- Germany

- /

- Semiconductors

- /

- XTRA:WAF

Does Siltronic’s 60% Rally Signal a Fresh Opportunity in 2025?

Reviewed by Bailey Pemberton

Are you eyeing Siltronic stock and wondering if now’s your window of opportunity? You’re not alone. In recent weeks, Siltronic’s share price has come roaring back to life, up a remarkable 17.4% over just seven days and rising almost 60% over the past month. That kind of surge can grab anyone’s attention, especially after a rough patch where the stock had dropped 19.5% over the last year and is still down more than 30% over the past five years. So, what’s going on?

The silicon wafer supplier has been swept up in renewed optimism about the semiconductor industry, driven by broader market developments and investor confidence in a rebound for European tech. Market watchers have noted a shift in risk perception, as industry demand indicators point to a possible upswing ahead. This rapid change in sentiment could be fueling the share price momentum seen recently, suggesting some investors are reassessing the company’s long-term prospects.

Of course, stellar stock performance over a few weeks only tells part of the story. When you look under the hood at Siltronic’s valuation metrics, the picture shifts. By tallying six core valuation checks, Siltronic earns a value score of 2 out of 6. This means it is currently considered undervalued in two areas. That leaves plenty of room for a valuation deep-dive and a closer look at how the market stacks up the company right now.

Next, we’ll break down how Siltronic measures up across different valuation approaches. Stay tuned, as an even smarter lens on valuation will be discussed at the end of the article.

Siltronic scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Siltronic Discounted Cash Flow (DCF) Analysis

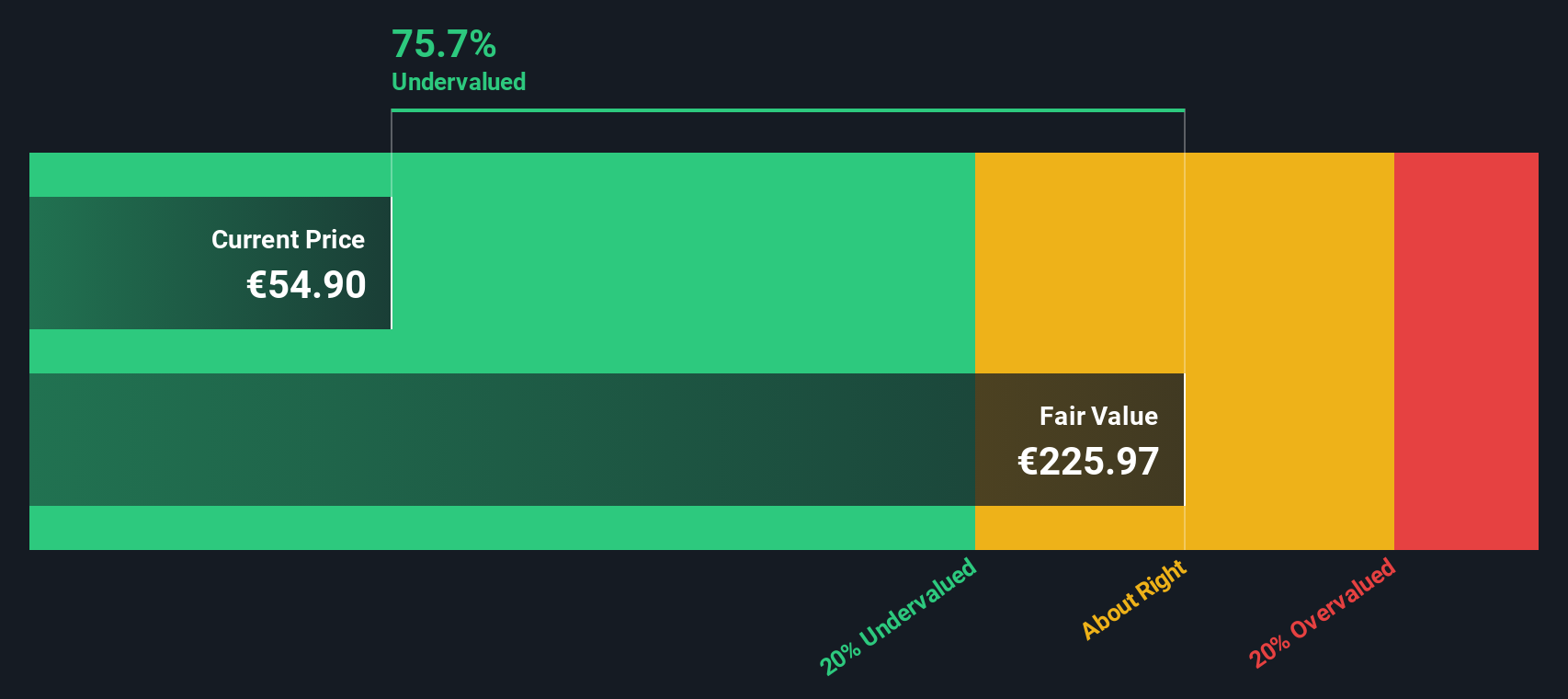

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to the present to estimate intrinsic value. For Siltronic, this approach uses the 2 Stage Free Cash Flow to Equity method, projecting both near-term analyst estimates and more generalized future growth.

Right now, Siltronic’s last twelve months’ Free Cash Flow (FCF) sits at -€576 million, reflecting recent challenges. However, analysts expect a material turnaround, with projected FCF reaching €213 million in 2027. Extrapolating further, estimates suggest FCF could grow to over €834 million by 2035. These later forecasts are less certain since they move beyond direct analyst projections.

Based on these long-term cash flow scenarios and discounted calculations, the DCF model places Siltronic’s fair value at €225.87 per share. This value is 76.3% higher than its current share price, indicating the market is significantly discounting Siltronic’s future cash-generating potential.

In summary, despite recent financial setbacks, the DCF analysis suggests Siltronic’s stock could be dramatically undervalued if projected recoveries materialize.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Siltronic is undervalued by 76.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Siltronic Price vs Earnings (PE)

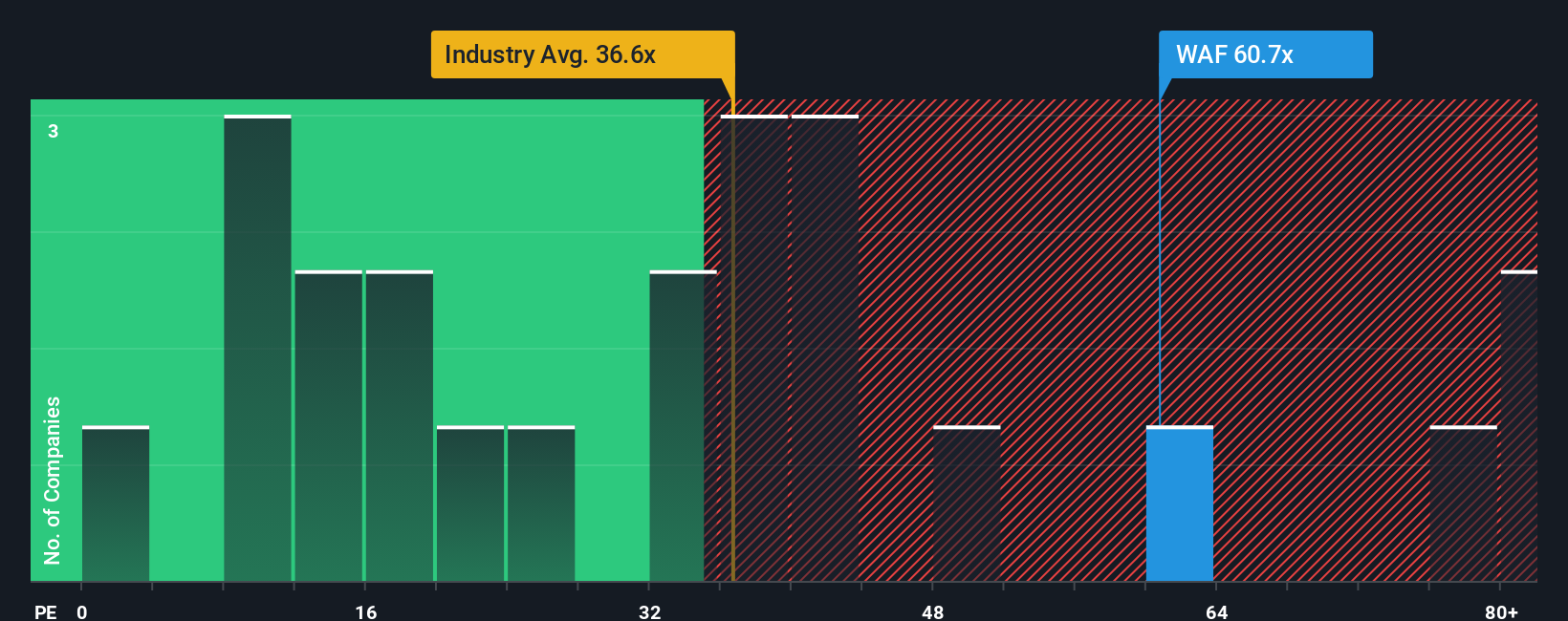

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it directly relates a company's current share price to its per-share earnings. For investors, it offers a quick gauge of how much they are paying for one euro of the company’s earnings, helping put the current valuation in context against profits.

What constitutes a "normal" or "fair" PE ratio depends a lot on expectations about future growth and risk. If a company is expected to grow quickly, investors generally accept a higher PE, anticipating rising earnings in the future. In contrast, economic or business risks can suppress the PE, as investors demand a discount for uncertainty.

Right now, Siltronic trades at a PE ratio of 55.02x. That is well above the industry average PE of 37.85x and considerably higher than its peer group, which averages 14.53x. However, it is important to go beyond basic comparisons to truly understand if the stock is fairly valued. Simply Wall St’s proprietary “Fair Ratio” for Siltronic is 16.34x. This advanced metric calculates the PE that is justifiable considering factors like the company’s expected earnings growth, its industry, profit margins, market capitalization, and risk profile. By using this context-aware Fair Ratio, investors get a much clearer signal than simply looking at peers or the overall sector.

Comparing Siltronic’s current PE of 55.02x to its Fair Ratio of 16.34x, the stock appears significantly overvalued based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Siltronic Narrative

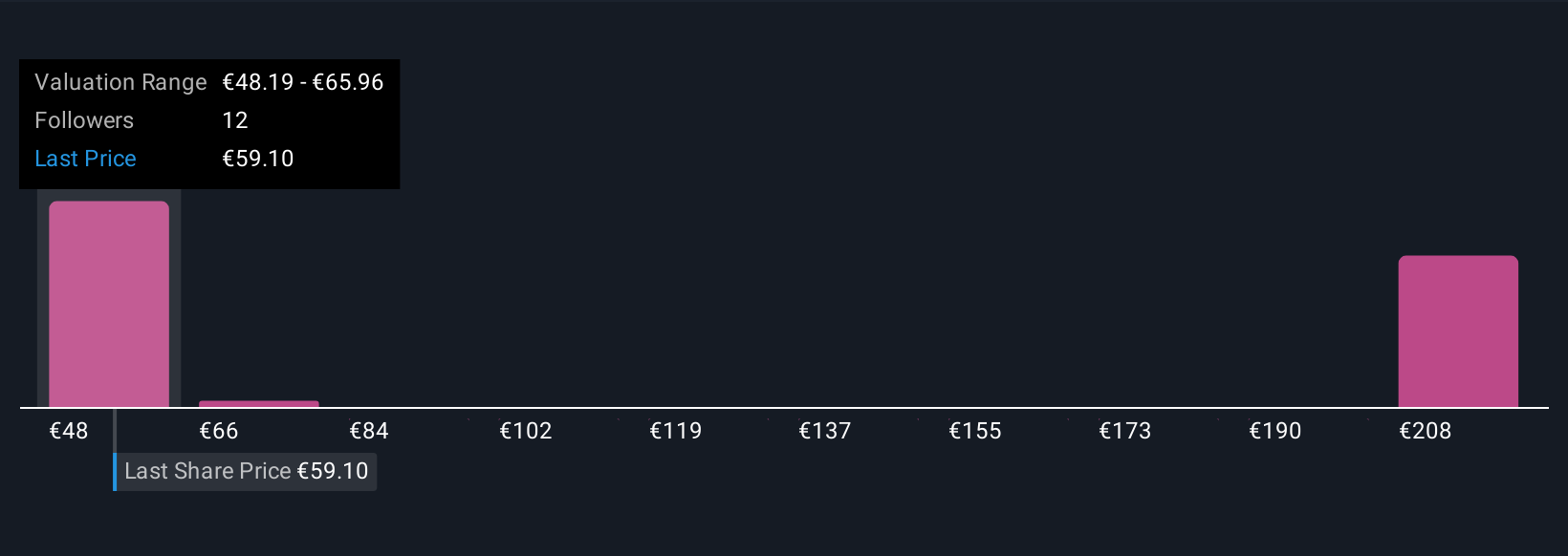

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, more personal way to make investment decisions. A Narrative is simply your story or viewpoint on a company, combining your expectations for its future revenue, earnings, and margins into one cohesive picture. Instead of relying purely on standard metrics, Narratives let you connect the dots from a company’s business outlook and industry trends directly to your estimate of its fair value.

On Simply Wall St’s Community page, millions of investors use Narratives as an easy, interactive tool to outline their assumptions and instantly see how they compare. These Narratives are dynamic, meaning they update automatically when news or financial results come in, keeping your view both current and actionable.

By comparing your Narrative-derived Fair Value to Siltronic’s current share price, you can make clearer decisions on when to buy or sell, tailored to your personal outlook. For example, some investors believe Siltronic could be worth as much as €64.00 if AI demand accelerates and margins expand, while others see a value closer to €35.35 if challenges persist. Narratives make it effortless to see where you stand and why.

Do you think there's more to the story for Siltronic? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:WAF

Siltronic

Develops, produces, markets, and sells hyperpure silicon wafers for the semiconductor industry in Germany, rest of Europe, the United States, Taiwan, Mainland China, South Korea, rest of Asia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)