- Germany

- /

- Electrical

- /

- XTRA:S92

Investors Continue Waiting On Sidelines For SMA Solar Technology AG (ETR:S92)

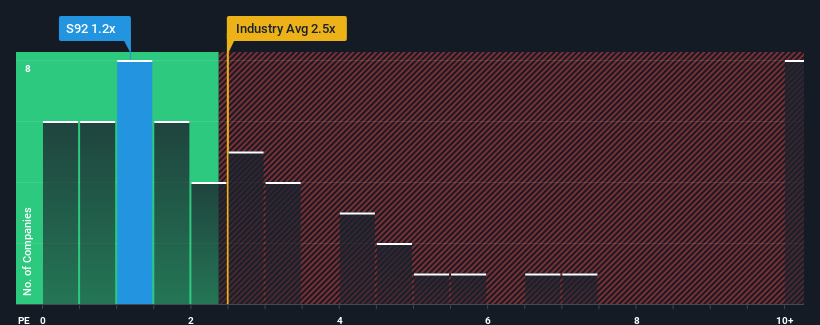

SMA Solar Technology AG's (ETR:S92) price-to-sales (or "P/S") ratio of 1.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Semiconductor industry in Germany have P/S ratios greater than 2x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for SMA Solar Technology

What Does SMA Solar Technology's P/S Mean For Shareholders?

Recent times have been advantageous for SMA Solar Technology as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SMA Solar Technology.How Is SMA Solar Technology's Revenue Growth Trending?

In order to justify its P/S ratio, SMA Solar Technology would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 74% last year. Pleasingly, revenue has also lifted 59% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 12% per annum over the next three years. That's shaping up to be materially higher than the 8.4% per year growth forecast for the broader industry.

With this information, we find it odd that SMA Solar Technology is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at SMA Solar Technology's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 3 warning signs for SMA Solar Technology (2 make us uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of SMA Solar Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:S92

SMA Solar Technology

Develops, produces, and sells PV and battery inverters, monitoring systems for PV systems, and charging solutions for electric vehicles in Germany and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives