The Bull Case For Nemetschek (XTRA:NEM) Could Change Following Strong Q3 and GoCanvas Integration Success

Reviewed by Sasha Jovanovic

- Nemetschek SE recently announced its third-quarter 2025 results, reporting sales of €293.13 million and net income of €55.26 million, both higher than the same period last year, alongside reaffirmed annual earnings guidance that includes the revenue impact of its GoCanvas acquisition.

- A distinguishing insight is the confirmation that the GoCanvas acquisition is expected to contribute significantly to Nemetschek's currency-adjusted revenue growth, highlighting the company's ongoing integration of acquired businesses into its performance outlook.

- We’ll explore how Nemetschek’s strong third-quarter results and confirmed guidance could influence its investment narrative and future expectations.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nemetschek Investment Narrative Recap

For shareholders in Nemetschek, the central belief hinges on the company’s drive to accelerate recurring revenues through SaaS and subscription models while acquiring and integrating growth assets like GoCanvas. The strong Q3 results and reaffirmed 2025 guidance do reinforce the near-term catalyst around successful SaaS migration and improved revenue visibility, but they do not materially lessen the biggest risk: that the pace of multiyear contract adoption could lead to unpredictable revenue swings if it slows or reverses.

Among recent announcements, the completion of the GoCanvas acquisition and the explicit estimate of a 450 basis point revenue lift in this year’s guidance are particularly relevant. This directly ties into the catalyst of successful M&A integration, which is crucial for sustaining above-market growth and supporting Nemetschek’s positioning in high-demand digital construction and design markets. In contrast, investors should pay close attention to the risk that revenue predictability could come under pressure if multiyear contract trends change suddenly…

Read the full narrative on Nemetschek (it's free!)

Nemetschek's outlook anticipates €1.7 billion in revenue and €359.5 million in earnings by 2028. This scenario is based on a projected 14.0% annual revenue growth rate and a €171.3 million increase in earnings from the current €188.2 million level.

Uncover how Nemetschek's forecasts yield a €123.79 fair value, a 33% upside to its current price.

Exploring Other Perspectives

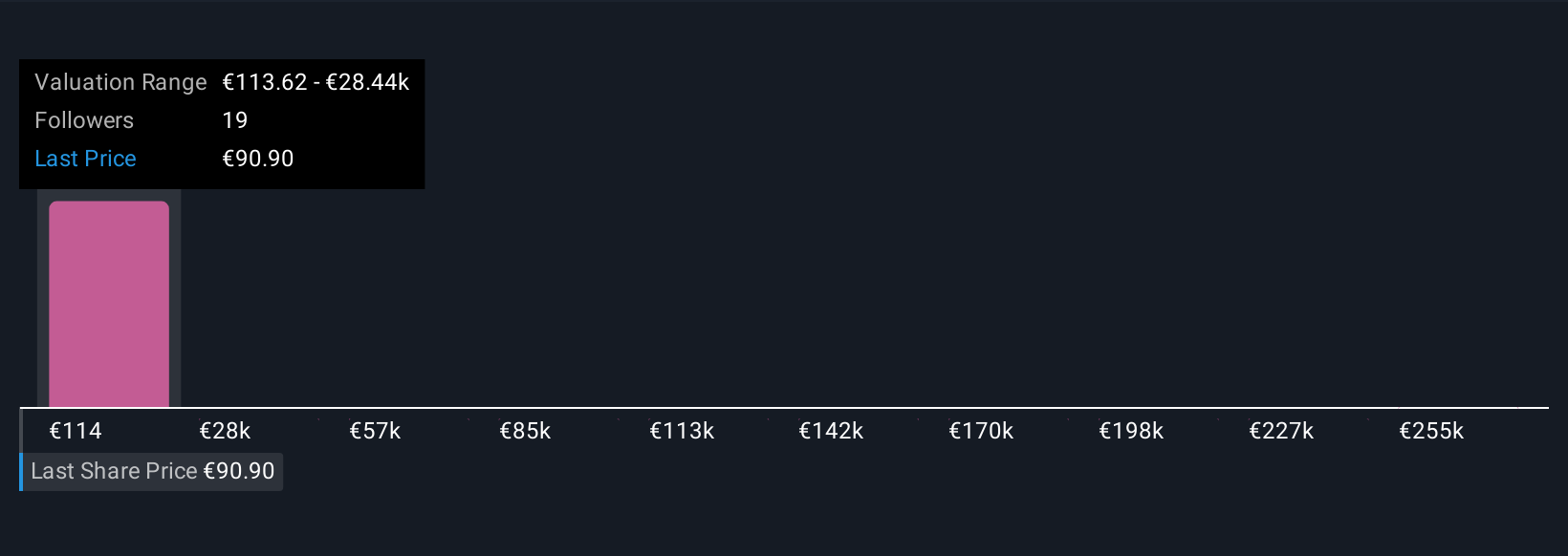

Three Simply Wall St Community fair value estimates for Nemetschek range from €113 to over €283,000, showing extraordinary diversity in private investor outlooks. As recurring revenue continues to climb, your perspective on revenue visibility and contract trends may shape very different conclusions about the company’s future, explore several viewpoints to inform your own.

Explore 3 other fair value estimates on Nemetschek - why the stock might be a potential multi-bagger!

Build Your Own Nemetschek Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nemetschek research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Nemetschek research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nemetschek's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nemetschek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NEM

Nemetschek

Provides software solutions for architecture, engineering, construction, operation, and media industries in Germany, the rest of Europe, the Americas, the Asia Pacific, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives