As we step into January 2025, the global markets present a mixed landscape, with U.S. stocks closing out another strong year despite recent economic data pointing to challenges such as contracting manufacturing activity and revised GDP forecasts. Amid these dynamics, small-cap indices like the S&P MidCap 400 and Russell 2000 have shown resilience, suggesting potential opportunities for investors seeking undiscovered gems in less prominent corners of the market. In this environment, identifying promising stocks often involves looking for companies with solid fundamentals that can weather economic fluctuations while capitalizing on niche growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Lam Soon (Hong Kong) (SEHK:411)

Simply Wall St Value Rating: ★★★★★★

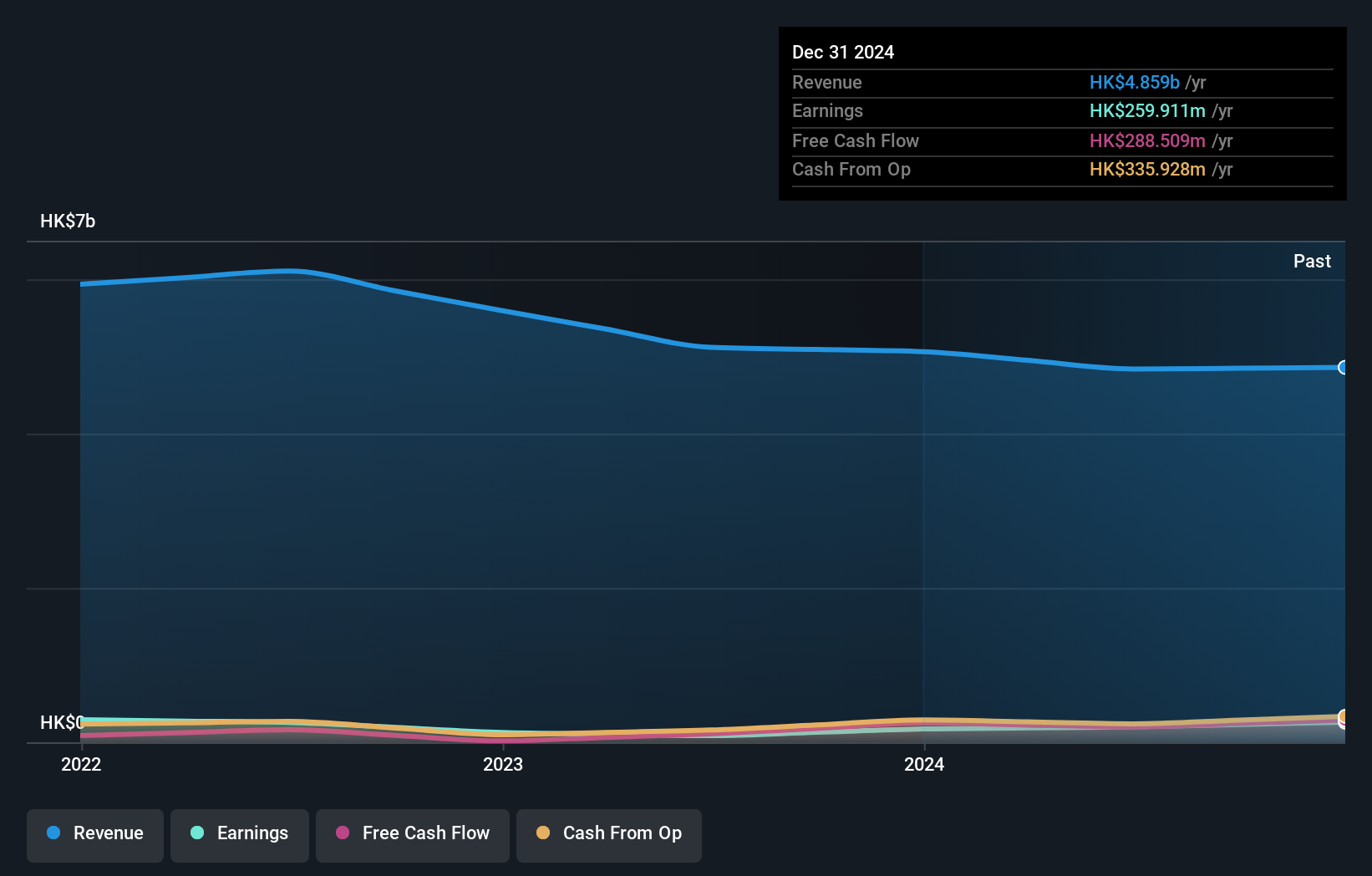

Overview: Lam Soon (Hong Kong) Limited is an investment holding company involved in the manufacturing, trading, and processing of food and home care products across Hong Kong, China, and Macau with a market capitalization of approximately HK$1.95 billion.

Operations: Lam Soon (Hong Kong) derives its revenue primarily from the food segment, contributing approximately HK$4.03 billion, while the home care segment adds about HK$809.84 million.

Lam Soon (Hong Kong) stands out with its strong financial health, trading at 52.1% below fair value and boasting high-quality earnings. The company is debt-free, a position it has maintained for over five years, which likely contributes to its robust financial standing. Despite a challenging industry backdrop with the food sector contracting by 3.3%, Lam Soon's earnings surged by 135% last year, showcasing resilience and potential for growth. Recent board changes include the appointment of Ms. Cheung Man Ying as an Independent Non-Executive Director, bringing extensive experience in retail and consumer products to the table.

- Navigate through the intricacies of Lam Soon (Hong Kong) with our comprehensive health report here.

Gain insights into Lam Soon (Hong Kong)'s past trends and performance with our Past report.

GRG Metrology & Test Group (SZSE:002967)

Simply Wall St Value Rating: ★★★★★★

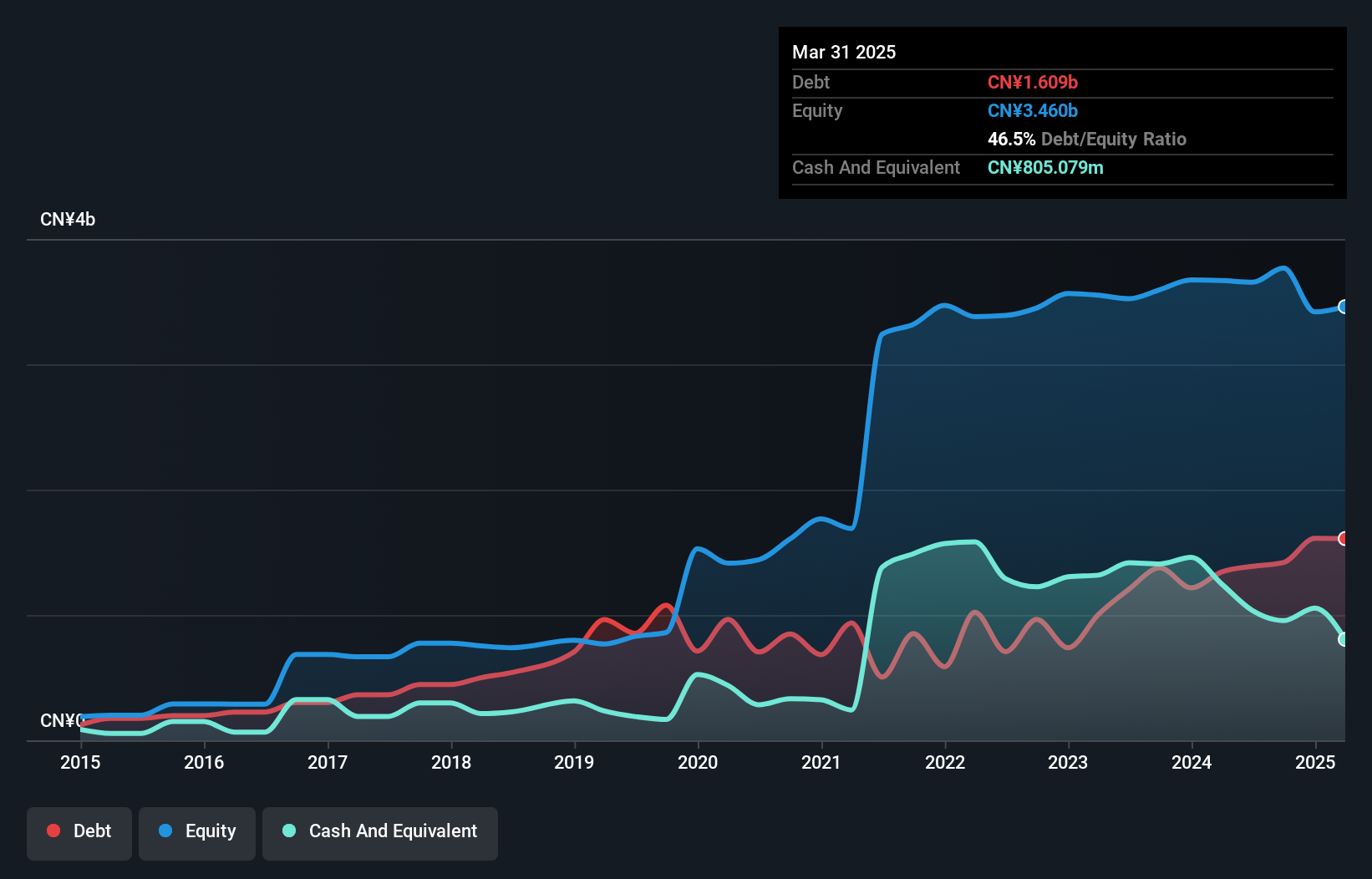

Overview: GRG Metrology & Test Group Co., Ltd. is a third-party measurement and testing technology service company with a market cap of CN¥9.30 billion.

Operations: GRG Metrology & Test Group's revenue primarily stems from its services in the measurement and testing technology sector. The company's financial performance is highlighted by its gross profit margin, which shows notable trends over recent periods.

GRG Metrology & Test Group, a smaller player in its field, has demonstrated notable financial progress. Over the past year, earnings grew by 5.7%, surpassing the industry average of -2.8%. The company trades at 66.5% below its estimated fair value, suggesting potential undervaluation. With a satisfactory net debt to equity ratio of 12.3%, GRG's financial structure appears stable and manageable. Recent activities include repurchasing approximately 3.96% of shares for CNY 384 million and announcing a cash dividend distribution plan with CNY 2.50 per share payout, indicating shareholder-friendly initiatives amidst strong earnings performance.

- Delve into the full analysis health report here for a deeper understanding of GRG Metrology & Test Group.

Understand GRG Metrology & Test Group's track record by examining our Past report.

IVU Traffic Technologies (XTRA:IVU)

Simply Wall St Value Rating: ★★★★★★

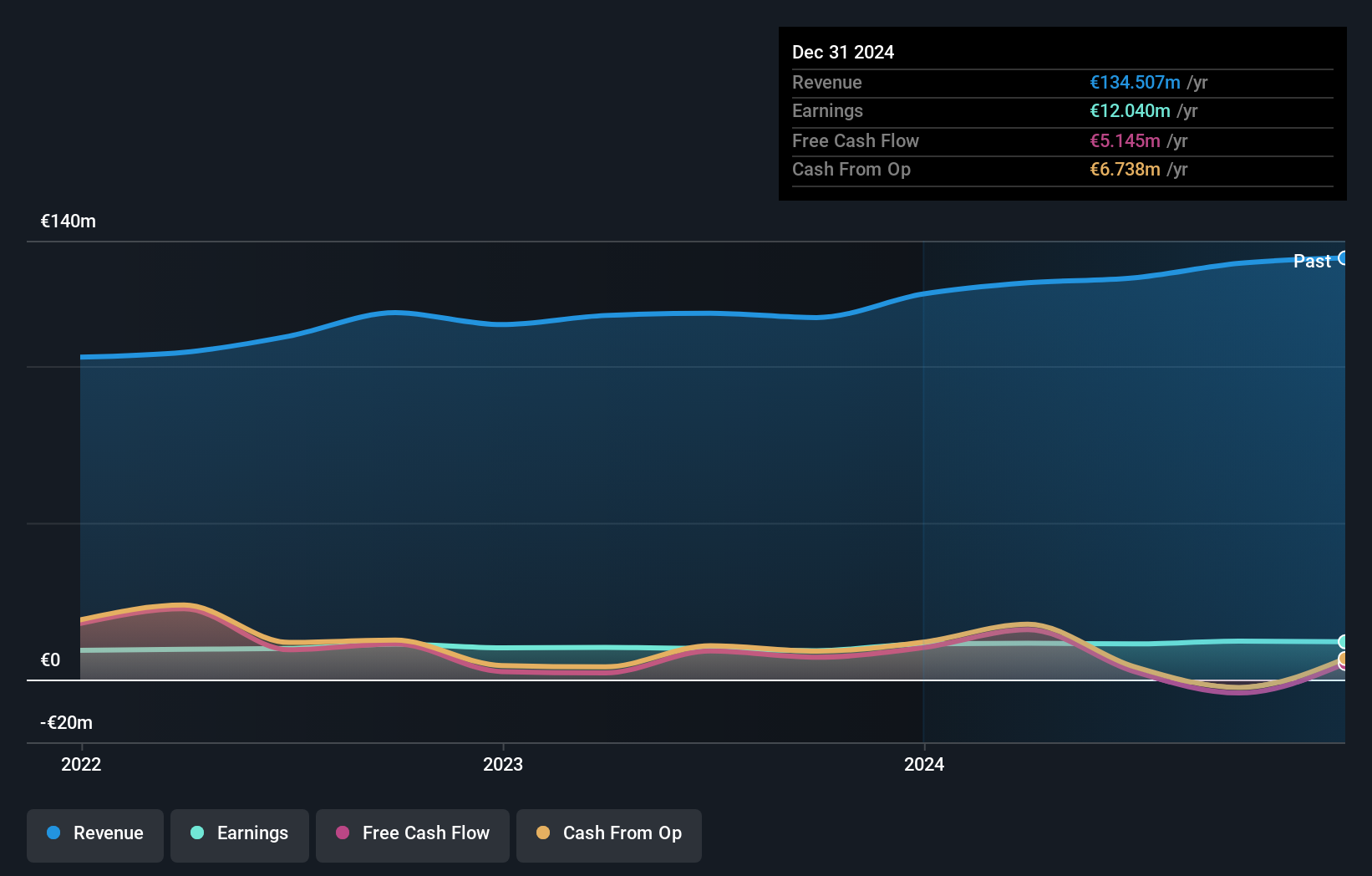

Overview: IVU Traffic Technologies AG, with a market cap of €261.72 million, develops, installs, maintains, and operates integrated IT solutions for buses and trains worldwide through its subsidiaries.

Operations: IVU Traffic Technologies generates revenue primarily from its Public Transport segment, which includes logistics, amounting to €132.86 million.

IVU Traffic Technologies, a nimble player in the software sector, recently reported robust earnings growth of 32.7%, outpacing the industry average of 10.6%. Its price-to-earnings ratio at 21.4x suggests it is attractively valued compared to peers averaging 22.8x. The company remains debt-free for five years, underscoring financial stability and eliminating concerns over interest coverage or debt obligations. Notably, IVU secured a significant long-term contract with BLS AG for its IVU.rail product, enhancing its market position and prospects for sustained revenue streams without relying on free cash flow positivity as a metric of success.

Where To Now?

- Dive into all 4650 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IVU

IVU Traffic Technologies

Develops, installs, maintains, and operates integrated IT solutions for buses and trains worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)