- France

- /

- Entertainment

- /

- ENXTPA:BLV

Amper Leads 3 High Growth Tech Stocks in Europe

Reviewed by Simply Wall St

The European market has recently witnessed a positive shift, with the pan-European STOXX Europe 600 Index climbing 3.44% as concerns over tariffs eased, and major indices like Germany's DAX and France's CAC 40 showing significant gains. In this environment of renewed optimism and economic growth, identifying high-growth tech stocks such as Amper can be crucial for investors looking to capitalize on emerging opportunities within the tech sector in Europe.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 21.29% | 66.10% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.12% | 25.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 77.62% | ★★★★★★ |

| CD Projekt | 33.48% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Amper (BME:AMP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amper, S.A. offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors both in Spain and globally with a market cap of €228.99 million.

Operations: Amper, S.A. generates revenue primarily from its Energy and Sustainability segment (€339.33 million) and its Defense, Security, and Telecommunications segment (€84.44 million).

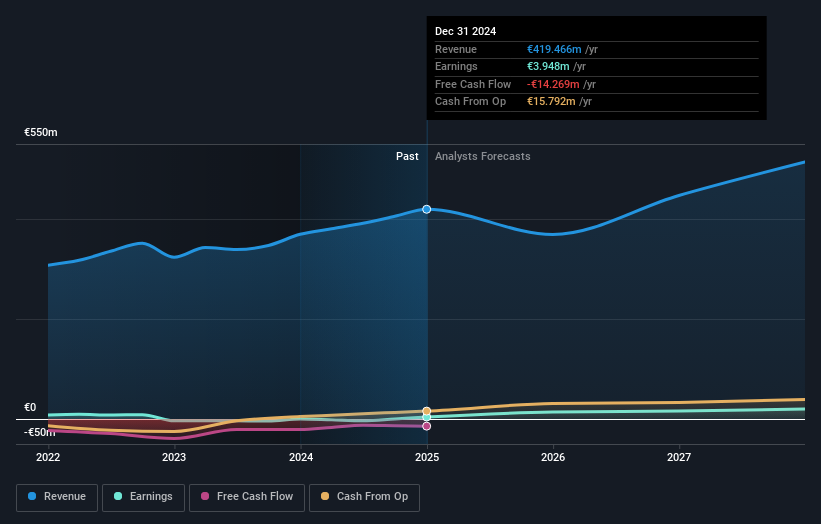

Amper, S.A. has demonstrated a robust turnaround with its latest financial results, reporting a significant shift from a net loss of EUR 1.49 million to a net income of EUR 0.142 million in 2024. This recovery is underscored by an impressive annual revenue increase to EUR 432.41 million, up from EUR 384.01 million the previous year, marking a growth rate of 12.6%. The company's commitment to innovation is evident in its R&D spending trends which are crucial for sustaining long-term growth in the competitive tech landscape of Europe. Despite challenges such as volatile share prices and interest payments not being well-covered by earnings, Amper's future prospects appear promising with an expected earnings growth of 45.6% per annum—significantly outpacing the broader Spanish market's forecasted growth of just over 5%. This potential is further bolstered by strategic investments in sectors poised for expansion and ongoing efforts to enhance operational efficiencies across its business segments.

- Navigate through the intricacies of Amper with our comprehensive health report here.

Gain insights into Amper's past trends and performance with our Past report.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of approximately €1.55 billion.

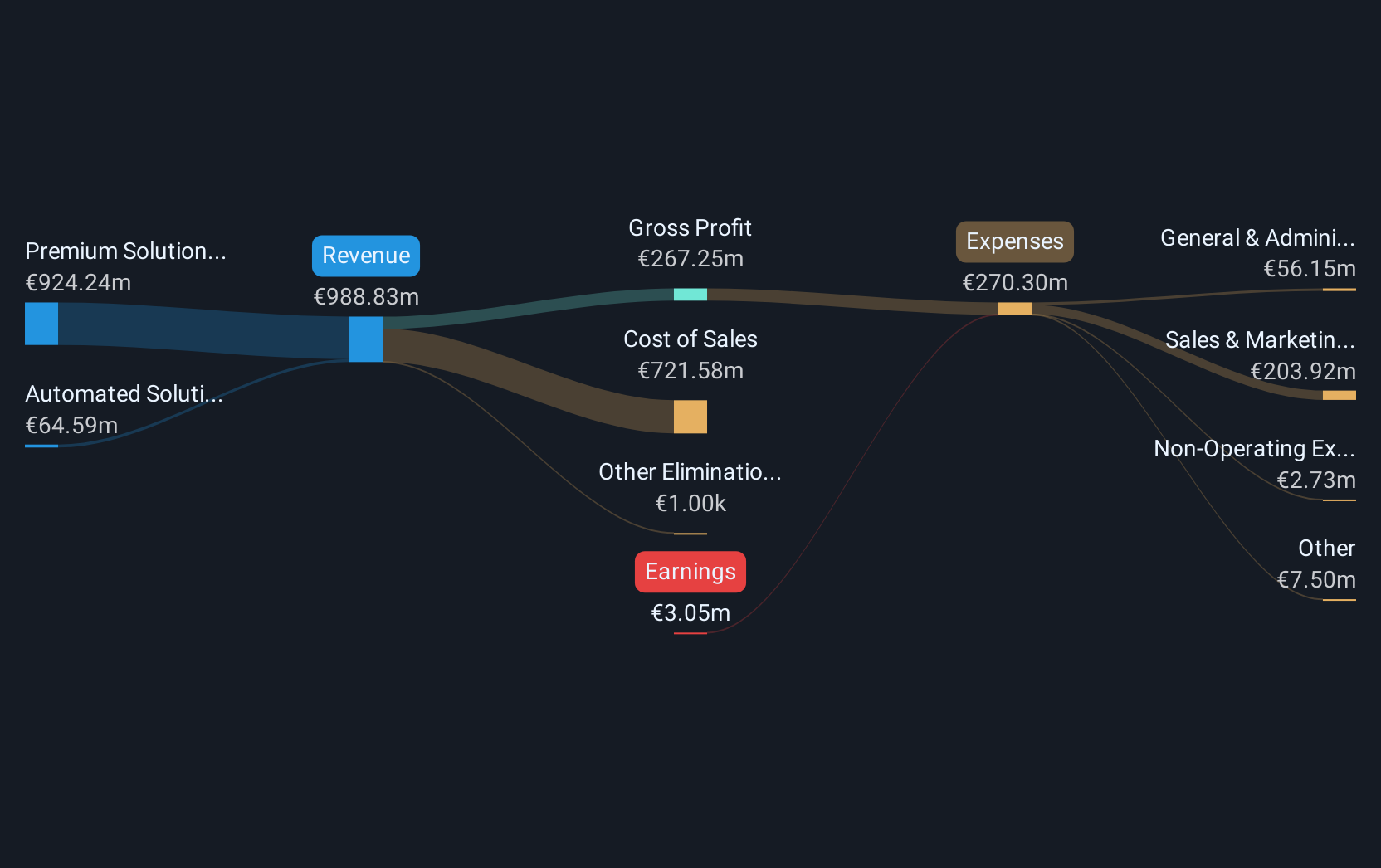

Operations: With a market cap of approximately €1.55 billion, Believe generates revenue primarily from Premium Solutions (€924.24 million) and Automated Solutions (€64.59 million).

Believe S.A. has shown resilience in a challenging market, with its revenue climbing to €988.83 million, a 13% increase year-over-year. Despite currently being unprofitable, the company's losses have narrowed from €5.48 million to €3.05 million, reflecting improved operational efficiency and cost management strategies. This performance is underpinned by a robust R&D commitment that not only fuels innovation but also positions Believe for future profitability, expected within three years as it outpaces the French market's growth forecast of 5% per annum. Additionally, recent strategic moves like the proposed acquisition by TCMI Inc., which includes a squeeze-out of minority shareholders at €15.3 per share, highlight Believe's ongoing efforts to consolidate its market position and enhance shareholder value.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally with a market capitalization of approximately €641.40 million.

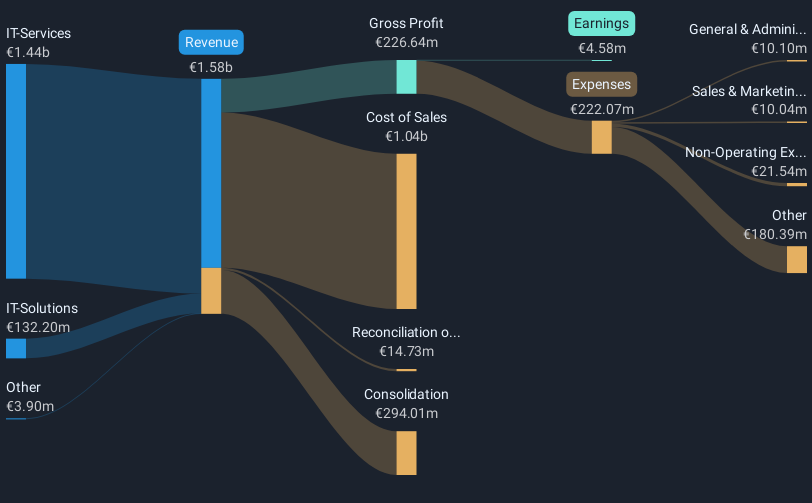

Operations: The company generates revenue primarily from IT services (€1.48 billion) and IT solutions (€136.01 million). It operates within Germany, Austria, Switzerland, and internationally.

Adesso SE, a European tech firm, has demonstrated robust financial growth with a significant increase in sales to €1.3 billion in 2024 from €1.14 billion the previous year, marking a 14% rise. This surge is complemented by a sharp uptick in net income which more than doubled to €8.12 million. The company's commitment to innovation is evident from its R&D investments, aligning with its strategic goals and supporting sustained growth above the German market's average of 5.7%. Furthermore, Adesso recently completed a share buyback program for €10 million and increased its dividend payout to €0.75 per share, signaling strong confidence in its financial health and future prospects.

- Get an in-depth perspective on adesso's performance by reading our health report here.

Evaluate adesso's historical performance by accessing our past performance report.

Next Steps

- Navigate through the entire inventory of 226 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Believe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BLV

Believe

Provides digital music services for independent labels and local artists in France, Germany, rest of Europe, the Americas, Asia, Oceania, and Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives