As European markets experience modest growth, with the pan-European STOXX Europe 600 Index remaining stable amidst interest rate policy assessments and trade uncertainties, investors are increasingly looking towards dividend stocks as a reliable source of income. In this environment, identifying strong dividend stocks involves evaluating companies with consistent earnings and robust cash flow, which can offer stability in times of economic fluctuation.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.36% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.75% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.69% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.37% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 11.56% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.65% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.69% | ★★★★★☆ |

| Banca Popolare di Sondrio (BIT:BPSO) | 6.03% | ★★★★★☆ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Vienna Insurance Group (WBAG:VIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vienna Insurance Group AG, with a market cap of €5.99 billion, operates through its subsidiaries to offer insurance products and services in Austria and internationally.

Operations: Vienna Insurance Group AG generates revenue through its provision of insurance products and services across Austria and international markets.

Dividend Yield: 3.3%

Vienna Insurance Group's dividend profile shows both strengths and weaknesses. While the company offers a modest dividend yield of 3.31%, below Austria's top quartile, its dividends are well-covered by earnings and cash flows, with payout ratios of 29.5% and 49.3% respectively. However, the dividends have been volatile over the past decade despite recent growth in payments. VIG trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation alongside income returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Vienna Insurance Group.

- Our valuation report unveils the possibility Vienna Insurance Group's shares may be trading at a discount.

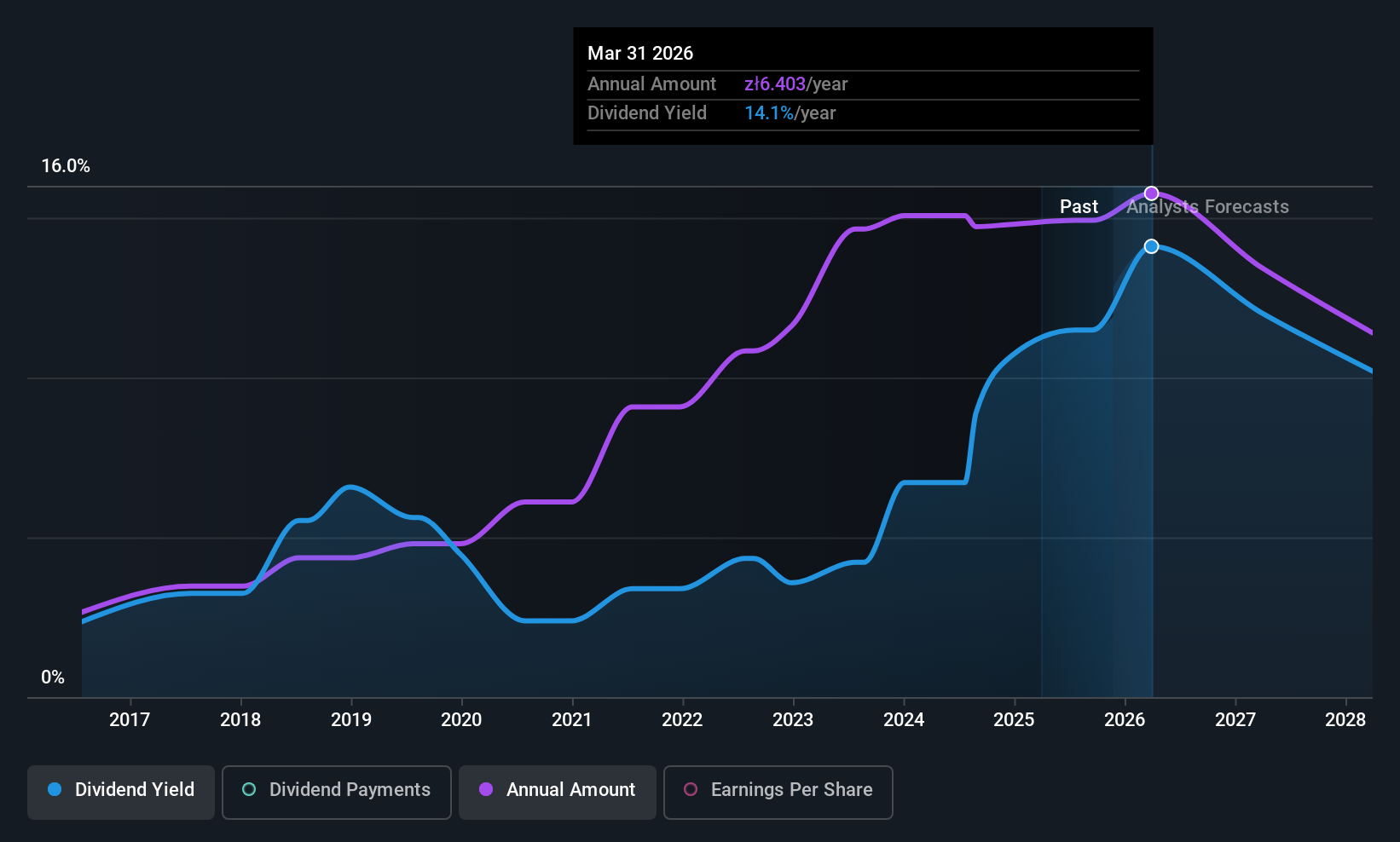

Text (WSE:TXT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Text S.A. develops and distributes online text communication software for businesses worldwide, with a market cap of PLN1.37 billion.

Operations: Text S.A.'s revenue is primarily generated from its Live Chat segment, which accounts for PLN352.14 million.

Dividend Yield: 11.4%

Text S.A.'s dividend yield of 11.41% is among the highest in Poland, yet it raises concerns about sustainability due to high payout ratios—102.9% of earnings and 119.6% of cash flows—indicating dividends are not well-covered by financial performance. Despite this, dividends have been stable and growing over the past decade. Recent earnings showed a decline, with net income at PLN 31.02 million from PLN 43.73 million year-over-year, potentially impacting future payouts if trends continue.

- Unlock comprehensive insights into our analysis of Text stock in this dividend report.

- In light of our recent valuation report, it seems possible that Text is trading behind its estimated value.

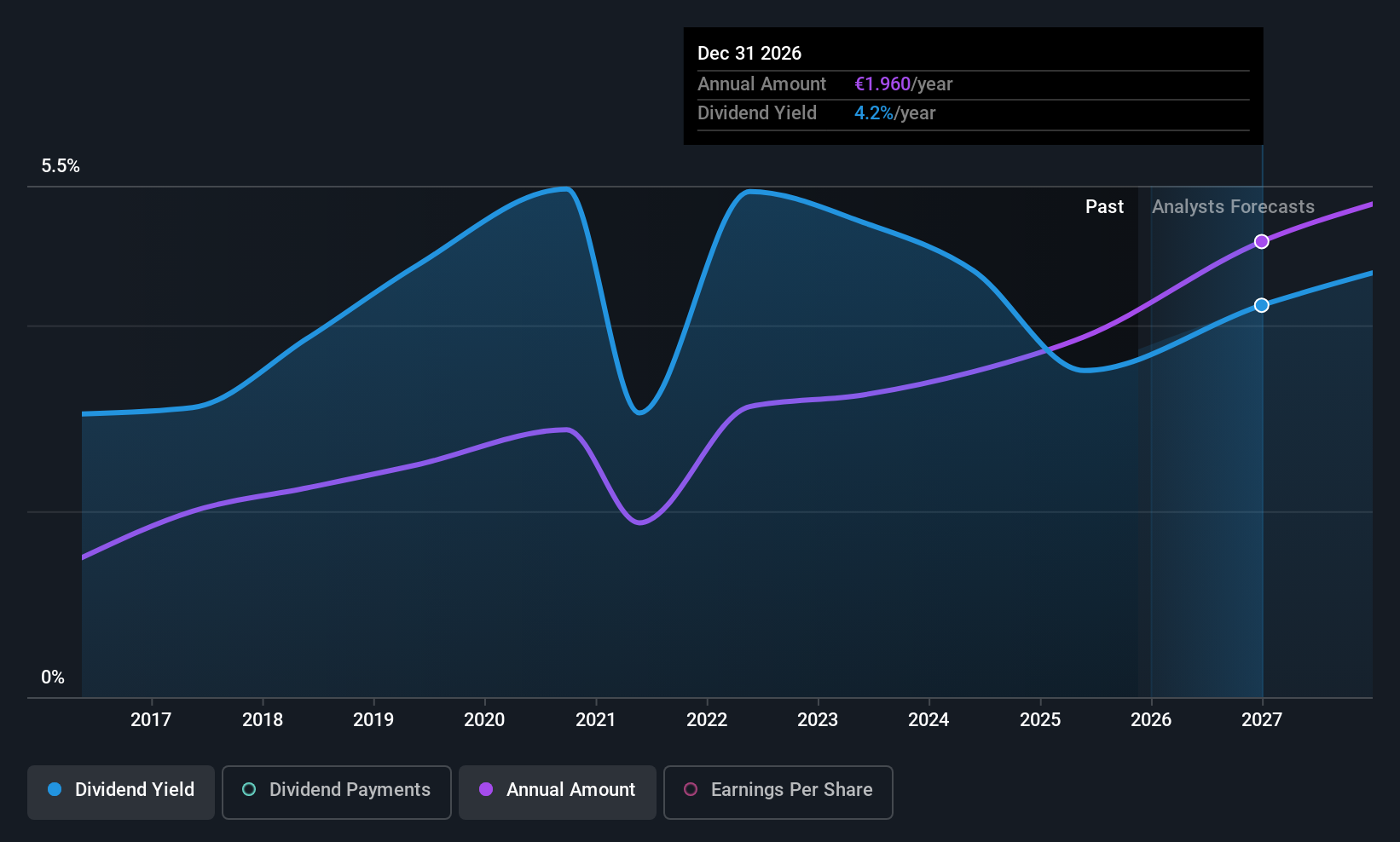

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, with a market cap of €218.69 million, provides business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Operations: All for One Group SE's revenue segments include €74.61 million from LOB and €456.65 million from CORE.

Dividend Yield: 3.5%

All for One Group SE offers a stable dividend yield of 3.52%, supported by a low cash payout ratio of 23.8% and earnings coverage at 49%, indicating sustainability. Although the yield is below Germany's top tier, dividends have grown steadily over the past decade. Recent guidance suggests revenue between €505 million and €520 million, with EBIT margins expected to improve only by 2026/27 due to current geopolitical challenges impacting customer behavior and product segments.

- Delve into the full analysis dividend report here for a deeper understanding of All for One Group.

- Our comprehensive valuation report raises the possibility that All for One Group is priced lower than what may be justified by its financials.

Turning Ideas Into Actions

- Click here to access our complete index of 230 Top European Dividend Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM primarily in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives