The analysts covering Manz AG (ETR:M5Z) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon. At €53.20, shares are up 8.6% in the past 7 days. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

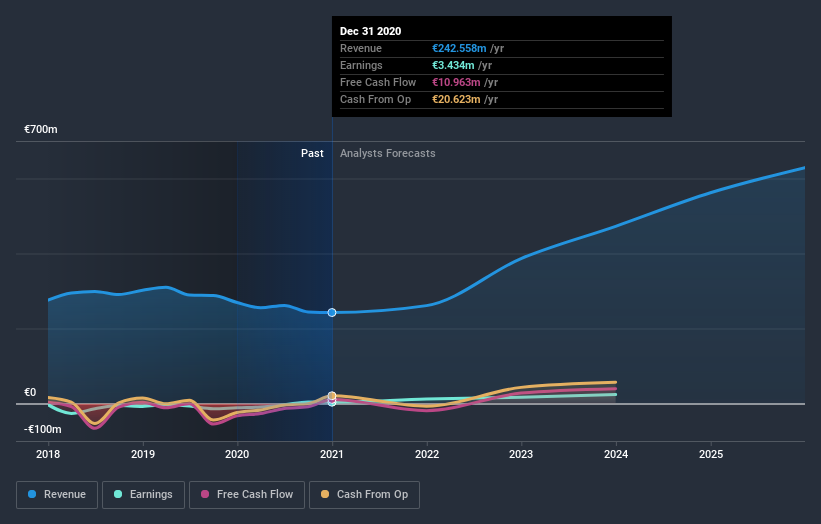

Following the downgrade, the most recent consensus for Manz from its dual analysts is for revenues of €261m in 2021 which, if met, would be a reasonable 7.6% increase on its sales over the past 12 months. Statutory earnings per share are presumed to soar 243% to €1.52. Prior to this update, the analysts had been forecasting revenues of €364m and earnings per share (EPS) of €2.89 in 2021. Indeed, we can see that the analysts are a lot more bearish about Manz's prospects, administering a sizeable cut to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for Manz

The average price target climbed 11% to €48.43 despite the reduced earnings forecasts, suggesting that this earnings impact could be a positive for the stock, once it passes. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Manz analyst has a price target of €60.00 per share, while the most pessimistic values it at €40.50. This shows there is still some diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's clear from the latest estimates that Manz's rate of growth is expected to accelerate meaningfully, with the forecast 7.6% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 2.7% p.a. over the past five years. Other similar companies in the industry (with analyst coverage) are also forecast to grow their revenue at 8.5% per year. Manz is expected to grow at about the same rate as its industry, so it's not clear that we can draw any conclusions from its growth relative to competitors.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Lamentably, they also downgraded their sales forecasts, but the business is still expected to grow at roughly the same rate as the market itself. The increasing price target is not intuitively what we would expect to see, given these downgrades, and we'd suggest shareholders revisit their investment thesis before making a decision.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. See why we're concerned about Manz's balance sheet by visiting our risks dashboard for free on our platform here.

You can also see our analysis of Manz's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

When trading Manz or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:M5Z

Manz

Operates as a high-tech mechanical engineering company that provides production equipment in Germany, rest of Europe, the United States, Taiwan, China, rest of Asia, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives