- Italy

- /

- Consumer Finance

- /

- BIT:MOL

European Growth Stocks With High Insider Ownership September 2025

Reviewed by Simply Wall St

As European markets experience a slight uptick, highlighted by the STOXX Europe 600 Index's recent gains, investors are closely watching the European Central Bank's steady interest rate stance amid modestly improved economic forecasts. In this environment of cautious optimism, growth companies with high insider ownership can be particularly appealing as they often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 73.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 91% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| Circus (XTRA:CA1) | 24.5% | 72.6% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.7% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's explore several standout options from the results in the screener.

Moltiply Group (BIT:MOL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Moltiply Group S.p.A. is a holding company in the financial services industry with a market cap of €1.69 billion.

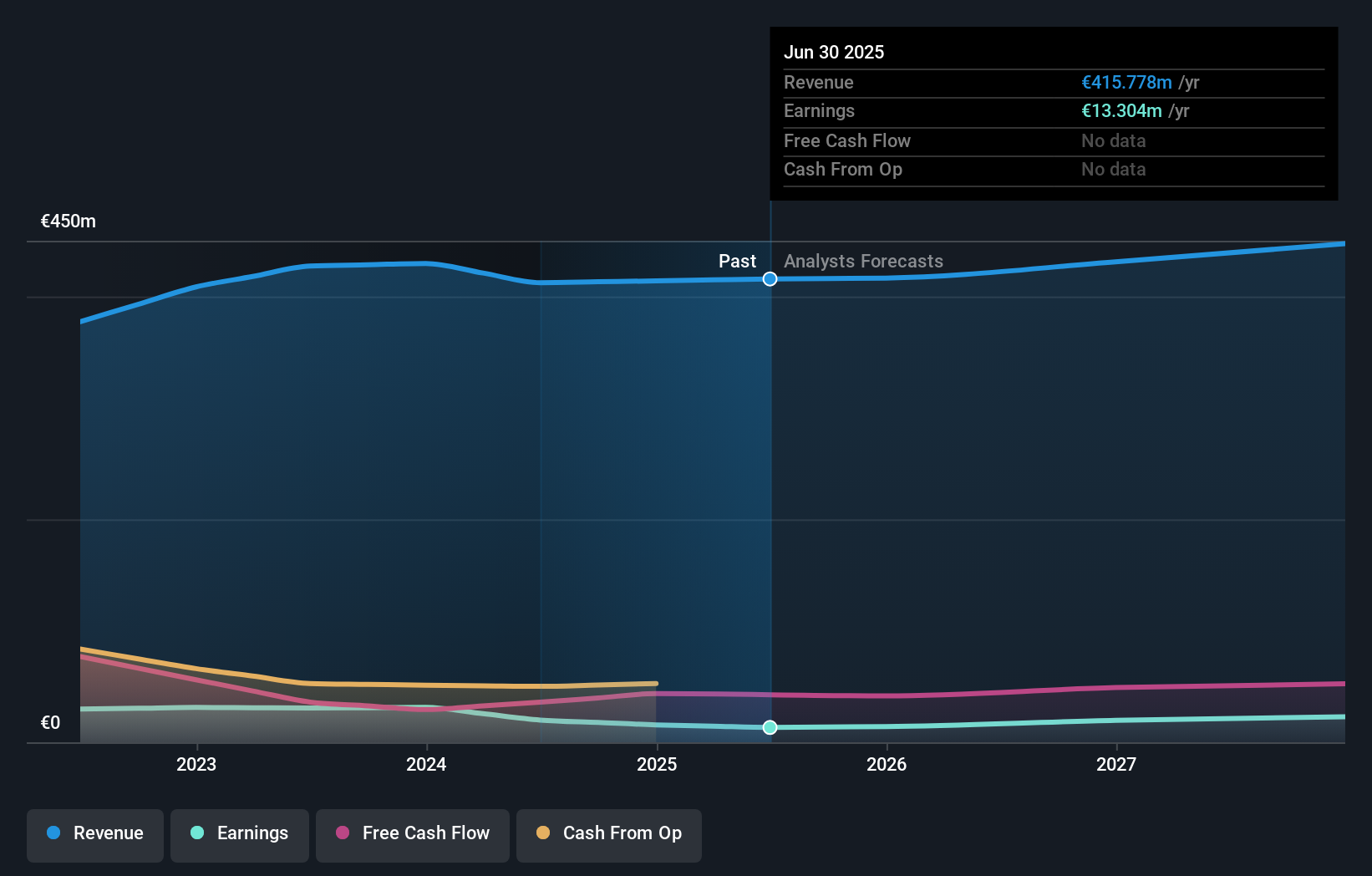

Operations: The company's revenue is derived from two main segments: the Mavriq Division, contributing €282.92 million, and Moltiply BPO&Tech, generating €258.09 million.

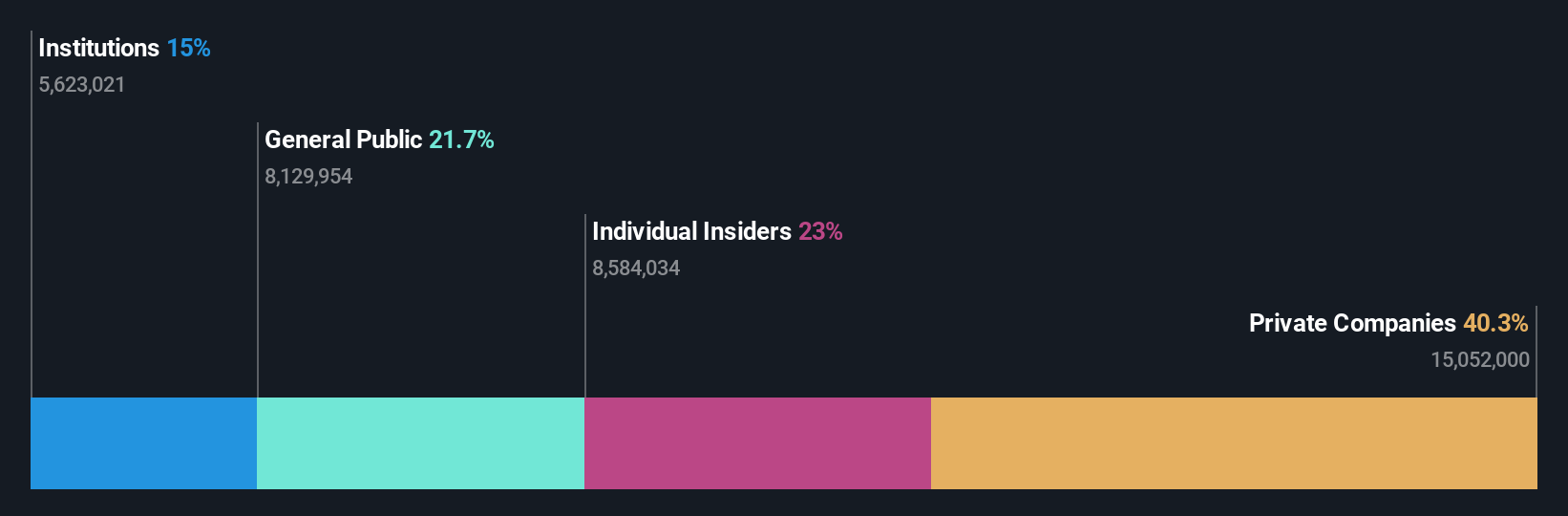

Insider Ownership: 25.2%

Earnings Growth Forecast: 31% p.a.

Moltiply Group S.p.A. demonstrates strong growth potential with earnings forecasted to increase by 31% annually, outpacing the Italian market's 9.2%. Recent earnings show a rise in net income to €21.16 million for H1 2025, up from €19.7 million year-on-year, indicating robust performance. However, its debt coverage by operating cash flow is lacking and insider trading data is unavailable for the past three months, which could be a consideration for investors evaluating insider confidence.

- Get an in-depth perspective on Moltiply Group's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Moltiply Group shares in the market.

Roche Bobois (ENXTPA:RBO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Roche Bobois S.A. operates in the global furniture design and distribution industry, with a market cap of €366.39 million.

Operations: Roche Bobois S.A. generates its revenue through the design and distribution of furniture across global markets.

Insider Ownership: 32.6%

Earnings Growth Forecast: 23.5% p.a.

Roche Bobois S.A. shows promising growth potential with earnings expected to increase by 23.5% annually, surpassing the French market's 12.2%. Despite stable revenue guidance for 2025 and a slower revenue growth forecast of 3.1%, its strategic expansions in North America and Luxembourg highlight its commitment to growth. The stock trades at a significant discount to fair value, though high debt levels and an unstable dividend track record may concern investors seeking financial stability.

- Delve into the full analysis future growth report here for a deeper understanding of Roche Bobois.

- Upon reviewing our latest valuation report, Roche Bobois' share price might be too optimistic.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products across Europe, with a market capitalization of approximately €7.06 billion.

Operations: The company's revenue segments consist of €1.01 billion from B2B and €9.98 billion from B2C activities.

Insider Ownership: 10.3%

Earnings Growth Forecast: 21% p.a.

Zalando SE's earnings are forecast to grow significantly at 21% annually, outpacing the German market's 16.8%. Despite a slower revenue growth forecast of 9.5%, which still exceeds the market average, the company reported robust earnings for Q2 2025 with sales of €2.84 billion and net income of €96.6 million. Trading at a substantial discount to its estimated fair value, Zalando benefits from strong insider ownership and strategic expansion efforts including its acquisition of ABOUT YOU.

- Navigate through the intricacies of Zalando with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Zalando is priced lower than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 213 Fast Growing European Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MOL

Moltiply Group

A holding company that operates in the financial services industry.

High growth potential with acceptable track record.

Market Insights

Community Narratives