InVision Aktiengesellschaft Just Missed EPS By 37%: Here's What Analysts Think Will Happen Next

It's been a good week for InVision Aktiengesellschaft (ETR:IVX) shareholders, because the company has just released its latest yearly results, and the shares gained 7.9% to €27.20. Statutory earnings per share fell badly short of expectations, coming in at €0.17, some 37% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at €13m. This is an important time for investors, as they can track a company's performance in its report, look at what expert is forecasting for next year, and see if there has been any change to expectations for the business. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analyst has changed their mind on InVision after the latest results.

Check out our latest analysis for InVision

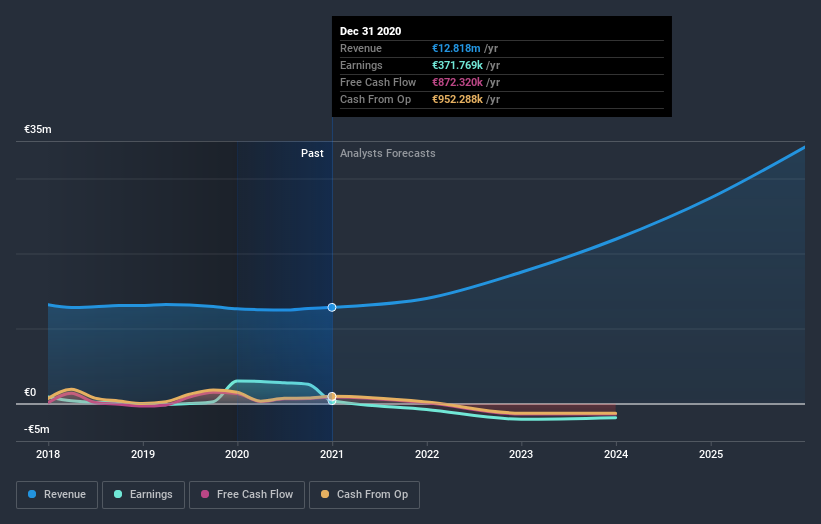

Taking into account the latest results, the most recent consensus for InVision from lone analyst is for revenues of €14.0m in 2021 which, if met, would be a notable 9.2% increase on its sales over the past 12 months. The company is forecast to report a statutory loss of €0.37 in 2021, a sharp decline from a profit over the last year. In the lead-up to this report, the analyst had been modelling revenues of €13.3m and earnings per share (EPS) of €0.40 in 2021. Yet despite a modest lift to revenues, the analyst is now forecasting a loss instead of a profit, which looks like a reduction in sentiment after the latest results.

The average price target rose 55% to €31.00, even thoughthe analyst has been updating their forecasts to show higher revenues and higher forecast losses.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. One thing stands out from these estimates, which is that InVision is forecast to grow faster in the future than it has in the past, with revenues expected to display 9.2% annualised growth until the end of 2021. If achieved, this would be a much better result than the 0.1% annual decline over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 6.1% per year. Not only are InVision's revenues expected to improve, it seems that the analyst is also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analyst is expecting InVision to become unprofitable next year. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analyst believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At least one analyst has provided forecasts out to 2025, which can be seen for free on our platform here.

It is also worth noting that we have found 5 warning signs for InVision (2 don't sit too well with us!) that you need to take into consideration.

When trading InVision or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:IVX

InVision

Develops and markets products and services in the field of workforce management and education in Europe and the United States.

Mediocre balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion