- Germany

- /

- Semiconductors

- /

- XTRA:M5Z

Take Care Before Jumping Onto Manz AG (ETR:M5Z) Even Though It's 25% Cheaper

To the annoyance of some shareholders, Manz AG (ETR:M5Z) shares are down a considerable 25% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

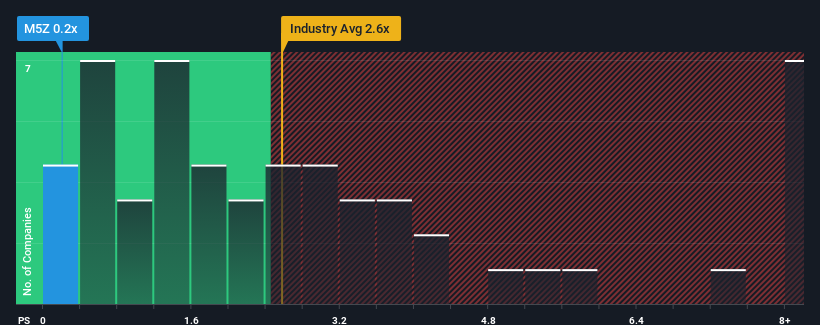

Since its price has dipped substantially, Manz may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Semiconductor industry in Germany have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Manz

How Has Manz Performed Recently?

Manz could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Manz.Do Revenue Forecasts Match The Low P/S Ratio?

Manz's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 8.4% each year as estimated by the three analysts watching the company. With the industry predicted to deliver 8.5% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Manz's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Manz's recently weak share price has pulled its P/S back below other Semiconductor companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Manz remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Manz, and understanding them should be part of your investment process.

If you're unsure about the strength of Manz's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M5Z

Manz

Operates as a high-tech mechanical engineering company that provides production equipment in Germany, rest of Europe, the United States, Taiwan, China, rest of Asia, and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives