Revenues Not Telling The Story For niiio finance group AG (ETR:NIIN) After Shares Rise 34%

niiio finance group AG (ETR:NIIN) shares have had a really impressive month, gaining 34% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

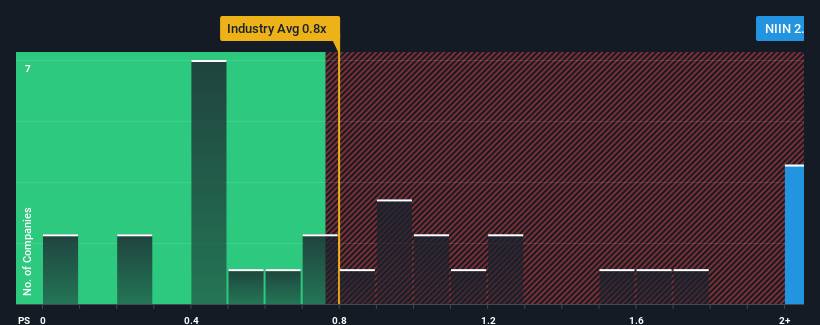

Following the firm bounce in price, you could be forgiven for thinking niiio finance group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.2x, considering almost half the companies in Germany's IT industry have P/S ratios below 0.8x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for niiio finance group

What Does niiio finance group's Recent Performance Look Like?

niiio finance group certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think niiio finance group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For niiio finance group?

There's an inherent assumption that a company should outperform the industry for P/S ratios like niiio finance group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 53% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 116% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 9.7% over the next year. That's not great when the rest of the industry is expected to grow by 9.8%.

In light of this, it's alarming that niiio finance group's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does niiio finance group's P/S Mean For Investors?

niiio finance group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that niiio finance group currently trades on a much higher than expected P/S for a company whose revenues are forecast to decline. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

Plus, you should also learn about these 2 warning signs we've spotted with niiio finance group (including 1 which is a bit unpleasant).

If these risks are making you reconsider your opinion on niiio finance group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NIIN

niiio finance group

Provides cloud-based software-as-a-service solutions for banks and financial service providers.

Low with imperfect balance sheet.

Market Insights

Community Narratives