- Germany

- /

- Specialty Stores

- /

- XTRA:FIE

How Investors May Respond To Fielmann Group (XTRA:FIE) Surpassing €1.8 Billion in Nine-Month Sales

Reviewed by Sasha Jovanovic

- Fielmann Group AG announced on November 6, 2025, that it achieved higher sales of €1.84 billion and net income of €155.55 million for the nine months ended September 30, 2025, compared to the same period last year.

- The company's notable earnings increase highlights a period of strong business momentum and improved profitability, underscored by higher basic and diluted earnings per share.

- With rising profitability as a key theme, we’ll examine how this performance shapes Fielmann Group's broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Fielmann Group's Investment Narrative?

Owning Fielmann Group stock requires belief in its ability to consistently grow sales and profits, underpinned by a robust brand and established presence in the European optical retail market. The recent earnings announcement shows higher sales of €1.84 billion and net income of €155.55 million for the nine months to September 2025, building on previously strong results. This momentum could reinforce near-term catalysts such as expanding market share, further margin improvements in line with management's target, and ongoing inclusion in key indices like the MDAX. However, share price weakness and a Price-To-Earnings Ratio above industry averages still reflect investor caution over relatively slow forecasted revenue and profit growth compared to the broader market. While the short-term news solidifies the company's profitability story, it doesn't erase risks like value concerns, slower top-line expansion, and return performance that has lagged both the market and peers.

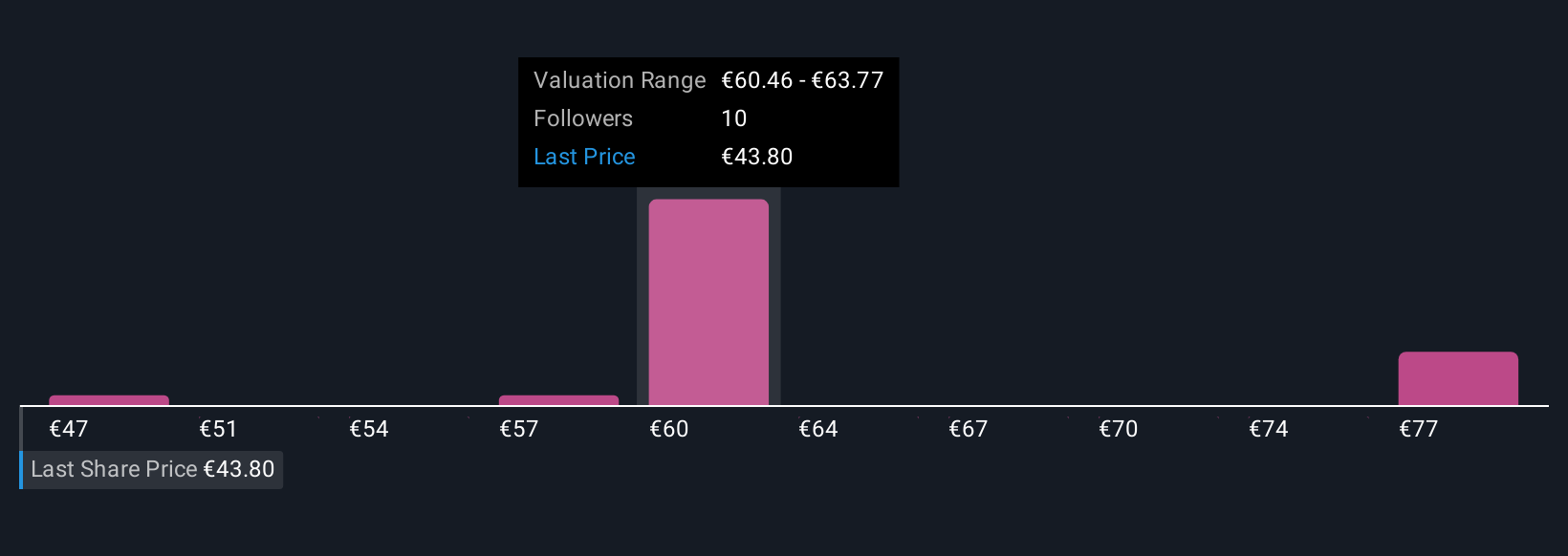

On the flip side, price-to-earnings remains higher than the sector, raising valuation questions for shareholders. Despite retreating, Fielmann Group's shares might still be trading 45% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on Fielmann Group - why the stock might be worth as much as 81% more than the current price!

Build Your Own Fielmann Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fielmann Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fielmann Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fielmann Group's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:FIE

Fielmann Group

Engages in vision care and audiology business in Germany, Switzerland, Austria, Spain, North America, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives