- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

Zalando (XTRA:ZAL) Eyes Growth with Strategic Conferences as CFO Transition Looms

Reviewed by Simply Wall St

Zalando (XTRA:ZAL) is navigating a dynamic period with significant developments on the horizon. With an impressive earnings growth forecast of 24.4% annually, Zalando is actively engaging with investors, as evidenced by their upcoming presentations at the Berenberg and Goldman Sachs Thirteenth German Corporate Conference and the Baader Investment Conference. However, the company faces challenges such as a low net profit margin and potential supply chain disruptions, which will be crucial topics in the forthcoming discussions.

Navigate through the intricacies of Zalando with our comprehensive report here.

Core Advantages Driving Sustained Success for Zalando

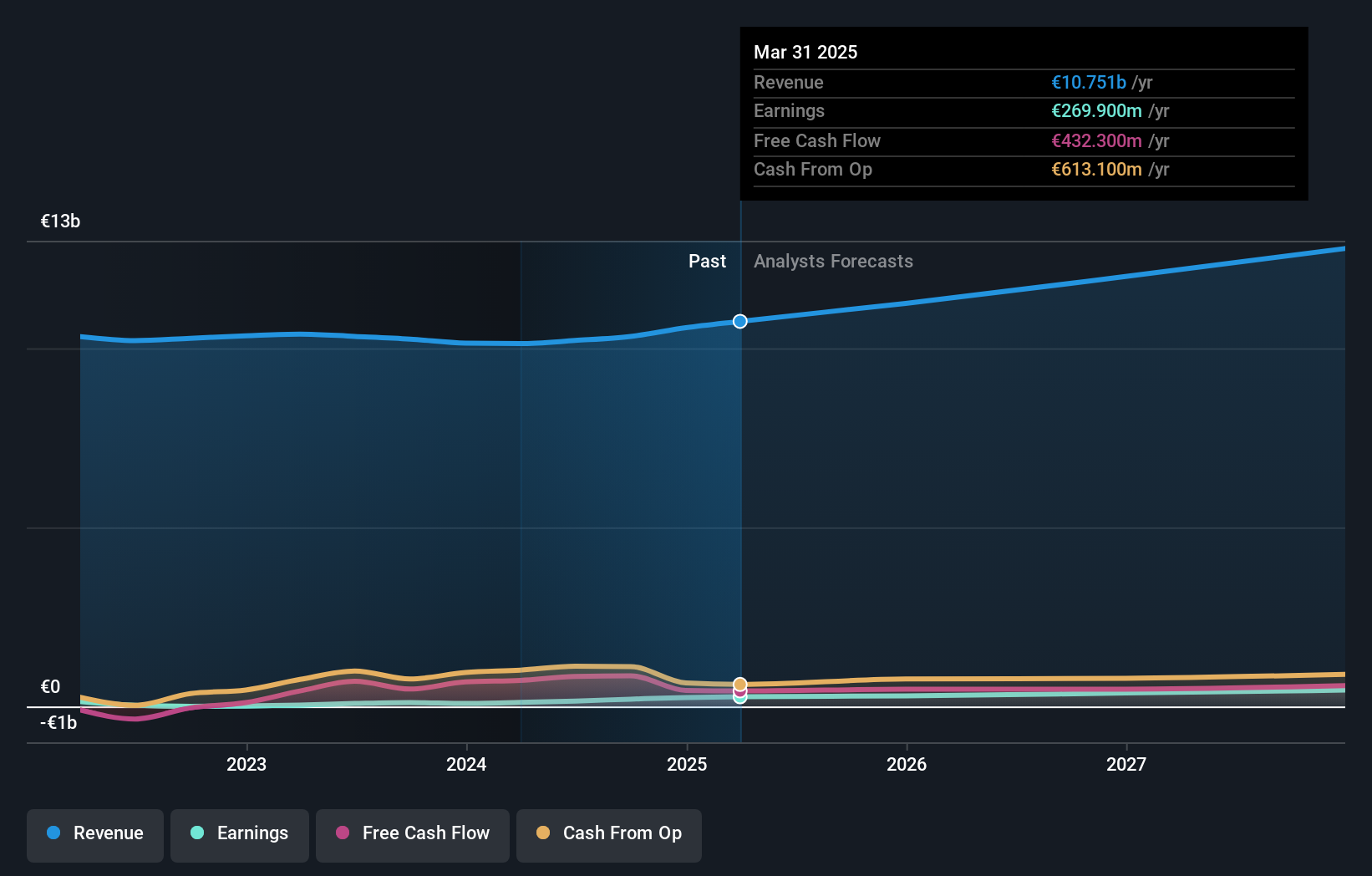

With a forecasted revenue growth of 5.6% per year, Zalando is outpacing the German market average. The company's earnings are expected to grow by 24.4% annually, surpassing the market average of 20.1%. This growth is underpinned by past earnings growth of 84.3% over the past year, which exceeds the 5-year average. The company's financial health is solid, with more cash than total debt and well-covered interest payments. This stability is bolstered by an experienced management team with an average tenure of 5.6 years, contributing to strategic goals and operational efficiency. Additionally, Zalando's current trading price of €28 is significantly below the estimated fair value of €70.03, suggesting it may be undervalued, despite a high SWS fair ratio compared to peers.

To dive deeper into how Zalando's valuation metrics are shaping its market position, check out our detailed analysis of Zalando's Valuation.Challenges Constraining Zalando's Potential

Zalando faces challenges with a current net profit margin of 1.5%, which is low compared to the previous year. The return on equity stands at 6.2%, below the desired threshold. Earnings growth is also projected to slow, raising concerns about sustaining momentum. Inventory management issues and rising cost pressures further complicate the financial situation. The company's valuation reflects these financial challenges and market perceptions.

To gain deeper insights into Zalando's historical performance, explore our detailed analysis of past performance.Growth Avenues Awaiting Zalando

Opportunities for Zalando include leveraging its leadership for strategic growth and capitalizing on significant earnings potential. The company is poised to enhance its market position through product-related announcements and strategic alliances, as evidenced by recent conference presentations. These initiatives could drive business expansion and strengthen its competitive edge.

See what the latest analyst reports say about Zalando's future prospects and potential market movements.Regulatory Challenges Facing Zalando

External threats such as economic headwinds and competitive pressures pose risks to Zalando's market share. Analysts' disagreement on target prices indicates uncertainty in market perception. Additionally, potential supply chain disruptions could impact product availability. The company's proactive approach to these challenges will be crucial in maintaining its market position.

Explore the current health of Zalando and how it reflects on its financial stability and growth potential.Conclusion

Zalando's projected revenue growth of 5.6% per year and earnings growth of 24.4% annually highlight its potential to outperform the German market, driven by strong past performance and a solid financial foundation. Challenges such as a low net profit margin and return on equity remain, but the company's strategic initiatives and experienced management position it well for future expansion and competitive advantage. The current trading price of €28, significantly below the estimated fair value of €70.03, suggests that the market may not fully recognize Zalando's growth prospects, offering an opportunity for investors. However, addressing inventory management and cost pressures, alongside navigating economic and competitive threats, will be crucial for sustaining its market position and achieving long-term success.

Summing It All Up

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:ZAL

Zalando

Operates an online platform for fashion and lifestyle products in Europe.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives