- Germany

- /

- Semiconductors

- /

- XTRA:AIXA

More Unpleasant Surprises Could Be In Store For AIXTRON SE's (ETR:AIXA) Shares After Tumbling 26%

To the annoyance of some shareholders, AIXTRON SE (ETR:AIXA) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop has obliterated the annual return, with the share price now down 5.6% over that longer period.

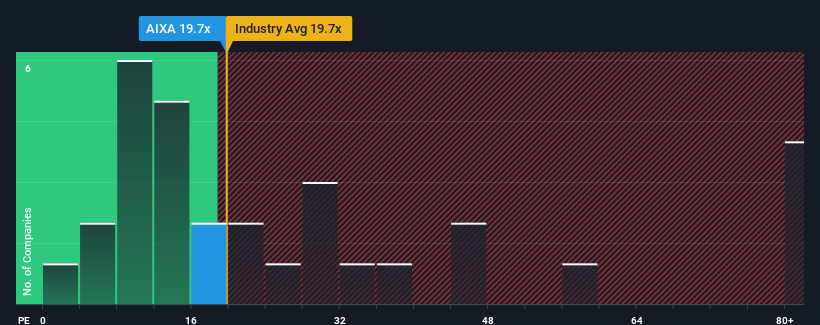

Although its price has dipped substantially, AIXTRON's price-to-earnings (or "P/E") ratio of 19.7x might still make it look like a sell right now compared to the market in Germany, where around half of the companies have P/E ratios below 15x and even P/E's below 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, AIXTRON has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for AIXTRON

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, AIXTRON would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 44% last year. Pleasingly, EPS has also lifted 314% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 13% per annum over the next three years. That's shaping up to be similar to the 14% per year growth forecast for the broader market.

In light of this, it's curious that AIXTRON's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On AIXTRON's P/E

Despite the recent share price weakness, AIXTRON's P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that AIXTRON currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AIXTRON (1 is potentially serious!) that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AIXA

AIXTRON

Provides deposition equipment to the semiconductor industry in Asia, Europe, and the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.