As European markets navigate the complexities of new trade tariffs and economic fluctuations, investors are keeping a close eye on dividend stocks that offer stability amidst uncertainty. In this environment, a strong dividend stock is often characterized by its ability to maintain consistent payouts and demonstrate resilience in the face of market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.10% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.71% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.54% | ★★★★★★ |

| ERG (BIT:ERG) | 5.49% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.11% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

NOTE (OM:NOTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOTE AB (publ) is an electronics manufacturing services provider operating in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally with a market cap of approximately SEK5.63 billion.

Operations: NOTE AB (publ) generates revenue through its electronics manufacturing services across multiple regions, including Sweden, Finland, the United Kingdom, Bulgaria, Estonia, and China.

Dividend Yield: 3.5%

NOTE AB's dividend profile reveals a mixed landscape for investors. While its dividends have increased over the past decade, they remain volatile and unreliable, with a payout ratio of 77.8% covered by earnings and a cash payout ratio of 38.3%. The recent quarterly earnings showed improved net income but declining sales, highlighting potential challenges in maintaining consistent dividend growth. Despite trading at good value compared to industry peers, its dividend yield is slightly below top-tier Swedish payers.

- Click here and access our complete dividend analysis report to understand the dynamics of NOTE.

- Insights from our recent valuation report point to the potential undervaluation of NOTE shares in the market.

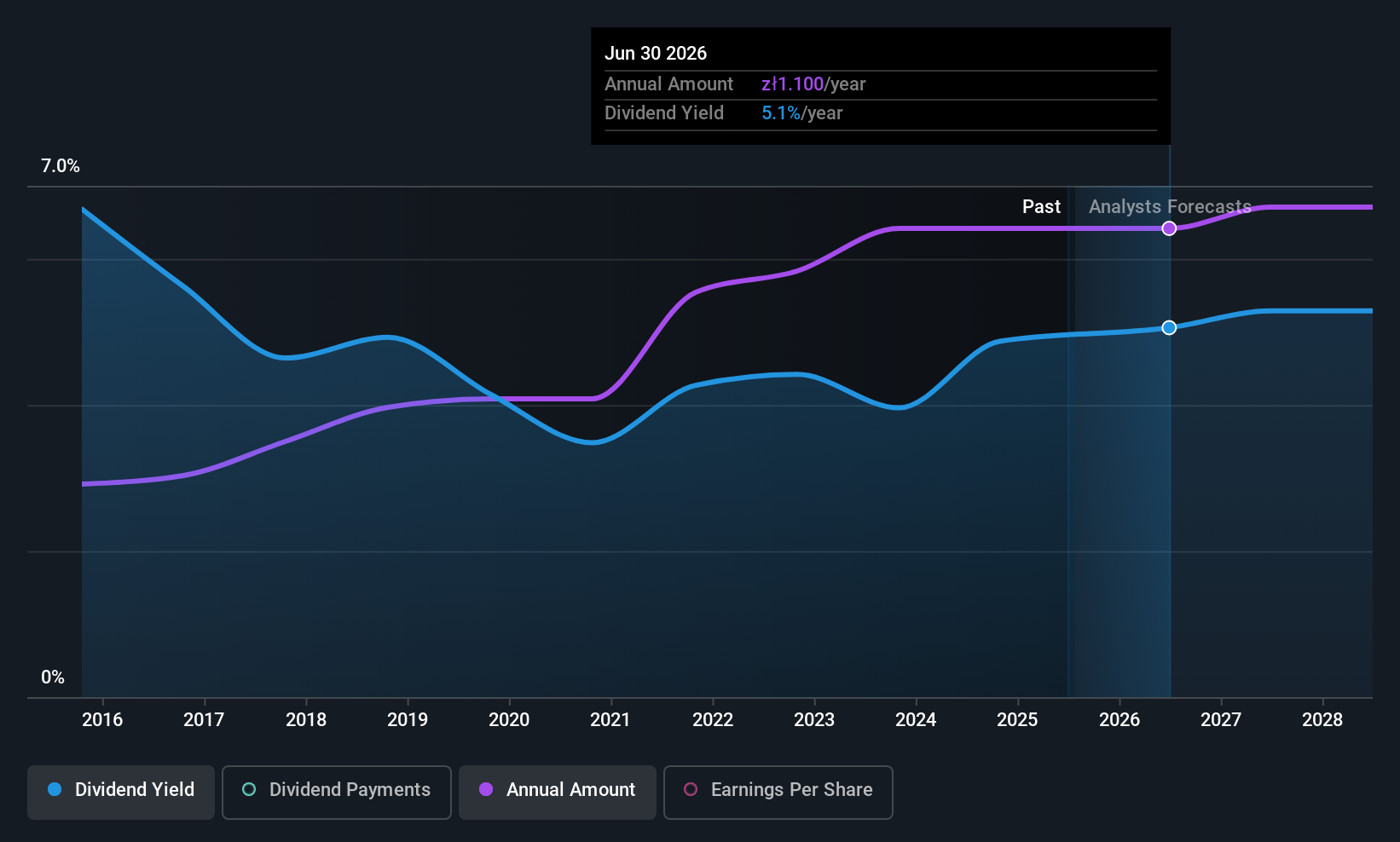

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A. operates in the manufacture, import, and distribution of grape wines across Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN558.33 million.

Operations: Ambra S.A. generates revenue through its activities in manufacturing, importing, and distributing grape wines across Poland, the Czech Republic, Slovakia, and Romania.

Dividend Yield: 5%

Ambra's dividend profile is characterized by stability and reliability, with consistent growth over the past decade. Despite a recent quarterly net loss of PLN 5.06 million, its dividends remain well-covered by earnings and cash flows, with payout ratios of 56.3% and 35.8%, respectively. However, its dividend yield of 4.97% is lower than Poland's top-tier payers. Trading below estimated fair value could offer potential upside despite recent revenue declines to PLN 150.63 million for the quarter.

- Dive into the specifics of Ambra here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Ambra is priced lower than what may be justified by its financials.

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg and internationally with a market cap of €245.48 million.

Operations: All for One Group SE generates revenue through its segments, with €75.12 million from LOB and €455.37 million from CORE.

Dividend Yield: 3.1%

All for One Group offers a stable dividend profile with consistent growth over the past decade. Despite recent earnings pressure, including a net income drop to €0.83 million in Q2 2025, dividends remain well-covered by earnings and cash flows, with payout ratios of 49.6% and 18.5%, respectively. The dividend yield of 3.15% is below Germany's top-tier payers, but shares trade significantly below estimated fair value, suggesting potential appeal for value-focused investors amidst revised guidance and revenue adjustments.

- Take a closer look at All for One Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that All for One Group is trading behind its estimated value.

Summing It All Up

- Gain an insight into the universe of 231 Top European Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOTE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NOTE

NOTE

Provides electronics manufacturing services in Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives