- Germany

- /

- Specialty Stores

- /

- XTRA:CEC

Ceconomy (ETR:CEC) Shareholders Received A Total Return Of -44% In The Last Three Years

Ceconomy AG (ETR:CEC) shareholders should be happy to see the share price up 21% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 83% in the last three years, falling well short of the market return.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Check out our latest analysis for Ceconomy

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Although the share price is down over three years, Ceconomy actually managed to grow EPS by 33% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

The company has kept revenue pretty healthy over the last three years, so we doubt that explains the falling share price. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

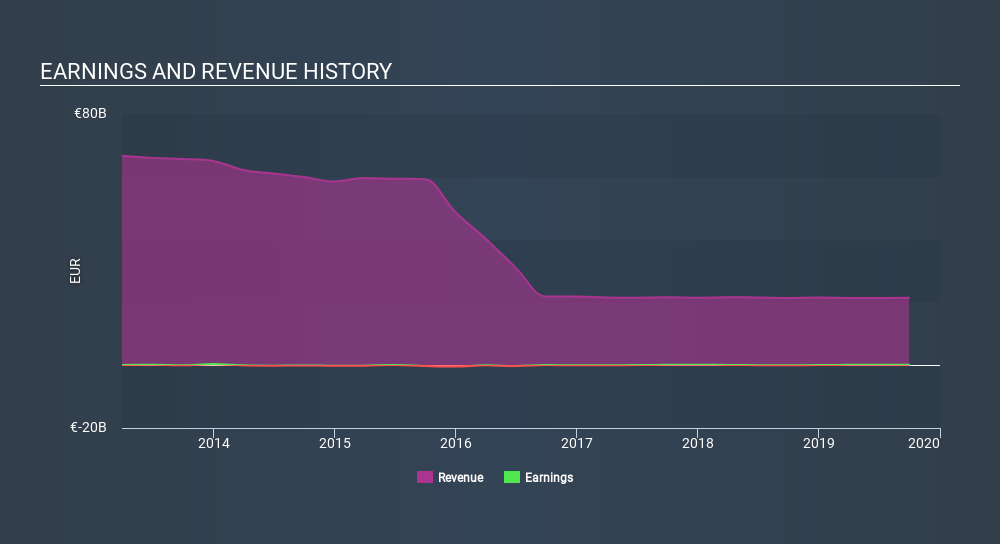

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Ceconomy in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Ceconomy's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Ceconomy's TSR of was a loss of 44% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Ceconomy shareholders have received a total shareholder return of 50% over one year. There's no doubt those recent returns are much better than the TSR loss of 7.2% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Ceconomy better, we need to consider many other factors. For instance, we've identified 1 warning sign for Ceconomy that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:CEC

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives