IVU Traffic Technologies AG (ETR:IVU) Vies For A Place In Your Dividend Portfolio: Here's Why

Is IVU Traffic Technologies AG (ETR:IVU) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

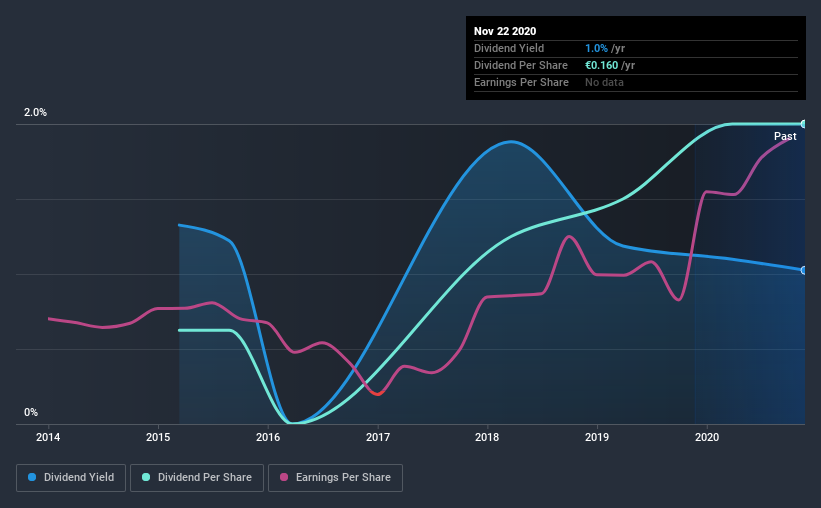

With a 1.0% yield and a six-year payment history, investors probably think IVU Traffic Technologies looks like a reliable dividend stock. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. The company also bought back stock during the year, equivalent to approximately 0.7% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on IVU Traffic Technologies!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, IVU Traffic Technologies paid out 21% of its profit as dividends. We'd say its dividends are thoroughly covered by earnings.

Another important check we do is to see if the free cash flow generated is sufficient to pay the dividend. IVU Traffic Technologies paid out 21% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's positive to see that IVU Traffic Technologies' dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note IVU Traffic Technologies' strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on IVU Traffic Technologies' financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that IVU Traffic Technologies has been paying a dividend for the past six years. It's good to see that IVU Traffic Technologies has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past six-year period, the first annual payment was €0.05 in 2014, compared to €0.2 last year. This works out to be a compound annual growth rate (CAGR) of approximately 21% a year over that time. The dividends haven't grown at precisely 21% every year, but this is a useful way to average out the historical rate of growth.

IVU Traffic Technologies has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, but it might be worth considering if the business has turned a corner.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see IVU Traffic Technologies has been growing its earnings per share at 25% a year over the past five years. The company is only paying out a fraction of its earnings as dividends, and in the past been able to use the retained earnings to grow its profits rapidly - an ideal combination.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. IVU Traffic Technologies performs highly under this analysis, although it falls slightly short of our exacting standards. At the right valuation, it could be a solid dividend prospect.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Are management backing themselves to deliver performance? Check their shareholdings in IVU Traffic Technologies in our latest insider ownership analysis.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade IVU Traffic Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:IVU

IVU Traffic Technologies

Develops, installs, maintains, and operates integrated IT solutions for buses and trains worldwide.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion