- Germany

- /

- Semiconductors

- /

- XTRA:S92

SMA Solar Technology AG (ETR:S92) Stock Catapults 46% Though Its Price And Business Still Lag The Industry

SMA Solar Technology AG (ETR:S92) shareholders are no doubt pleased to see that the share price has bounced 46% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 35% in the last year.

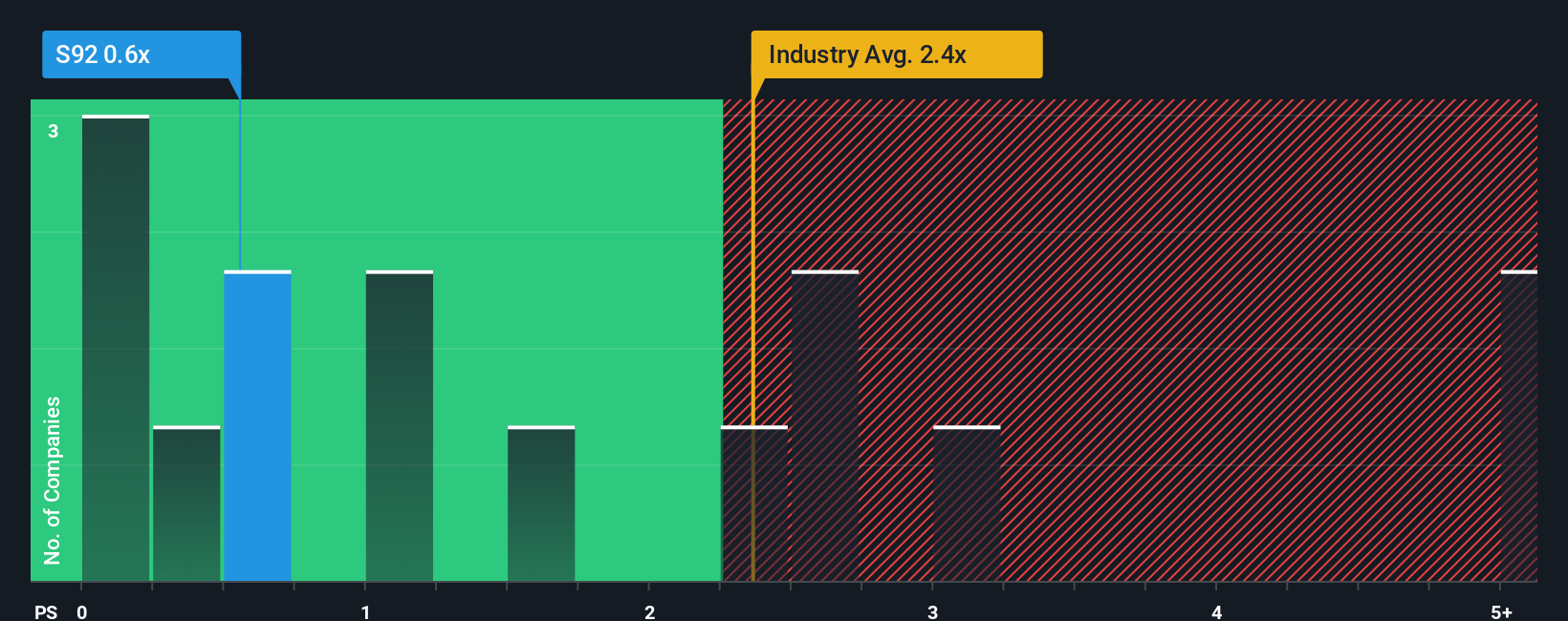

Although its price has surged higher, when close to half the companies operating in Germany's Semiconductor industry have price-to-sales ratios (or "P/S") above 1.7x, you may still consider SMA Solar Technology as an enticing stock to check out with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for SMA Solar Technology

What Does SMA Solar Technology's P/S Mean For Shareholders?

Recent times haven't been great for SMA Solar Technology as its revenue has been falling quicker than most other companies. It seems that many are expecting the dismal revenue performance to persist, which has repressed the P/S. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on SMA Solar Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For SMA Solar Technology?

In order to justify its P/S ratio, SMA Solar Technology would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. Even so, admirably revenue has lifted 51% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.1% per annum during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 8.9% each year growth forecast for the broader industry.

With this in consideration, its clear as to why SMA Solar Technology's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From SMA Solar Technology's P/S?

The latest share price surge wasn't enough to lift SMA Solar Technology's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SMA Solar Technology maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for SMA Solar Technology that we have uncovered.

If you're unsure about the strength of SMA Solar Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:S92

SMA Solar Technology

Develops, produces, and sells PV and battery inverters, transformers, chokes, monitoring systems for PV systems, and charging solutions for electric vehicles in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives