As European markets experience a pullback, with the pan-European STOXX Europe 600 Index ending 1.24% lower amid concerns about overvaluation in artificial intelligence-related stocks, investors are increasingly looking towards more stable options like dividend stocks. In this environment of cautious sentiment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration for those seeking to balance risk and reward in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.40% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.74% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.34% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.62% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.76% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.69% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Banco BPM (BIT:BAMI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco BPM S.p.A. is an Italian bank offering a range of banking and financial services to individual, business, and corporate clients, with a market cap of €19.83 billion.

Operations: Banco BPM S.p.A. generates its revenue through various banking and financial services tailored for individual, business, and corporate clients in Italy.

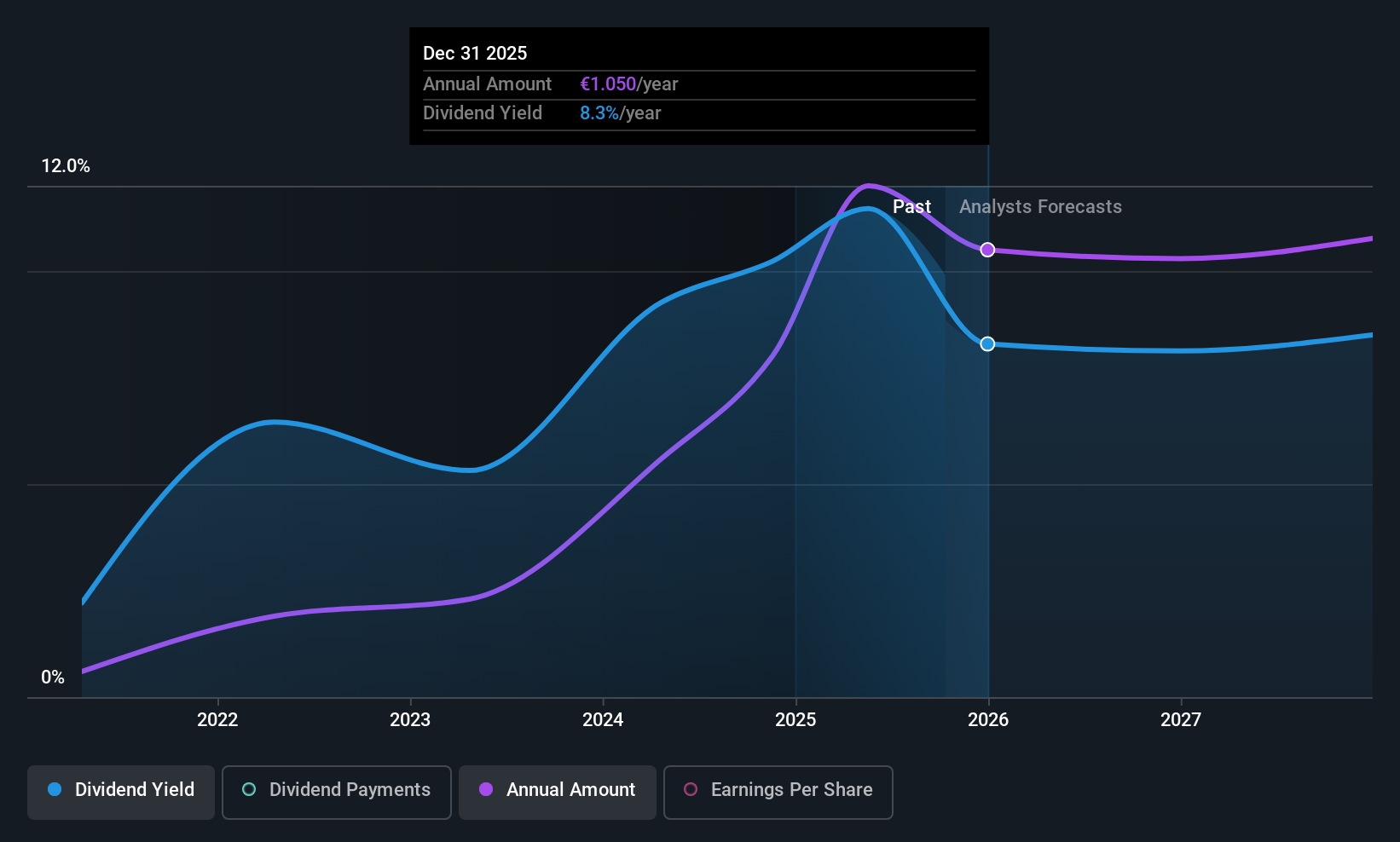

Dividend Yield: 9.1%

Banco BPM has shown an increase in dividend payments over the last five years, with a current payout ratio of 84.6% covered by earnings, and forecasts suggest sustainability at 80.1%. The dividend yield stands among the top 25% in Italy, though it has a high level of bad loans (2.5%) and low allowance for these (6%). Recent debt financing activities include issuing €500 million in green bonds under its Euro Medium Term Note Programme.

- Navigate through the intricacies of Banco BPM with our comprehensive dividend report here.

- According our valuation report, there's an indication that Banco BPM's share price might be on the expensive side.

Banca Sistema (BIT:BST)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banca Sistema S.p.A. offers a range of business and retail banking products and services in Italy with a market cap of €133.09 million.

Operations: Banca Sistema S.p.A. generates revenue through its diverse portfolio of business and retail banking products and services in Italy.

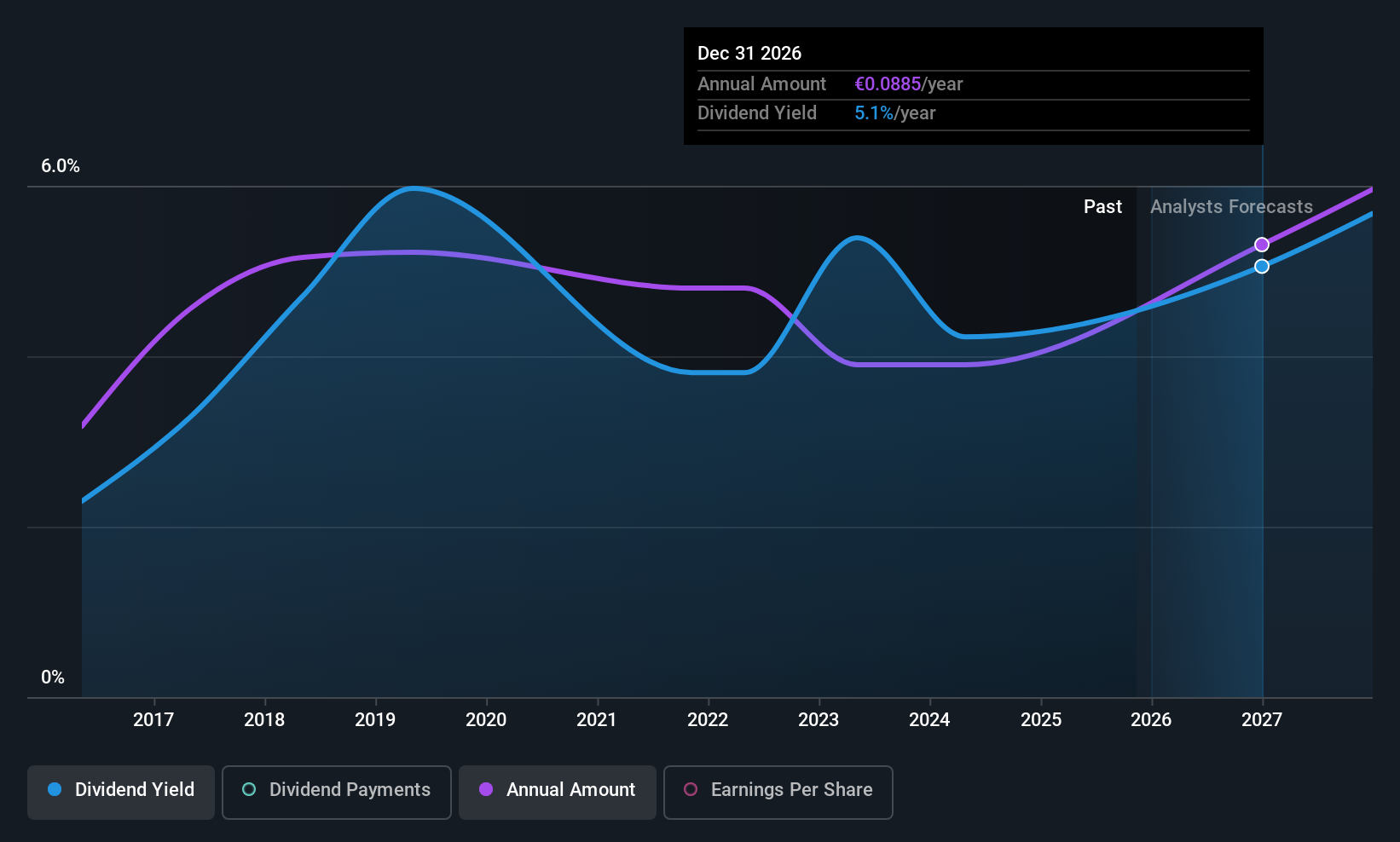

Dividend Yield: 3.9%

Banca Sistema offers a stable and reliable dividend, with payments growing over the past decade. Despite a low yield of 3.93% compared to top Italian payers, its dividends are well covered by earnings, with a current payout ratio of 34.8%, forecasted to decrease to 25.4%. The stock trades at good value relative to peers and industry averages but faces challenges with high bad loans (18.8%) and low allowances for these (12%).

- Click here to discover the nuances of Banca Sistema with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Banca Sistema is trading behind its estimated value.

All for One Group (XTRA:A1OS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally with a market cap of €209.83 million.

Operations: All for One Group SE generates revenue from its segments with €74.61 million from LOB and €456.65 million from CORE.

Dividend Yield: 3.7%

All for One Group provides a stable dividend yield of 3.66%, supported by a low payout ratio of 49% and a cash payout ratio of 23.8%. While its yield is below the top German payers, the dividends have been reliable and growing over the past decade. The company trades at good value, significantly below its estimated fair value, with earnings expected to grow annually by 27.92%, enhancing future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of All for One Group.

- Insights from our recent valuation report point to the potential undervaluation of All for One Group shares in the market.

Where To Now?

- Explore the 225 names from our Top European Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco BPM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BAMI

Banco BPM

Provides banking and financial products and services to individual, business, and corporate customers in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives