3 European Stocks Possibly Trading Below Their Intrinsic Value Estimates

Reviewed by Simply Wall St

As European markets grapple with the fallout from higher-than-expected U.S. trade tariffs, major indices like the STOXX Europe 600 have seen their steepest declines in years, reflecting broader concerns over economic growth and inflation. In such volatile conditions, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on market inefficiencies while navigating uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.90 | SEK97.74 | 50% |

| Zinzino (OM:ZZ B) | SEK139.80 | SEK278.41 | 49.8% |

| Mips (OM:MIPS) | SEK351.20 | SEK684.17 | 48.7% |

| LPP (WSE:LPP) | PLN15365.00 | PLN30699.29 | 49.9% |

| Absolent Air Care Group (OM:ABSO) | SEK282.00 | SEK551.36 | 48.9% |

| Fervi (BIT:FVI) | €14.70 | €29.13 | 49.5% |

| Kitron (OB:KIT) | NOK47.32 | NOK93.66 | 49.5% |

| Dino Polska (WSE:DNP) | PLN447.70 | PLN875.87 | 48.9% |

| Siemens Energy (XTRA:ENR) | €49.50 | €96.49 | 48.7% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.80 | 48.6% |

Let's uncover some gems from our specialized screener.

Canatu Oyj (HLSE:CANATU)

Overview: Canatu Oyj specializes in the development and manufacturing of advanced carbon nanotube materials and related products, with a market cap of €340.36 million.

Operations: The company generates revenue primarily from its Blank Checks segment, amounting to €3.30 million.

Estimated Discount To Fair Value: 41.2%

Canatu Oyj, trading at €9.8, is significantly undervalued compared to its estimated fair value of €16.65. Despite recent financial challenges, including a net loss of €3.6 million in 2024 and substantial shareholder dilution, the company is forecasted to achieve high revenue growth of 39.6% annually and become profitable within three years. The expansion into a new facility in Vantaa supports long-term growth plans by enhancing production capacity and operational efficiency through shared resources with existing sites.

- Insights from our recent growth report point to a promising forecast for Canatu Oyj's business outlook.

- Click to explore a detailed breakdown of our findings in Canatu Oyj's balance sheet health report.

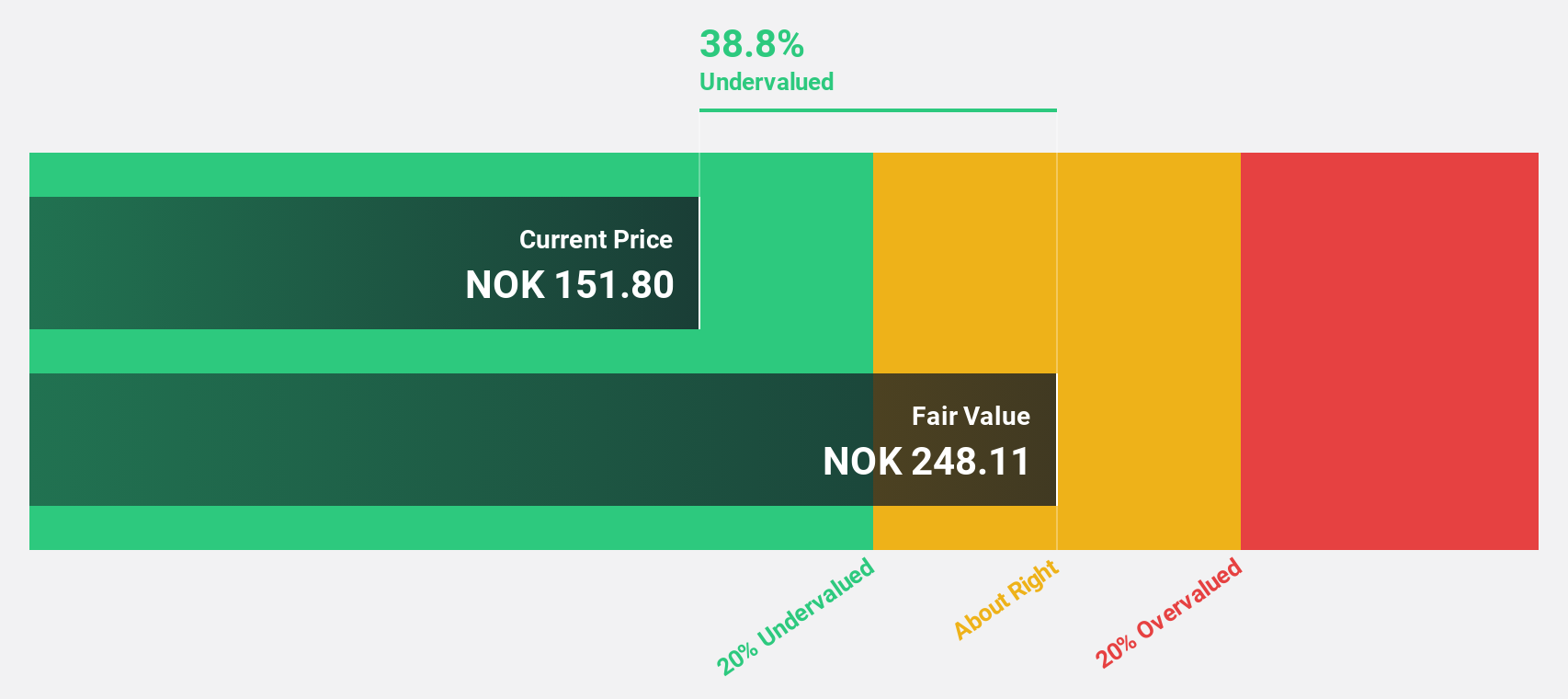

Atea (OB:ATEA)

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK14.05 billion.

Operations: The company's revenue segments are comprised of NOK8.80 billion from Norway, NOK12.76 billion from Sweden, NOK7.86 billion from Denmark, NOK3.58 billion from Finland, and NOK1.72 billion from the Baltics, with Group Shared Services contributing an additional NOK10.20 billion.

Estimated Discount To Fair Value: 46%

Atea, trading at NOK126, is highly undervalued with an estimated fair value of NOK233.43. Despite a slight decline in sales and net income for 2024, the company is poised for robust earnings growth of over 20% annually, outpacing the Norwegian market. Revenue growth is expected to be moderate at 7.3% per year. However, its dividend yield of 5.56% lacks sufficient earnings coverage, which may concern income-focused investors.

- Our growth report here indicates Atea may be poised for an improving outlook.

- Click here to discover the nuances of Atea with our detailed financial health report.

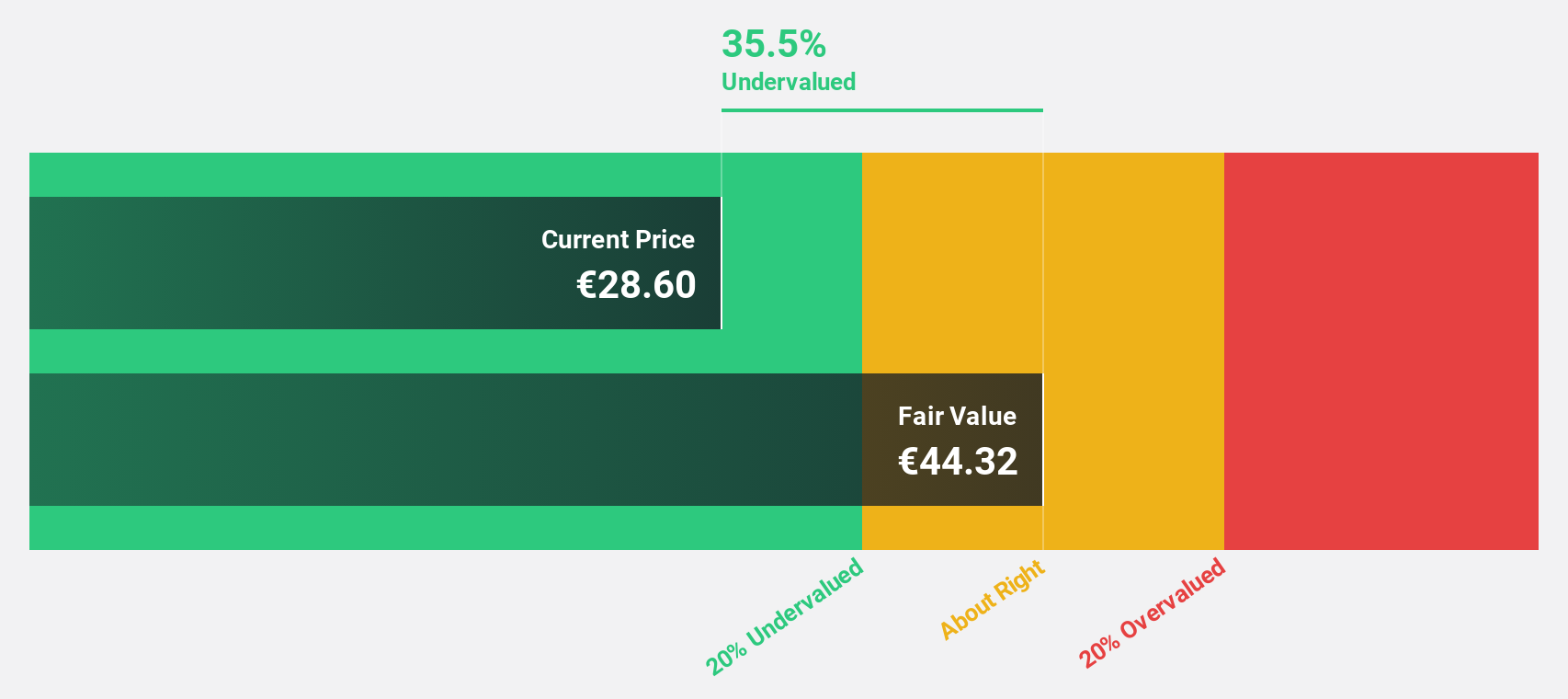

PSI Software (XTRA:PSAN)

Overview: PSI Software SE develops and integrates software solutions to optimize energy and material flow for utilities and industries globally, with a market cap of €362.42 million.

Operations: Revenue Segments (in millions of €): Energy Management €139.50, Production Management €116.80.

Estimated Discount To Fair Value: 47.8%

PSI Software, trading at €23.4, is significantly undervalued with a fair value estimate of €44.82. Despite reporting a net loss of €20.96 million for 2024, the company anticipates growth in new orders and sales by around 10% in 2025. The strategic alliance with Google Cloud aims to enhance efficiency and support SaaS transformation, potentially boosting long-term value creation as PSI transitions into a cloud-first software firm under its PSI reloaded strategy program.

- According our earnings growth report, there's an indication that PSI Software might be ready to expand.

- Take a closer look at PSI Software's balance sheet health here in our report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 181 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PSAN

PSI Software

Develops and integrates software solutions and products for optimizing the flow of energy and materials for utilities and industry worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives