INTERSHOP Communications Aktiengesellschaft's (ETR:ISHA) Shares Lagging The Industry But So Is The Business

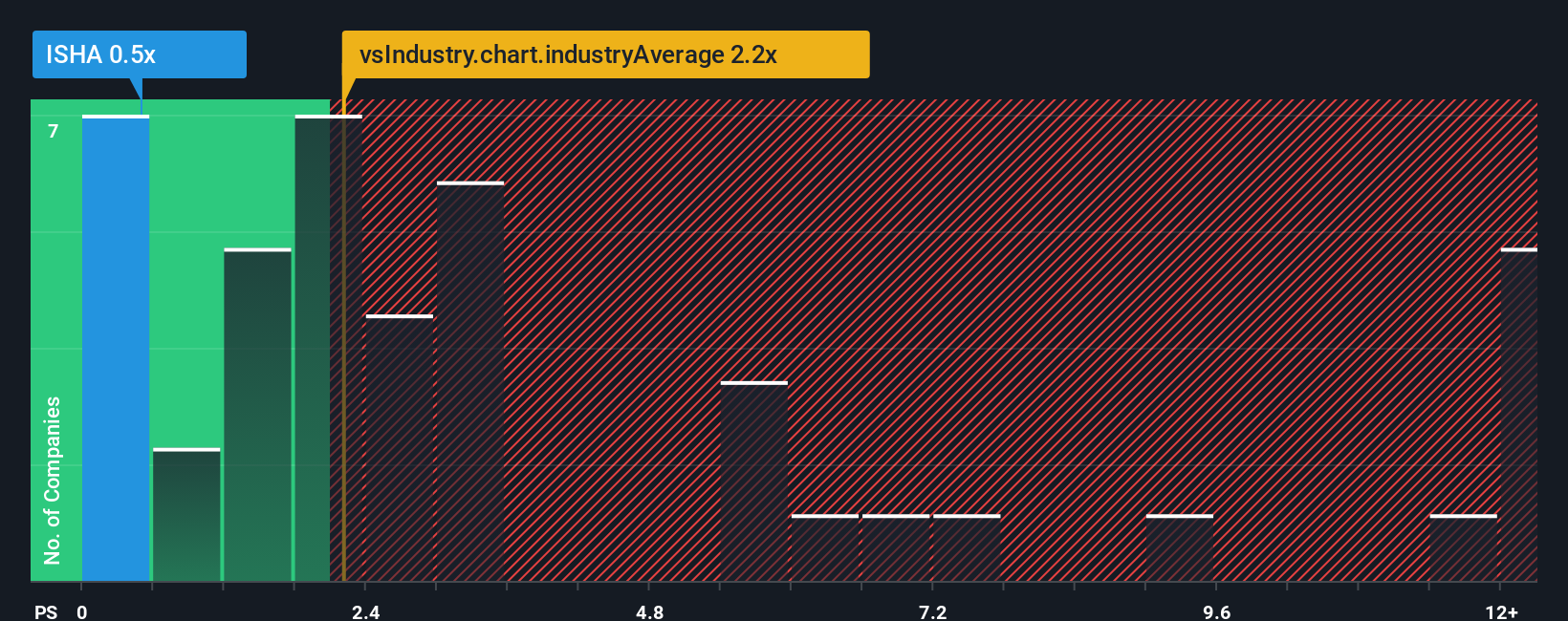

INTERSHOP Communications Aktiengesellschaft's (ETR:ISHA) price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Software industry in Germany, where around half of the companies have P/S ratios above 2.2x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for INTERSHOP Communications

How INTERSHOP Communications Has Been Performing

INTERSHOP Communications could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on INTERSHOP Communications will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For INTERSHOP Communications?

There's an inherent assumption that a company should underperform the industry for P/S ratios like INTERSHOP Communications' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.7%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 1.1% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 13% per annum growth forecast for the broader industry.

In light of this, it's understandable that INTERSHOP Communications' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does INTERSHOP Communications' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of INTERSHOP Communications' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

And what about other risks? Every company has them, and we've spotted 1 warning sign for INTERSHOP Communications you should know about.

If you're unsure about the strength of INTERSHOP Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ISHA

INTERSHOP Communications

Offers B2B ecommerce solutions in Germany and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives