- Germany

- /

- Specialty Stores

- /

- XTRA:CEC

Ceconomy (XTRA:CEC): Exploring Valuation as the Uptrend Draws Investor Interest

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 2.7% Overvalued

The prevailing narrative currently suggests that Ceconomy is modestly overvalued compared to its fair value estimate. This assessment is based on a comprehensive view of the company's projected earnings, revenue growth, and anticipated profit margins.

“The pending strategic partnership with JD.com (and anticipated regulatory approval) is expected to accelerate Ceconomy's digital transformation and supply chain efficiency, enhance innovation, and broaden product assortment. These factors may support long-term sales expansion and improved operating leverage.”

Want to uncover the math behind Ceconomy's soaring narrative? One of the core assumptions driving this valuation is a dramatic shift in future profits and margins, suggesting bold expectations for both earnings and revenue well beyond current levels. Interested in what could make this retail player warrant such a high future valuation? The numbers predicted in this narrative might surprise even seasoned market-watchers.

Result: Fair Value of €4.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost inflation and continued soft consumer demand, particularly in Germany, could present challenges to Ceconomy’s margin improvements and may slow any anticipated growth.

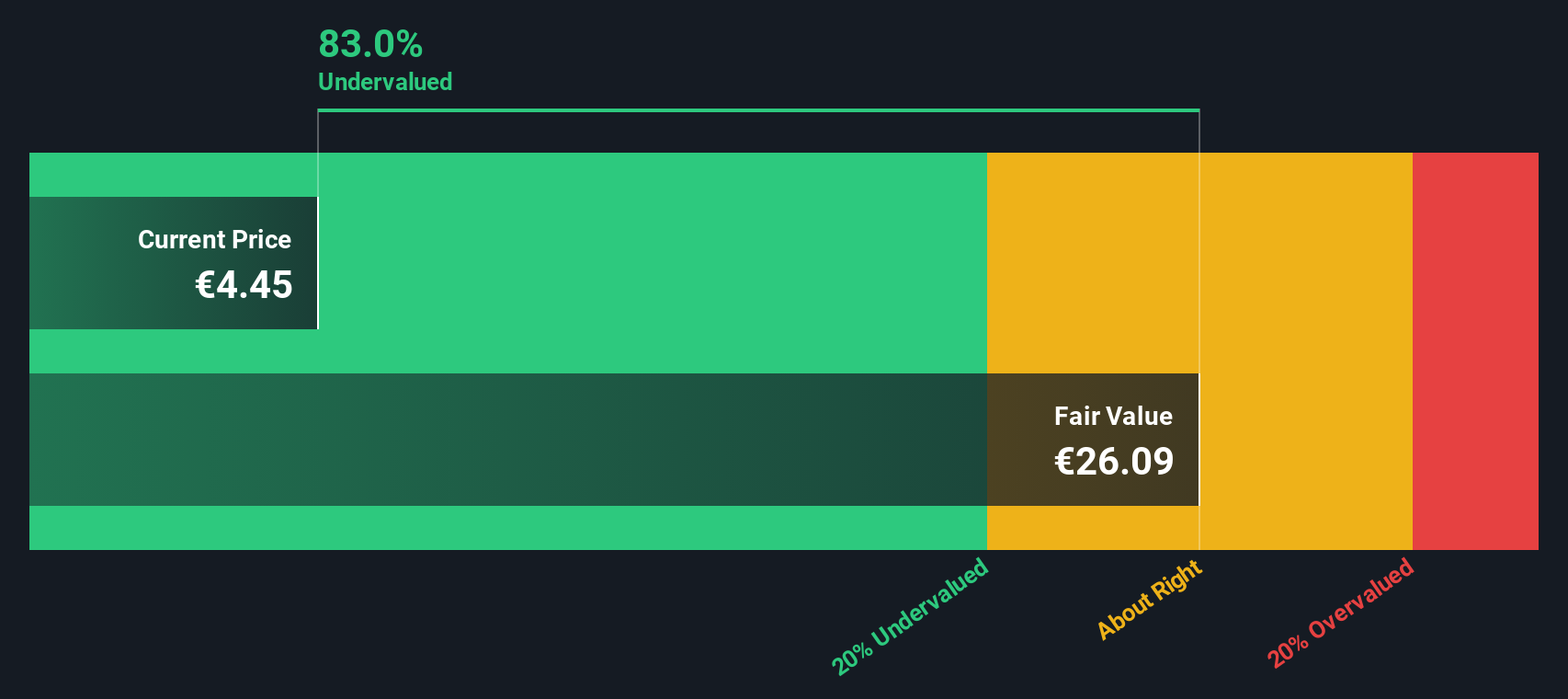

Find out about the key risks to this Ceconomy narrative.Another View: Discounted Cash Flow Model Tells a Different Story

While the analyst consensus currently points to Ceconomy being modestly overpriced, our DCF model arrives at a very different conclusion, suggesting the market might be missing a hidden layer of value. But which is closer to the mark?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Ceconomy to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Ceconomy Narrative

If you have a different angle or want to dig into the data yourself, you can build your own perspective in just a few minutes as well, and Do it your way.

A great starting point for your Ceconomy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Investment Edge?

Open the door to fresh opportunities in today’s markets. If you want new angles and smarter options, don’t miss these unique strategies on Simply Wall Street.

- Uncover hidden value gems as you tap into undervalued stocks based on cash flows that spot companies trading at compelling prices backed by strong fundamentals.

- Boost your income stream by leveraging dividend stocks with yields > 3% to pinpoint stocks with attractive, reliable dividend yields over 3%.

- Ride the tech revolution by targeting the hottest rapid-growth sectors within AI penny stocks leading breakthroughs in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CEC

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives