- Germany

- /

- Specialty Stores

- /

- XTRA:MRX

Investors Appear Satisfied With Mister Spex SE's (ETR:MRX) Prospects As Shares Rocket 29%

Mister Spex SE (ETR:MRX) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 4.7% isn't as impressive.

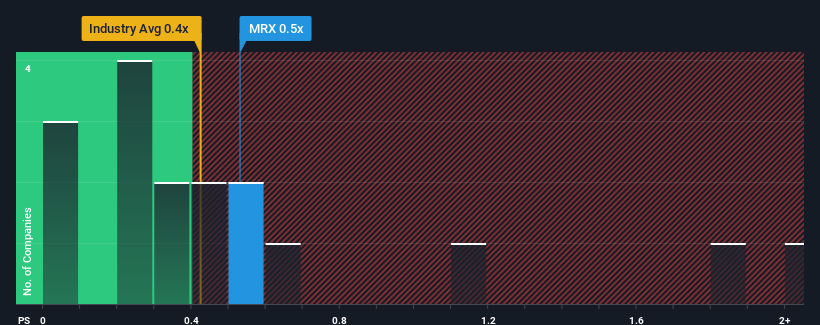

Although its price has surged higher, it's still not a stretch to say that Mister Spex's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Germany, where the median P/S ratio is around 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Mister Spex

How Has Mister Spex Performed Recently?

With revenue growth that's superior to most other companies of late, Mister Spex has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Mister Spex's future stacks up against the industry? In that case, our free report is a great place to start.How Is Mister Spex's Revenue Growth Trending?

Mister Spex's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.2% last year. Revenue has also lifted 29% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.8% per year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 5.6% growth per annum, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Mister Spex's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Mister Spex's P/S

Mister Spex's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A Mister Spex's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Specialty Retail industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

You always need to take note of risks, for example - Mister Spex has 1 warning sign we think you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MRX

Mister Spex

Provides and markets eyewear products in Germany and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives