As the German market shows signs of resilience with the DAX gaining 0.35% amidst mixed performances in other European indices, investors are keenly observing opportunities for stable returns. In this context, dividend stocks stand out as a compelling choice for those seeking consistent income and potential growth. A good dividend stock typically offers a reliable payout history, strong financial health, and the ability to sustain dividends even during economic fluctuations. Given the current market conditions, selecting stocks that demonstrate these qualities can provide both stability and long-term value to investors' portfolios.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.24% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.93% | ★★★★★★ |

| MLP (XTRA:MLP) | 5.11% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.79% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.59% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.89% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.50% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

| Brenntag (XTRA:BNR) | 3.31% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.36% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top German Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE offers IT solutions both in Germany and internationally, with a market cap of €359.50 million.

Operations: DATAGROUP SE generates revenue through various segments, including IT Outsourcing (€460.30 million), IT Solutions (€148.50 million), and Consulting (€35.20 million).

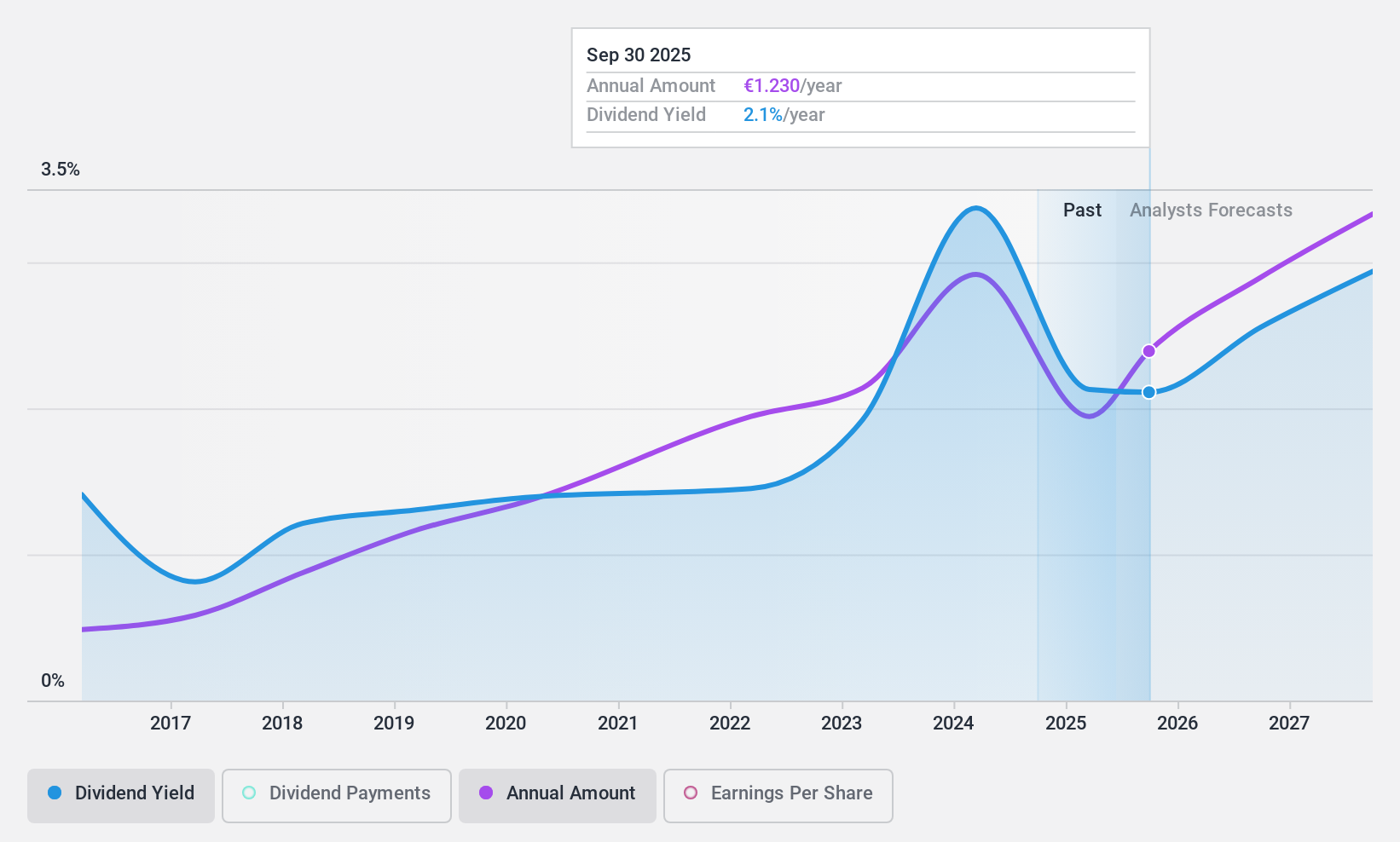

Dividend Yield: 3.5%

DATAGROUP SE's dividend payments are well covered by both earnings (48.1% payout ratio) and cash flows (28.2% cash payout ratio), indicating sustainability despite a volatile 10-year track record. The current dividend yield of 3.48% is lower than the top quartile in Germany, but the company has shown consistent growth in dividends over the past decade. Trading at a significant discount to its estimated fair value, DATAGROUP also benefits from strong profit growth forecasts and good relative market value, though it carries high debt levels.

- Navigate through the intricacies of DATAGROUP with our comprehensive dividend report here.

- The valuation report we've compiled suggests that DATAGROUP's current price could be quite moderate.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MVV Energie AG, with a market cap of €2.08 billion, operates in Germany providing electricity, heat, gas, water, and waste treatment and disposal products through its subsidiaries.

Operations: MVV Energie AG's revenue segments include New Energies (€959.74 million), Customer Solutions (€7.54 billion), and Generation and Infrastructure (€1.75 billion).

Dividend Yield: 3.6%

MVV Energie's dividend payments are well covered by earnings due to a low payout ratio of 30.5%, though they are not supported by free cash flow, raising sustainability concerns. Despite a consistent and growing dividend history over the past decade, the current yield of 3.64% is below the top 25% in Germany. The company faces challenges with debt coverage from operating cash flow and has seen profit margins decline from last year’s figures.

- Take a closer look at MVV Energie's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of MVV Energie shares in the market.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG produces and distributes sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €123.55 million.

Operations: Schloss Wachenheim AG generates €441.16 million in revenue from its alcoholic beverages segment.

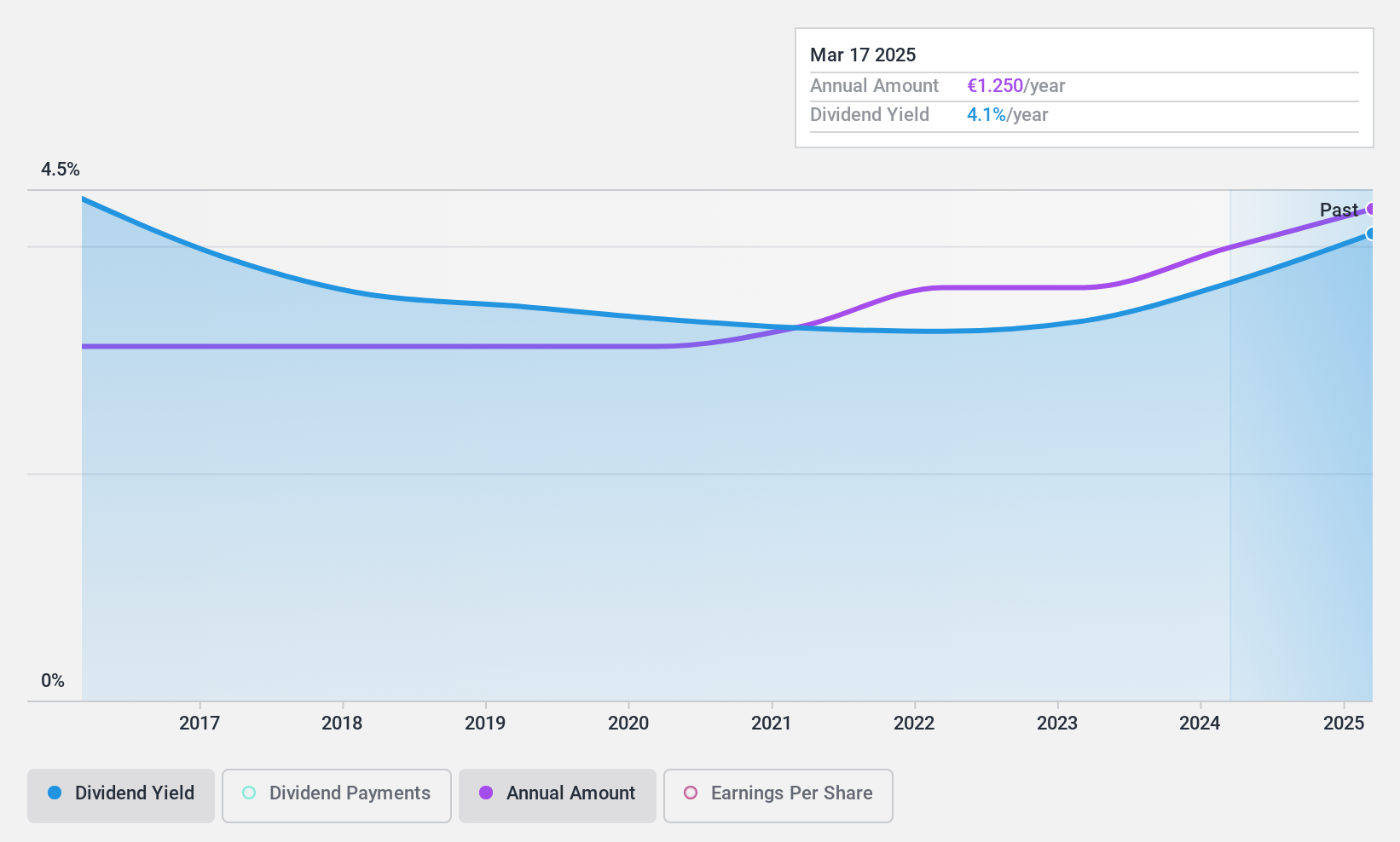

Dividend Yield: 3.8%

Schloss Wachenheim's dividend payments have been stable and growing over the past 10 years, indicating reliability. However, the dividends are not well covered by free cash flows due to a high cash payout ratio of 113.1%, raising sustainability concerns. Trading at 14.3% below estimated fair value and offering a yield of 3.85%, it is considered good value compared to peers but falls short of the top 25% in Germany for dividend yield.

- Delve into the full analysis dividend report here for a deeper understanding of Schloss Wachenheim.

- Our comprehensive valuation report raises the possibility that Schloss Wachenheim is priced lower than what may be justified by its financials.

Taking Advantage

- Click this link to deep-dive into the 30 companies within our Top German Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives