Investors ignore increasing losses at EQS Group (ETR:EQS) as stock jumps 17% this past week

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. To wit, the EQS Group share price has climbed 92% in five years, easily topping the market decline of 8.5% (ignoring dividends).

Since it's been a strong week for EQS Group shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for EQS Group

Because EQS Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, EQS Group can boast revenue growth at a rate of 16% per year. Even measured against other revenue-focussed companies, that's a good result. While the compound gain of 14% per year is good, it's not unreasonable given the strong revenue growth. If the strong revenue growth continues, we'd expect the share price to follow, in time. Of course, you'll have to research the business more fully to figure out if this is an attractive opportunity.

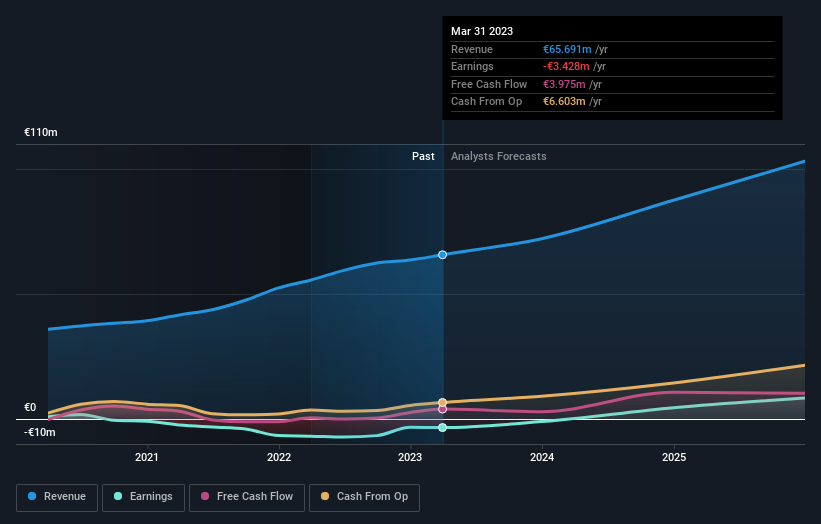

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on EQS Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that EQS Group shares lost 3.9% throughout the year, that wasn't as bad as the market loss of 4.5%. Longer term investors wouldn't be so upset, since they would have made 14%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. You could get a better understanding of EQS Group's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: EQS Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

If you're looking to trade EQS Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EQS Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EQS

EQS Group

EQS Group AG provides cloud-based software in the areas of corporate compliance; investor relations; and environment, social, and governance in Germany and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives