SAP achieved better returns than the German Software industry's 38% increase over the past year, suggesting competitive advantage in the sector.

The recently announced collaboration is expected to support revenue and earnings forecasts by potentially expanding SAP's market reach and reinforcing its brand value. With cloud and AI developments at the forefront, this initiative could accelerate adoption of SAP's technological advancements, contributing positively to revenue streams such as the anticipated near €5 billion cloud revenue.

SAP's share price remains 8.5% below the average analyst price target of €279.05, indicating analysts' relatively optimistic outlook compared to current market pricing of €255.3. This gap reflects differing expectations of future revenue growth, profit margins, and challenges that SAP might face, making the consensus target an aspirational benchmark for ongoing company performance assessments. As SAP continues to address global uncertainties, this collaboration may reinforce investor confidence in SAP's capacity for resilience and adaptability.

Review our historical performance report to gain insights into SAP's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives