As the European Central Bank continues to cut interest rates, Germany's DAX index has shown resilience with a 1.46% increase, reflecting optimism in the region's economic outlook. This environment presents an opportunity to explore lesser-known stocks that may benefit from easing monetary policies and potential market growth. In this context, identifying stocks with strong fundamentals and innovative business models could reveal promising investment opportunities in Germany's dynamic market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

All for One Group (XTRA:A1OS)

Simply Wall St Value Rating: ★★★★★☆

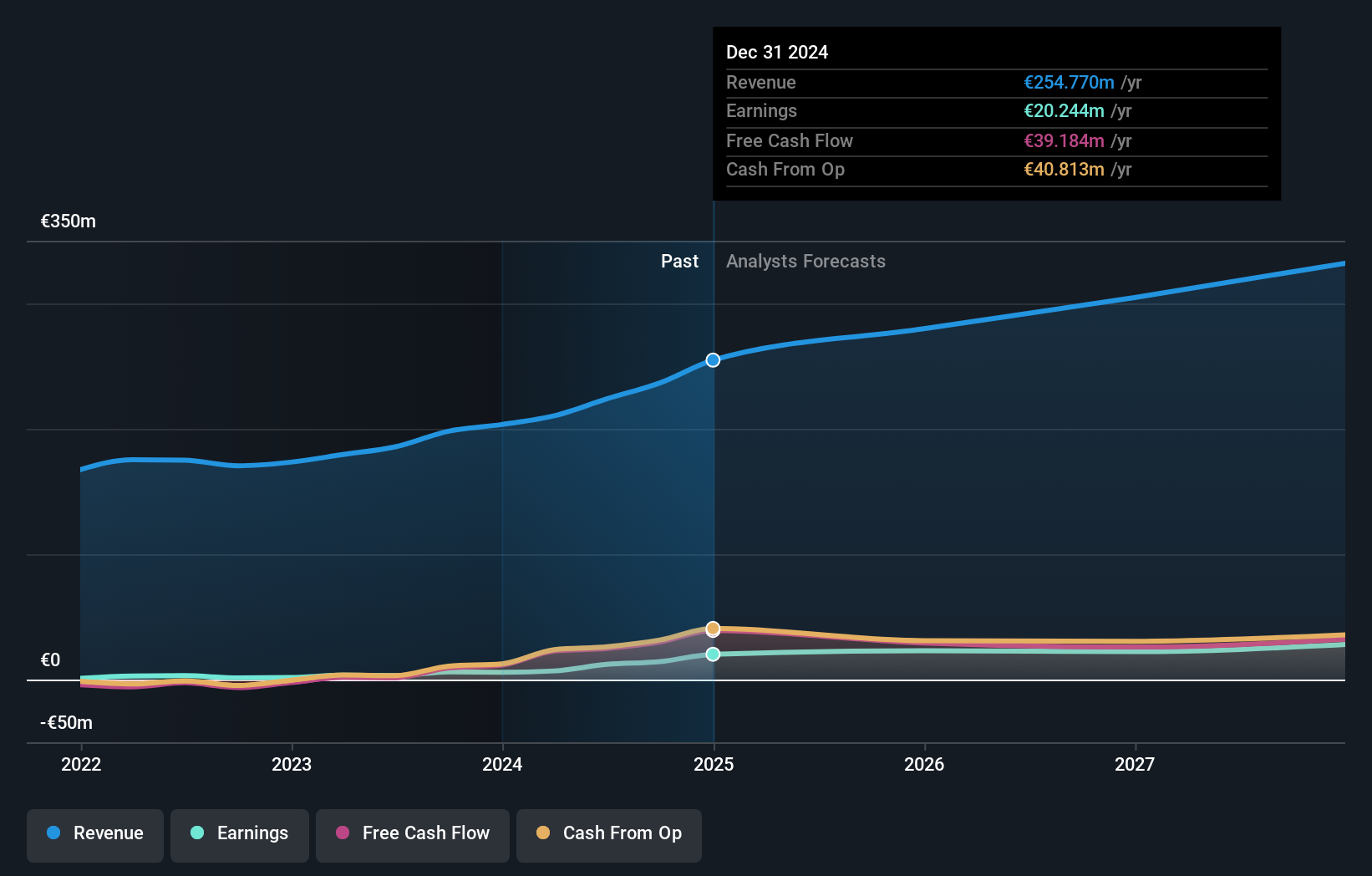

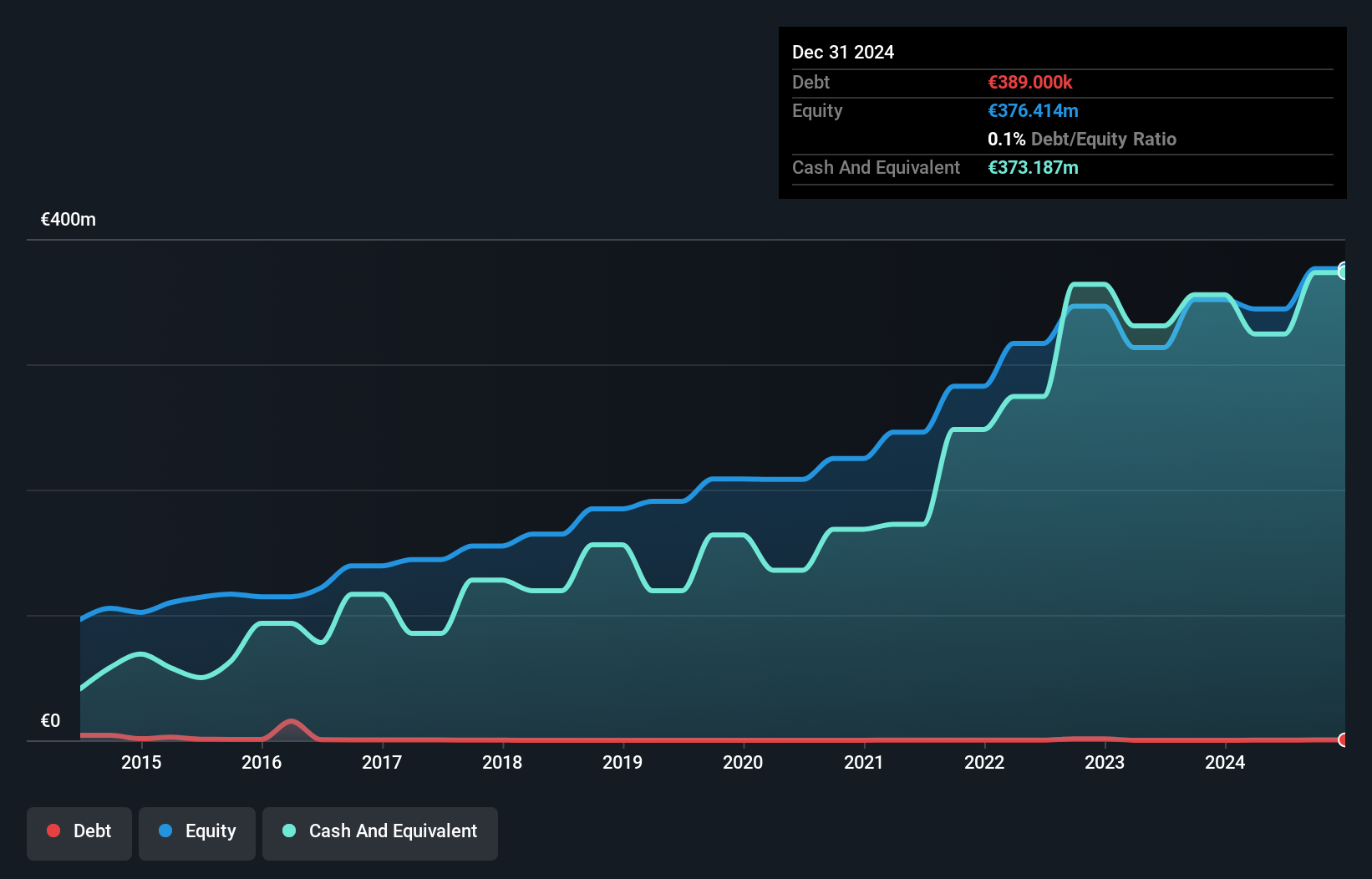

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally; it has a market capitalization of €271.44 million.

Operations: The company generates revenue primarily from its CORE segment, contributing €442.47 million, and the LOB segment, adding €77.01 million.

All for One Group, a promising player in the IT sector, reported impressive earnings growth of 59.6% last year, outpacing the industry's 16.8%. The company is trading at a substantial discount of 69.3% below its estimated fair value, suggesting potential undervaluation. Despite an increase in debt to equity ratio from 36.9% to 71.2% over five years, its net debt to equity remains satisfactory at 29.5%. Recent buybacks saw the repurchase of shares worth €3.7 million, indicating confidence in future prospects as earnings per share rose from a loss of €0.55 to €0.11 this quarter compared to last year.

- Take a closer look at All for One Group's potential here in our health report.

Gain insights into All for One Group's past trends and performance with our Past report.

SNP Schneider-Neureither & Partner (XTRA:SHF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SNP Schneider-Neureither & Partner SE provides software solutions for managing digital transformation processes and has a market capitalization of €390.38 million.

Operations: SNP Schneider-Neureither & Partner SE generates revenue primarily from its Service and Software segments, with €137.50 million and €76.46 million respectively. The EXA segment contributes an additional €11.09 million to the overall revenue stream.

SNP's earnings have surged, with a 284% growth over the past year, significantly outpacing the IT industry's 17%. The company is profitable and free cash flow positive, with a net debt to equity ratio of 41%, which is considered high. Recent results show substantial improvement; Q2 net income reached €5.52 million from €0.35 million last year, while six-month figures rose to €7.92 million from €1.7 million previously. Basic earnings per share increased to €1.09 from €0.23 a year ago, reflecting strong performance momentum as it revises its revenue guidance upwards for 2024 between €225-240 million.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG is a company that offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market capitalization of approximately €725.56 million.

Operations: Logwin AG's primary revenue streams are from its Air + Ocean segment, generating €954.25 million, and the Solutions segment, contributing €275.78 million.

Logwin, a notable player in the logistics sector, has seen some turbulence with its recent earnings report for the half year ending June 2024. Sales dipped to €643.5 million from €672.97 million, while net income fell to €31.86 million from €40.49 million in the previous year. Basic earnings per share also decreased to €11.07 from last year's €14.06, reflecting challenges within the industry and negative earnings growth of -2.2% compared to an industry average of 9%. Despite these hurdles, Logwin trades at 31% below its estimated fair value and maintains strong cash flow positivity, suggesting potential undervaluation opportunities for investors looking beyond current performance dips.

- Unlock comprehensive insights into our analysis of Logwin stock in this health report.

Evaluate Logwin's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 52 German Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade All for One Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives