As the pan-European STOXX Europe 600 Index remains relatively flat, with mixed returns across major stock indexes, investors are keeping a close eye on inflation trends and labor market stability in the eurozone. In this environment of cautious optimism and steady economic indicators, identifying promising opportunities among lesser-known stocks can be particularly rewarding. A good stock often combines solid fundamentals with growth potential that aligns well with current market conditions, making it an attractive choice for those seeking to uncover hidden gems in the European market.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Flügger group | 30.11% | 1.55% | -30.01% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 14.04% | 21.73% | 17.76% | ★★★★★☆ |

| Deutsche Balaton | 5.64% | -7.61% | -16.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A. is a financial institution that offers wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market capitalization of €683.65 million.

Operations: Renta 4 Banco generates revenue primarily through wealth management, brokerage, and corporate advisory services. The company's net profit margin is a key indicator of its financial efficiency.

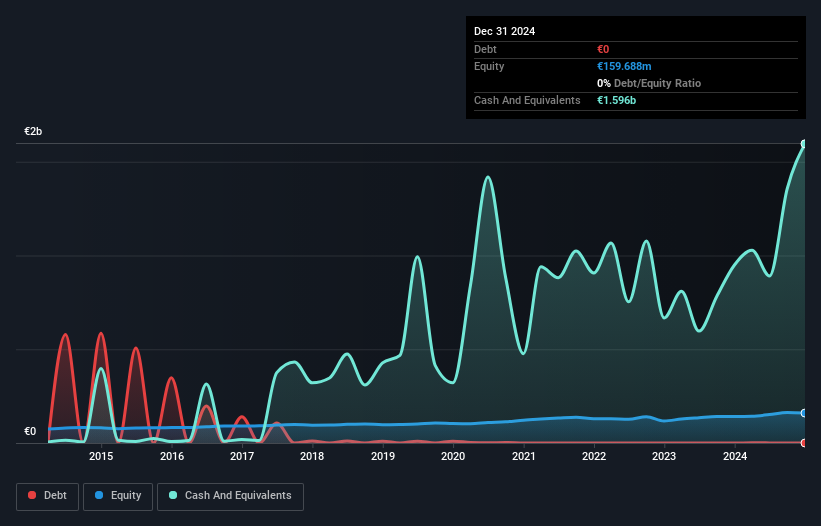

Renta 4 Banco, a nimble player in the financial sector, has demonstrated impressive earnings growth of 23%, outpacing the Capital Markets industry's 12.8%. With its debt-free status compared to a debt-to-equity ratio of 9.4% five years ago, it stands on solid ground. The company enjoys high-quality past earnings and positive free cash flow, although its share price has been highly volatile over the last three months. This dynamic environment suggests potential for both risk and reward as Renta 4 navigates forward with no immediate concerns about cash runway or interest coverage due to its lack of debt obligations.

Boryszew (WSE:BRS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Boryszew S.A. operates in the automotive, metals, and chemical industries both in Poland and internationally, with a market capitalization of PLN1.28 billion.

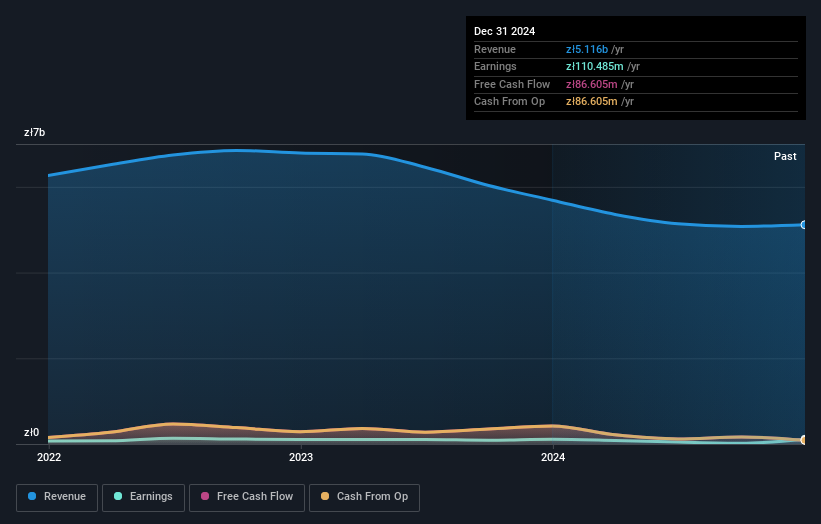

Operations: Boryszew S.A. generates revenue primarily from its metals segment, contributing PLN2.82 billion, followed by the motorization segment at PLN1.54 billion, and chemistry at PLN153.55 million.

Boryszew, a noteworthy player in the metals and mining sector, has seen its debt-to-equity ratio improve from 107.7% to 49.5% over the last five years, indicating better financial leverage. However, its interest coverage remains low at just 0.3x EBIT, which might raise some concerns about debt servicing capabilities. On a brighter note, Boryszew's earnings have outpaced industry trends with a robust growth of 33.4%, despite having experienced high share price volatility recently. A notable one-off gain of PLN164.9 million has impacted recent results positively, while its P/E ratio of 11.7x suggests it could be undervalued compared to the broader Polish market at 13x.

- Unlock comprehensive insights into our analysis of Boryszew stock in this health report.

Evaluate Boryszew's historical performance by accessing our past performance report.

innoscripta (XTRA:1INN)

Simply Wall St Value Rating: ★★★★★☆

Overview: innoscripta SE offers software-as-a-service solutions for managing research and development tax incentives and project management consulting in Germany, with a market capitalization of €1.06 billion.

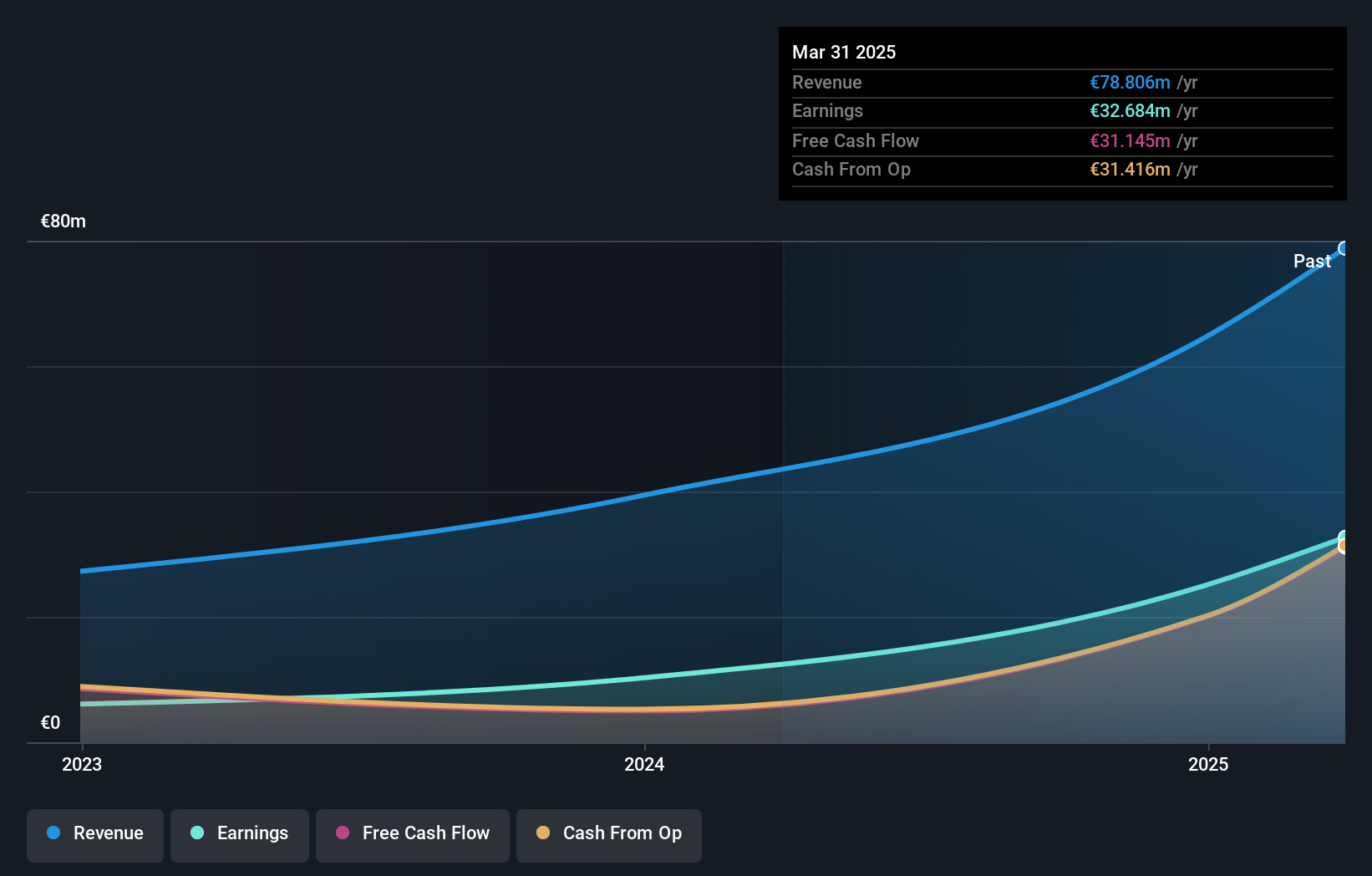

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to €78.81 million.

Innoscripta has made waves with its recent IPO, raising €223.60 million by offering 1.86 million shares at €120 each. This move comes on the heels of a robust earnings growth of 134% over the past year, outpacing the software industry average of 24%. Trading at a substantial discount to its estimated fair value, it presents an intriguing opportunity for investors. The company boasts high-quality earnings and maintains more cash than total debt, indicating financial stability despite recent share price volatility. With earnings forecasted to grow annually by 26%, Innoscripta seems poised for continued expansion in the market.

- Delve into the full analysis health report here for a deeper understanding of innoscripta.

Explore historical data to track innoscripta's performance over time in our Past section.

Make It Happen

- Discover the full array of 321 European Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if innoscripta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1INN

innoscripta

Provides software-as-a-service for managing research and development (R&D) tax incentives and project management consulting in Germany.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives