SAP (XTRA:SAP) Expands Talent Solutions with Phenom Endorsed App Integration

Reviewed by Simply Wall St

SAP (XTRA:SAP) achieved a notable milestone this quarter with Phenom's platform becoming an SAP Endorsed App, enhancing recruitment efforts for SAP SuccessFactors users. This development, coupled with substantial partnerships such as the one with Accenture for cloud pathways, are significant steps towards strengthening its market position. Despite these advancements, SAP's quarter ended with a stock price move of 3.81%, aligning with broader market trends which have risen 13% over the past year. While the company's strategic efforts may have influenced sentiment, the stock's performance broadly mirrored current market dynamics, reinforcing its stability amid broader economic conditions.

Buy, Hold or Sell SAP? View our complete analysis and fair value estimate and you decide.

SAP's recent collaboration with Phenom and Accenture is a promising move for its SuccessFactors platform, potentially driving greater adoption and enhancing recruitment efforts. This development is expected to bolster SAP's competitiveness in cloud applications. Over the long-term, SAP's total shareholder return, including dividends, was over very large for the three-year period, indicating significant investor gains. This performance highlights the resilience and growth potential of SAP compared to the broader market, which returned 16.6% over the past year, although SAP's one-year return aligned with the German Software industry's gain of 57.4%.

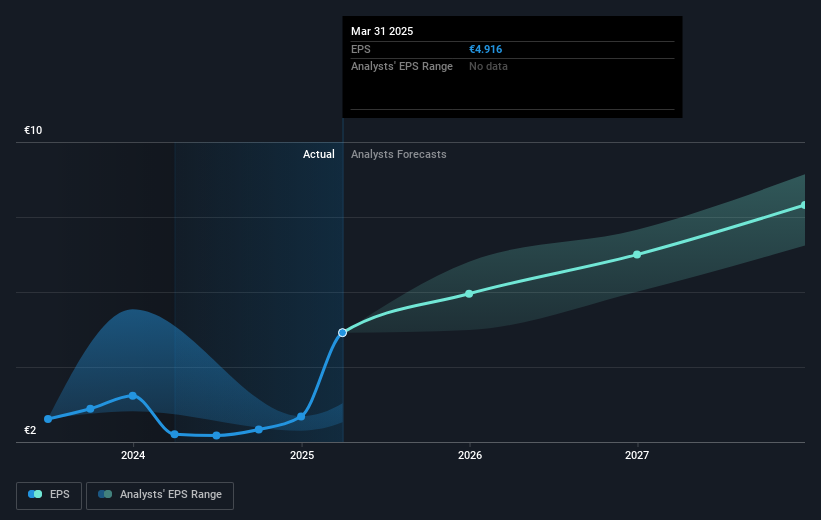

The partnerships and endorsements could positively influence revenue and earnings forecasts by expanding SAP's customer base and operational efficiency. Analysts forecast a growth rate of 12.1% annually in revenue, with earnings projected to more than double to €10.2 billion in the next few years. In light of these forecasts, the current share price of €255.3 sits reasonably close to the consensus price target of €279.05, suggesting moderate room for appreciation. Investors should consider SAP's potential to leverage its cloud and AI advancements along with current macroeconomic factors when evaluating the company's long-term investment appeal.

Learn about SAP's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)