Mensch und Maschine (XTRA:MUM) Margin Surprise Reinforces Bullish Narratives, Dividend Sustainability Still in Question

Reviewed by Simply Wall St

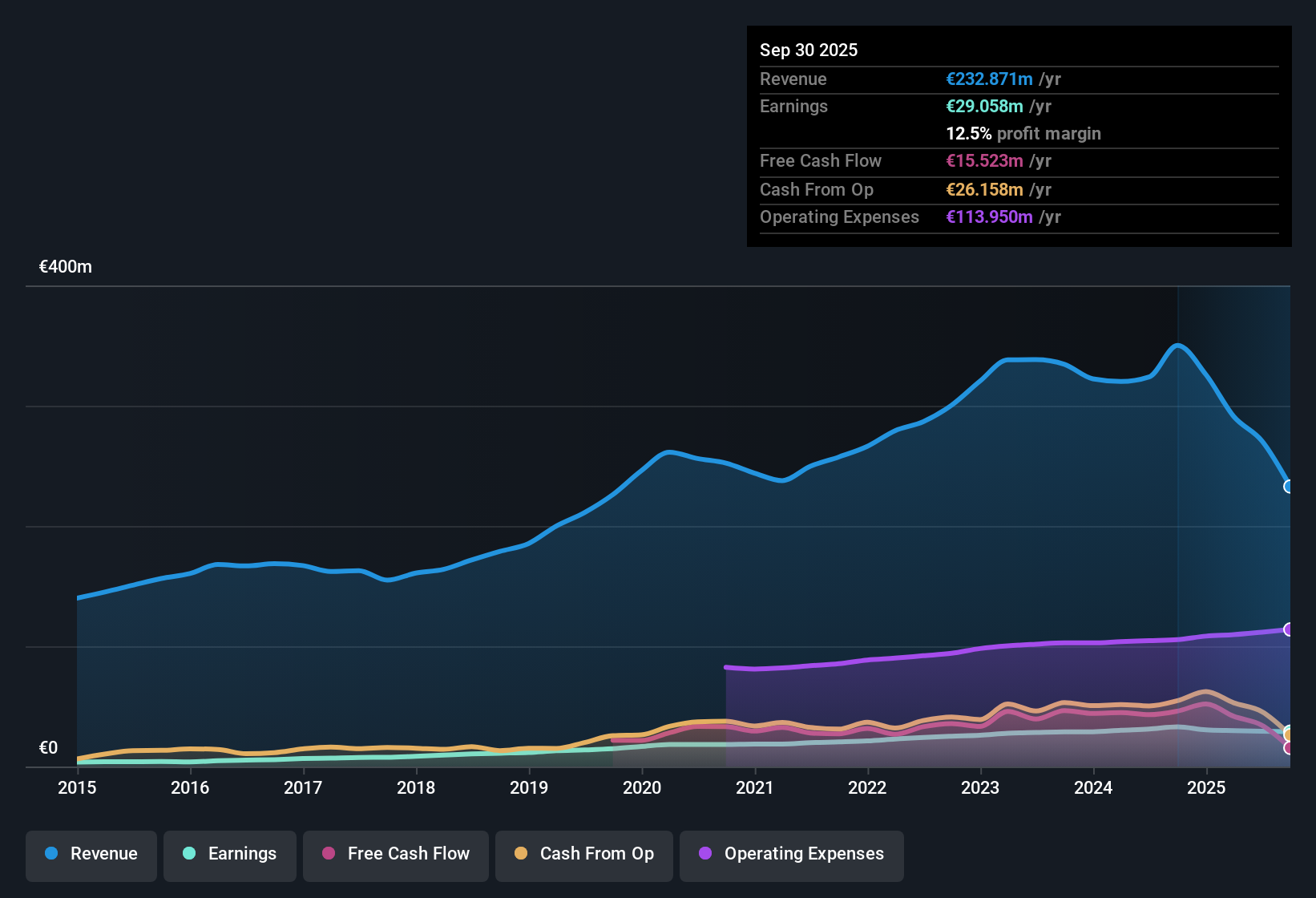

Mensch und Maschine Software (XTRA:MUM) delivered another quarter of profitability focus, posting a net profit margin of 12.6% compared to 9.4% a year ago. Over the past five years, earnings have grown at an annual rate of 10.9%. Forecasts now call for earnings growth of 14.76% per year, with revenue also expected to climb 9.4% annually, outpacing the broader German market. With shares currently trading at €42.7, investors are weighing the positive growth outlook against the ongoing question of dividend sustainability.

See our full analysis for Mensch und Maschine Software.The next section sets these headline results against the most widely followed market narratives, examining where the numbers back up the bullish case and where surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Moves Up to 12.6%

- Net profit margin climbed to 12.6%, a sizable jump from 9.4% in the prior year. This result highlights management's push for improved profitability over the last twelve months.

- What is surprising is that this higher profitability comes alongside consistent five-year annual earnings growth of 10.9%. This strongly supports the case that the company’s margin gains are not one-off benefits but reflect an ongoing improvement in business execution.

- The current net profit margin surpasses the German software sector’s average, giving MUM a competitive edge as digitalization trends continue.

- Annual earnings growth has strengthened the argument for durability in these results, especially given that sector volatility can affect peer profitability from one period to the next.

Dividend Sustainability Remains Under Scrutiny

- The company’s robust earnings growth is shadowed by the ongoing risk flagged in the EDGAR filing. The long-term sustainability of the dividend remains a concern for income-focused shareholders, even as margin improvement signals healthy cash generation.

- Critics highlight the tension between rapid forecasted growth (14.76% annual earnings) and the potential for future dividend strain, arguing that maintaining an attractive payout could become harder if growth investments take priority.

- Consensus narrative notes that while high-quality historical earnings lend confidence, the company’s willingness or ability to support long-term dividend levels will matter most for yield-seeking investors as competitive intensity rises.

- This debate in the consensus narrative points to a classic tradeoff. Strong growth uplifts near-term sentiment but may cap dividend upside longer term if cash is retained to fund expansion.

Shares Trade Below DCF Fair Value

- MUM’s shares currently trade at €42.70, which is well below the DCF fair value estimate of €81.52 and sits at a 24.2x PE ratio. This presents a meaningful discount to the European sector average (28.8x) but is just above direct peers (23.8x).

- This valuation setup directly feeds into market optimism that the share price has significant room to close the fair value gap. However, prevailing analysis also emphasizes that some of this discount reflects persisting dividend concerns and exposure to swings in tech sector sentiment.

- Bulls often cite the attractive discount relative to sector DCF models as an upside catalyst, but skeptics argue that sector outperformance can be fleeting and that dividend caution is already priced in.

- Current price implies a blend of opportunity and risk, as momentum in digital transformation could lift multiples; yet peer comparisons show a competitive market with limited room for error on profit delivery.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mensch und Maschine Software's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Mensch und Maschine is posting robust earnings, its growth ambitions have put the reliability of future dividend payments under scrutiny for income-focused investors.

If stable and attractive payouts are your priority, see these 1991 dividend stocks with yields > 3% for companies delivering solid dividends without the same uncertainties on long-term yield.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering, product data management, and building information modeling/management solutions in Germany, Austria, Switzerland, the United Kingdom, Italy, France, Hungary, and internationally.

Good value with proven track record.

Market Insights

Community Narratives