Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that SMA Solar Technology AG (ETR:S92) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for SMA Solar Technology

What Is SMA Solar Technology's Debt?

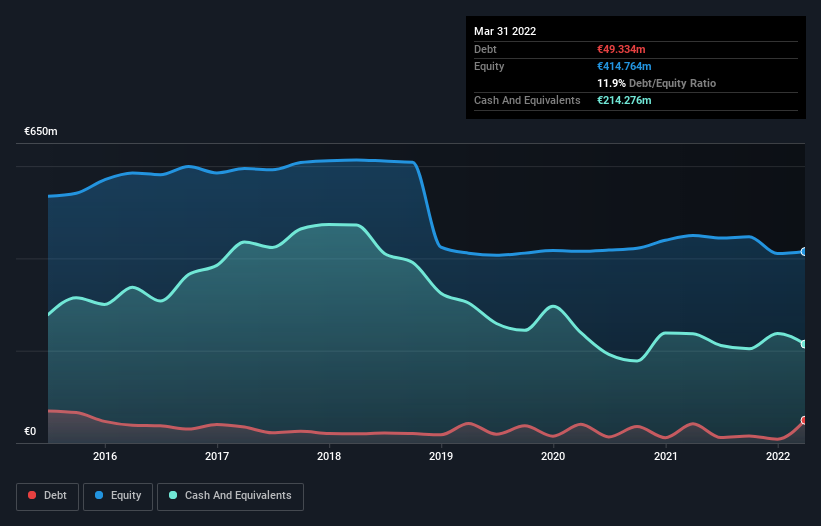

The image below, which you can click on for greater detail, shows that at March 2022 SMA Solar Technology had debt of €49.3m, up from €41.6m in one year. However, it does have €214.3m in cash offsetting this, leading to net cash of €164.9m.

How Healthy Is SMA Solar Technology's Balance Sheet?

The latest balance sheet data shows that SMA Solar Technology had liabilities of €359.6m due within a year, and liabilities of €287.7m falling due after that. On the other hand, it had cash of €214.3m and €169.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €263.4m.

Given SMA Solar Technology has a market capitalization of €1.61b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, SMA Solar Technology boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if SMA Solar Technology can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year SMA Solar Technology's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

So How Risky Is SMA Solar Technology?

While SMA Solar Technology lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow €20m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. With revenue growth uninspiring, we'd really need to see some positive EBIT before mustering much enthusiasm for this business. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for SMA Solar Technology you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:S92

SMA Solar Technology

Develops, produces, and sells PV and battery inverters, transformers, chokes, monitoring systems for PV systems, and charging solutions for electric vehicles in Germany and internationally.

Undervalued with adequate balance sheet.