Amidst renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced a downturn, with the pan-European STOXX Europe 600 Index ending 1.57% lower and major stock indexes such as Germany’s DAX and Italy’s FTSE MIB also declining significantly. In this challenging environment, identifying high-growth tech stocks requires a focus on companies with robust innovation capabilities and resilience to macroeconomic pressures, which can potentially offer opportunities despite broader market volatility.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| argenx | 21.76% | 26.84% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

We'll examine a selection from our screener results.

Fiera Milano (BIT:FM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fiera Milano S.p.A., along with its subsidiaries, specializes in organizing exhibitions, fairs, and events both in Italy and internationally, with a market capitalization of €408.93 million.

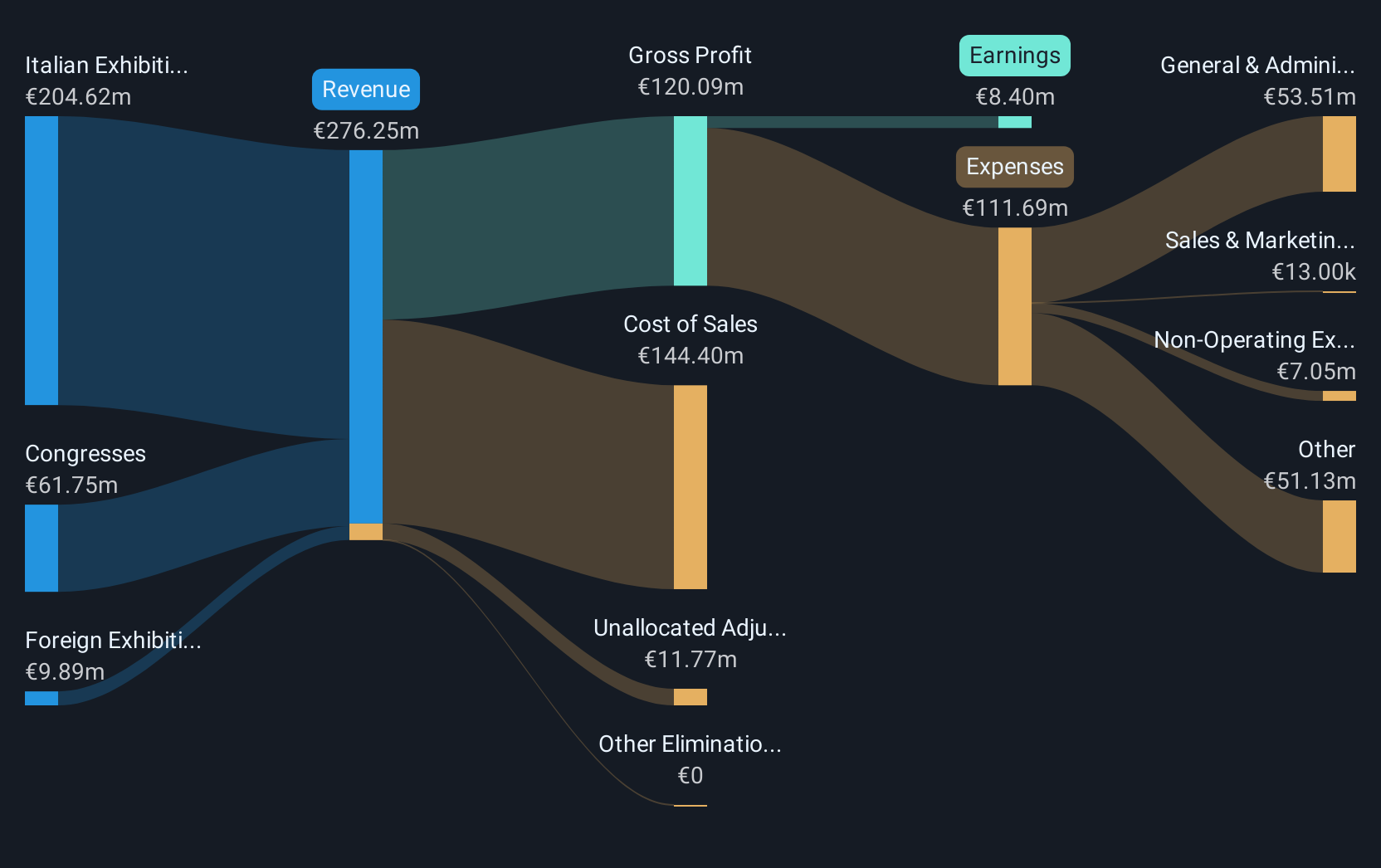

Operations: The company generates revenue primarily from its Italian Exhibitions Business (€204.62 million) and Congresses (€61.75 million), with a smaller contribution from the Foreign Exhibitions Business (€9.89 million).

Fiera Milano has navigated a challenging period, evidenced by its Q1 earnings with sales dropping to €63.69 million from €72.35 million year-over-year and swinging to a net loss of €3.2 million from a previous net income of €7.68 million. Despite this setback, the company forecasts an optimistic revenue range of €320 to €340 million for 2025, underpinned by expected significant earnings growth at 30.7% annually over the next three years—far outpacing the Italian market's average of 7.3%. This robust growth projection is supported by Fiera Milano's strategic presentations at key industry conferences, suggesting a resilient focus on innovation and market expansion despite recent financial volatilities.

- Take a closer look at Fiera Milano's potential here in our health report.

Review our historical performance report to gain insights into Fiera Milano's's past performance.

F-Secure Oyj (HLSE:FSECURE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: F-Secure Oyj is a cybersecurity company that provides security solutions in Finland and internationally, with a market cap of €338.87 million.

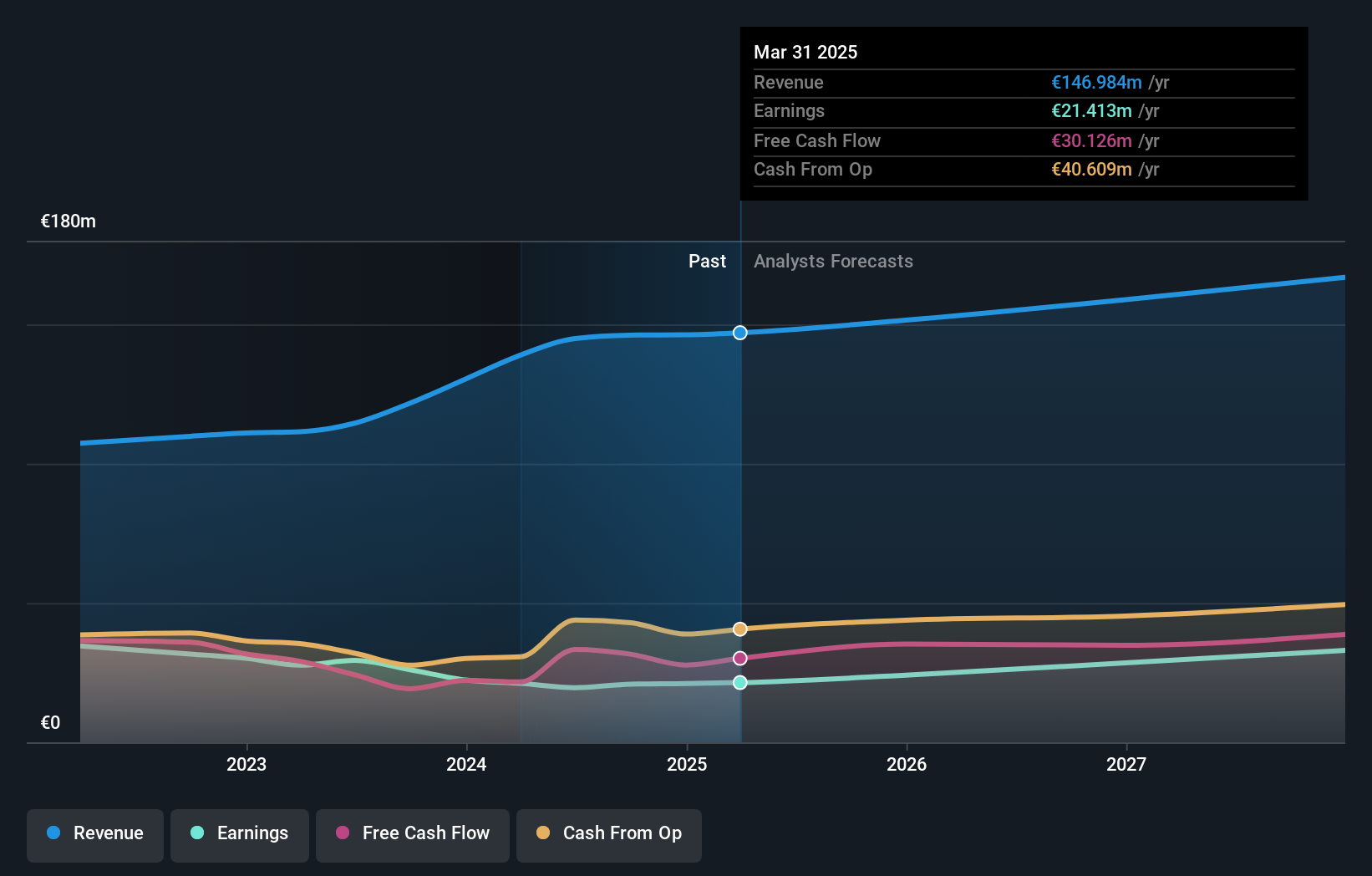

Operations: The company generates revenue primarily from its Consumer Security segment, which accounts for €146.98 million.

Amidst a competitive cyber security landscape, F-Secure Oyj has demonstrated resilience and strategic foresight. With a 4.7% annual revenue growth outpacing the Finnish market's 3.6%, the company’s recent EUR 35 million loan agreement with NIB aims to optimize liquidity and extend debt maturities, enhancing financial stability. The partnership with Orange, leveraging F-Secure's advanced solutions in Orange Cyberdefense's offerings, showcases its pivotal role in Europe’s cyber security sector. This collaboration not only expands its service reach but also enhances product capabilities critical for consumer protection against evolving threats.

- Dive into the specifics of F-Secure Oyj here with our thorough health report.

Explore historical data to track F-Secure Oyj's performance over time in our Past section.

All for One Group (XTRA:A1OS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: All for One Group SE, with a market cap of €259.98 million, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and other international markets.

Operations: The company generates revenue primarily through its CORE segment, contributing €455.37 million, and the LOB segment at €75.12 million. The focus on providing business software solutions for major platforms like SAP, Microsoft, and IBM underpins its operations across multiple European regions and beyond.

All for One Group SE, navigating through a transformative phase with strategic leadership changes and technological advancements, is poised to enhance its market position. The appointment of Dr. Ulrich Faisst as CTO heralds a focus on Business AI and SAP Cloud Conversion, signaling robust future prospects despite recent financial fluctuations—Q2 sales slightly increased to EUR 123.34 million from EUR 122.81 million year-over-year, yet net income dipped to EUR 0.833 million from EUR 3.14 million in the same period. This shift towards high-demand tech sectors could potentially revitalize growth trajectories, especially with earnings forecasted to surge by an impressive 22.2% annually, outpacing the broader German market's projection of 16.3%.

- Click here to discover the nuances of All for One Group with our detailed analytical health report.

Understand All for One Group's track record by examining our Past report.

Turning Ideas Into Actions

- Get an in-depth perspective on all 223 European High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSECURE

F-Secure Oyj

Operates as a cybersecurity company in Finland and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives