3 Prominent Stocks Estimated At 44.2% Or More Below Intrinsic Value

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policies, global markets have experienced significant fluctuations, with U.S. stocks reaching record highs driven by expectations of growth-friendly fiscal measures. Amid these developments, investors are increasingly focused on identifying undervalued opportunities that might benefit from the current economic landscape. In this context, understanding intrinsic value becomes crucial as it helps investors pinpoint stocks that may be trading below their true worth in a volatile market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$122.86 | US$245.13 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.14 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| TBC Bank Group (LSE:TBCG) | £31.35 | £62.68 | 50% |

| Afya (NasdaqGS:AFYA) | US$16.16 | US$32.25 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.06 | 49.8% |

| XPEL (NasdaqCM:XPEL) | US$45.46 | US$90.91 | 50% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.39 | MX$38.77 | 50% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

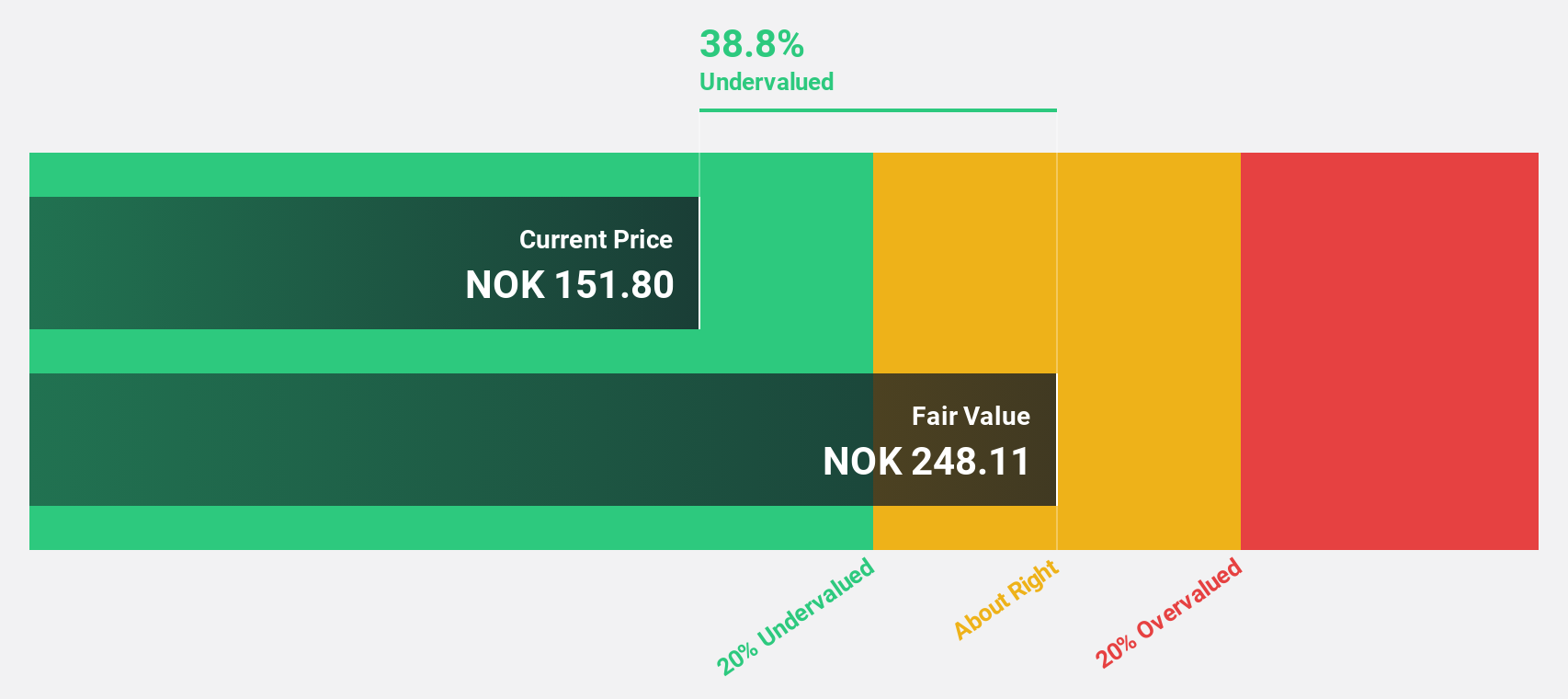

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK15.20 billion.

Operations: The company's revenue segments include NOK8.28 billion from Norway, NOK12.44 billion from Sweden, NOK7.37 billion from Denmark, NOK3.62 billion from Finland, and NOK1.76 billion from the Baltics, along with contributions of NOK9.20 billion from Group Shared Services and a deduction of NOK9.30 billion for Group Cost.

Estimated Discount To Fair Value: 44.2%

Atea ASA is trading at NOK 136, significantly below its estimated fair value of NOK 243.84, indicating it may be undervalued based on cash flows. Recent earnings showed a slight increase in net income to NOK 192 million for Q3 2024. Atea's revenue and profit growth forecasts exceed the Norwegian market averages, with an expected annual profit growth of over 21%. The company also announced a substantial frame agreement with Tiera Oy in Finland worth up to EUR 1.16 billion over four years.

- Our expertly prepared growth report on Atea implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Atea.

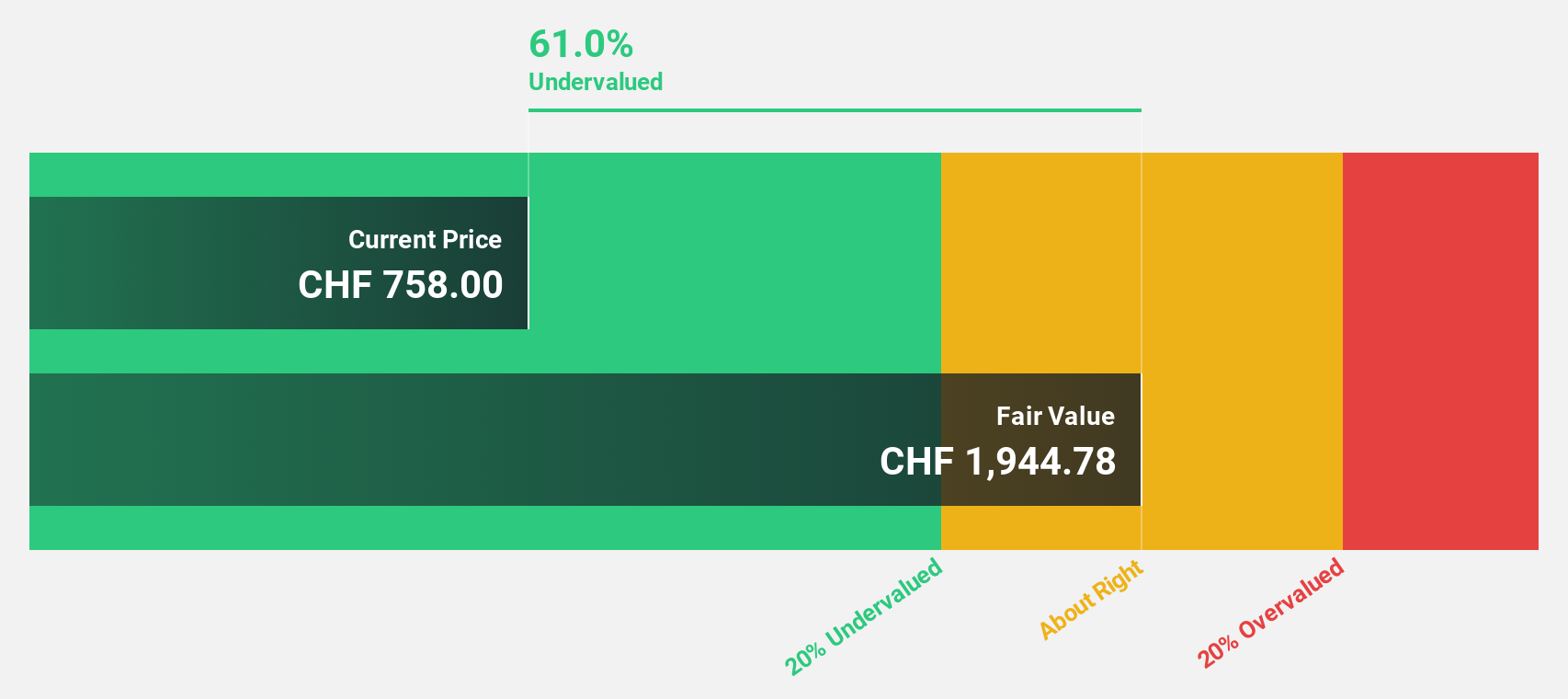

Emmi (SWX:EMMN)

Overview: Emmi AG, with a market cap of CHF4.38 billion, develops, produces, and markets a variety of dairy and fresh products across Switzerland and internationally in regions including Europe, the Americas, Africa, and Asia/Pacific.

Operations: Emmi's revenue segments include dairy and fresh products sold across Switzerland, Europe, the Americas, Africa, and Asia/Pacific.

Estimated Discount To Fair Value: 44.7%

Emmi is trading at CHF819, significantly below its estimated fair value of CHF1480.01, suggesting it is undervalued based on cash flows. The company's earnings are projected to grow 13% annually, outpacing the Swiss market's 11.2%. While revenue growth forecasts are modest at 5.1%, they still surpass the market average of 4.1%. Analysts anticipate a price increase of over 22%, and Emmi's return on equity is expected to reach a strong level in three years.

- Insights from our recent growth report point to a promising forecast for Emmi's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Emmi.

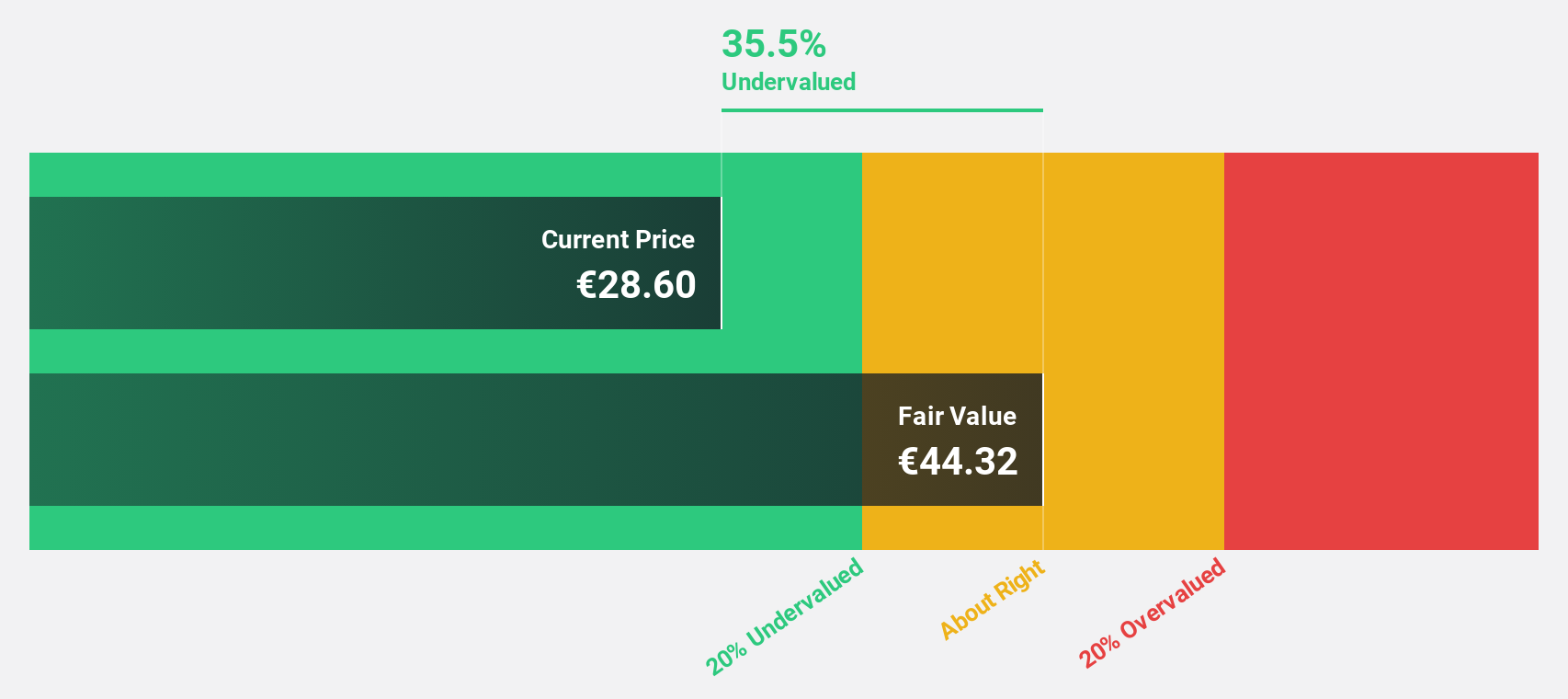

PSI Software (XTRA:PSAN)

Overview: PSI Software SE develops and integrates software solutions to optimize energy and material flows for utilities and industries globally, with a market cap of €334.54 million.

Operations: The company's revenue is primarily derived from its Energy Management segment, which accounts for €132.55 million, and its Production Management segment, contributing €134.45 million.

Estimated Discount To Fair Value: 44.6%

PSI Software is trading at €21.6, well below its estimated fair value of €39.01, indicating it is undervalued based on cash flows. Despite recent financial setbacks with a net loss for the third quarter and nine months of 2024, earnings are forecast to grow significantly at 64.21% annually over the next three years. The company is expected to become profitable within this period, with a strong return on equity projected at 20.9%.

- Our growth report here indicates PSI Software may be poised for an improving outlook.

- Get an in-depth perspective on PSI Software's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Unlock our comprehensive list of 900 Undervalued Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

Excellent balance sheet, good value and pays a dividend.