As the European Central Bank's recent rate cuts have buoyed major stock indexes, including Germany’s DAX, investors are increasingly looking at dividend stocks as a way to navigate the current economic landscape. In this environment, a good dividend stock is characterized by its ability to provide consistent payouts and potential for growth, making it an attractive option for those seeking stability and income in their portfolios.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 6.52% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.87% | ★★★★★★ |

| MLP (XTRA:MLP) | 4.87% | ★★★★★☆ |

| SAF-Holland (XTRA:SFQ) | 5.90% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.64% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.32% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 9.25% | ★★★★★☆ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.71% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

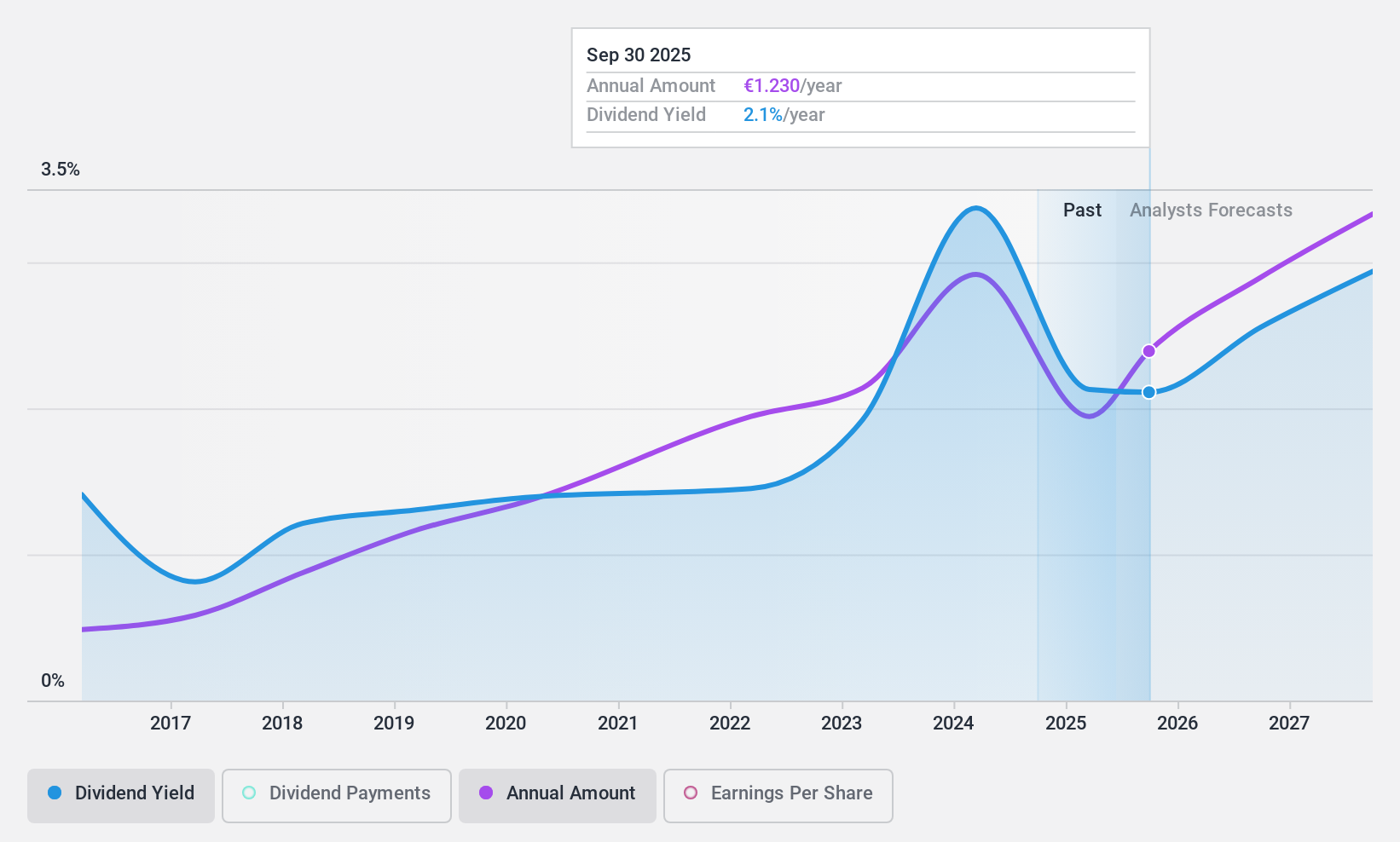

DATAGROUP (XTRA:D6H)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DATAGROUP SE provides IT solutions in Germany and internationally, with a market cap of €353.67 million.

Operations: DATAGROUP SE generates revenue primarily from its Services segment, which accounts for €456.25 million, and its Solutions & Consulting segment, contributing €77.59 million.

Dividend Yield: 3.5%

DATAGROUP's dividend yield of 3.53% is below the top quartile in Germany, and its dividend history has been volatile over the past decade. However, dividends are well-covered by earnings and cash flows, with payout ratios of 48.1% and 28.2%, respectively. Despite a high debt level, DATAGROUP is trading at a significant discount to its estimated fair value and was recently added to the S&P Global BMI Index, potentially increasing investor interest.

- Delve into the full analysis dividend report here for a deeper understanding of DATAGROUP.

- Our expertly prepared valuation report DATAGROUP implies its share price may be lower than expected.

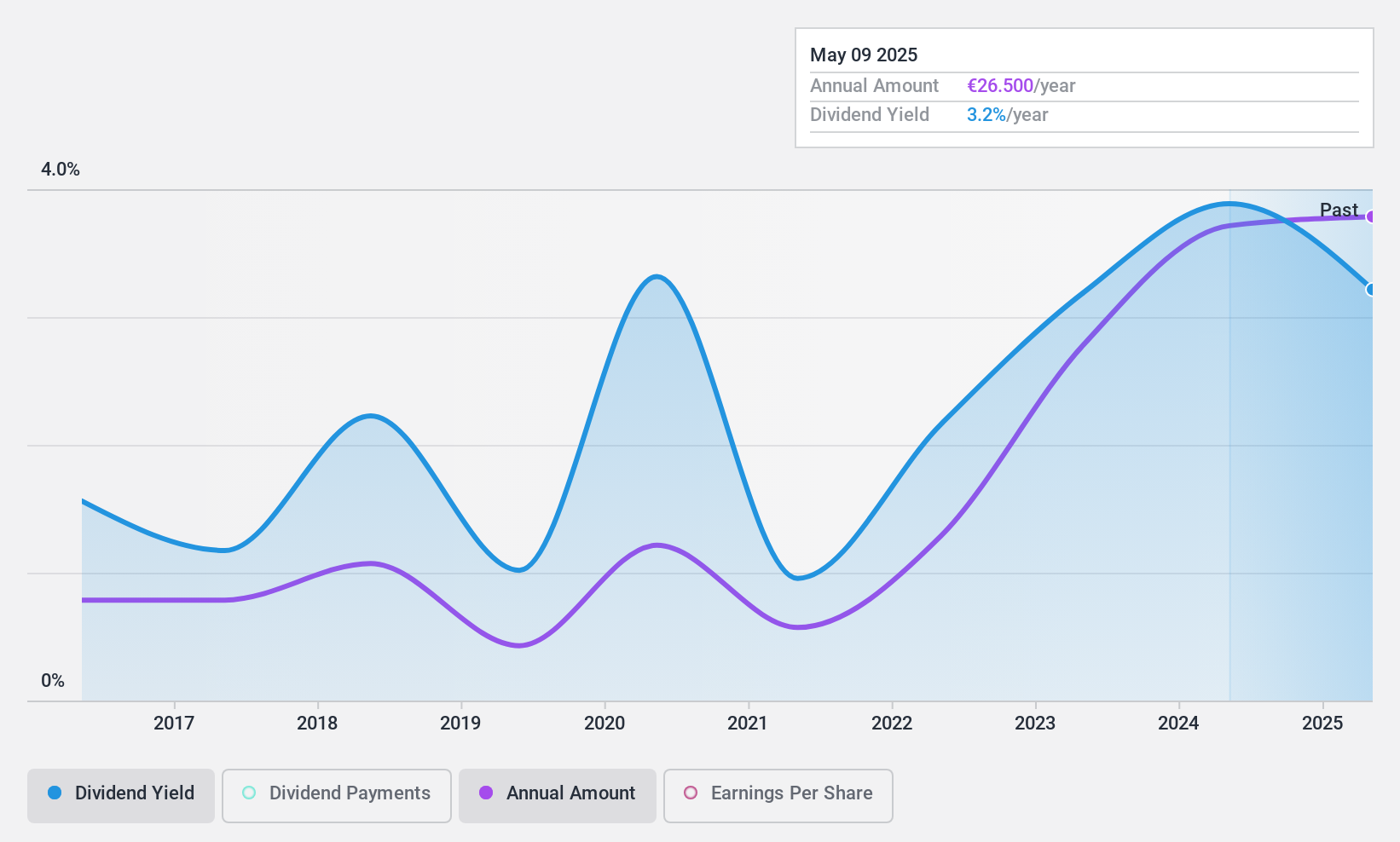

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, along with its subsidiaries, manufactures and supplies pumps, valves, and related services globally, with a market cap of €1.12 billion.

Operations: KSB SE & Co. KGaA generates revenue through its segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

Dividend Yield: 3.9%

KSB SE & Co. KGaA's dividend yield of 3.88% is below the top 25% in Germany, with a history of volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 29.9% and 24.2%, respectively. The company is trading at a significant discount to its estimated fair value, suggesting potential undervaluation despite recent earnings showing a slight decline in net income for the half year ended June 2024.

- Navigate through the intricacies of KSB SE KGaA with our comprehensive dividend report here.

- Our valuation report here indicates KSB SE KGaA may be undervalued.

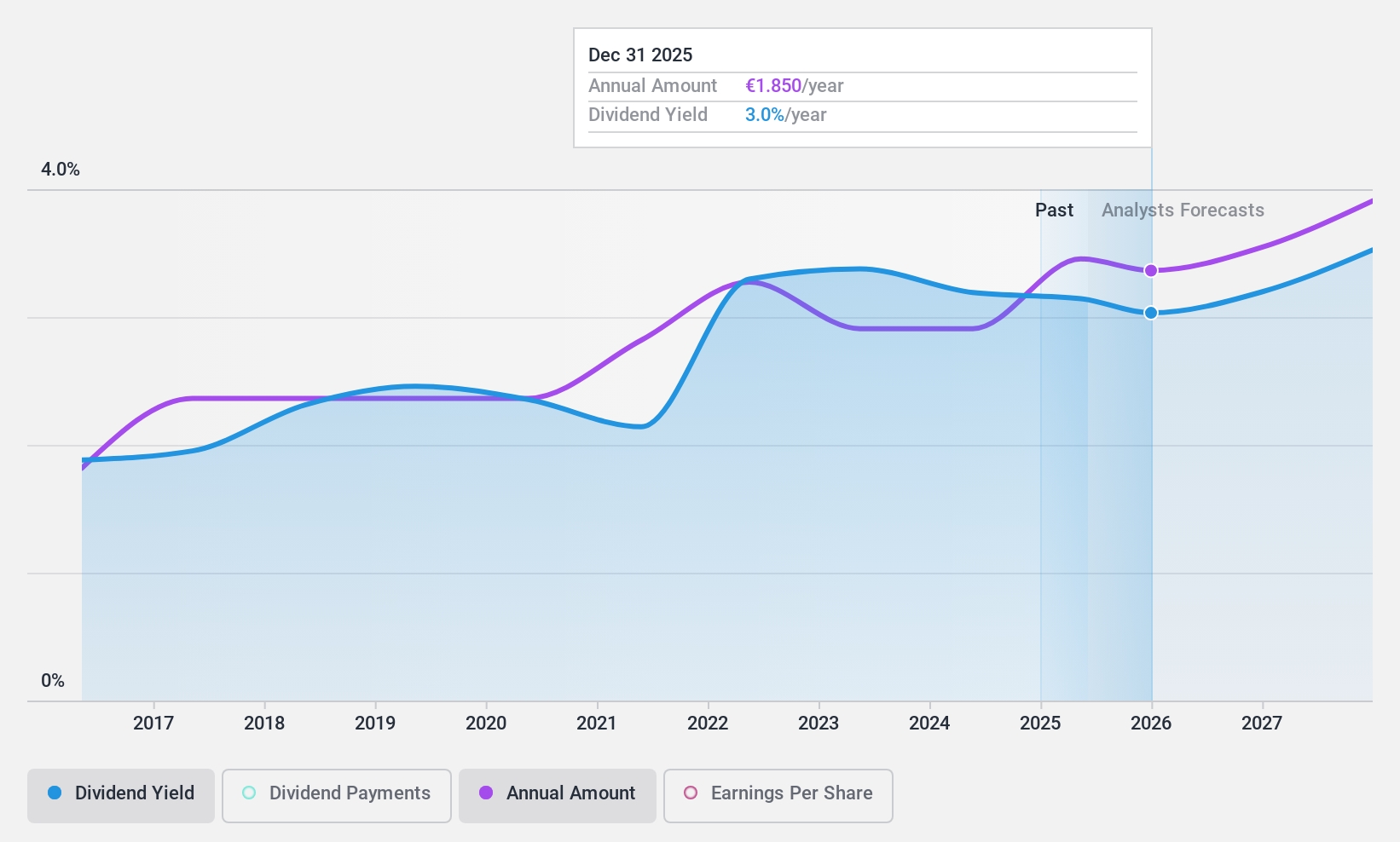

Uzin Utz (XTRA:UZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of €243.14 million.

Operations: Uzin Utz SE's revenue is primarily derived from its operations in Germany - Laying Systems (€209.68 million), Western Europe (€81.64 million), Netherlands - Laying Systems (€83.59 million), USA - Laying Systems (€73.60 million), Netherlands - Wholesale (€33.66 million), Germany - Surface Care and Refinement (€34.21 million), South/Eastern Europe (€27.70 million), and Germany - Machinery and Tools (€31.94 million).

Dividend Yield: 3.3%

Uzin Utz's dividend yield of 3.32% is modest compared to the top German dividend payers, but it offers stability with consistent growth over the past decade. The company's dividends are well-supported by a low payout ratio of 33.8% and a cash payout ratio of 19.9%, ensuring sustainability from both earnings and cash flows. Recent financial results show stable revenue and improved net income, reinforcing its capacity to maintain reliable dividend distributions.

- Dive into the specifics of Uzin Utz here with our thorough dividend report.

- Our valuation report unveils the possibility Uzin Utz's shares may be trading at a premium.

Where To Now?

- Dive into all 31 of the Top German Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:UZU

Uzin Utz

Develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives